TradingFunds Review

TradingFunds is very proud to provide a cutting-edge prop trading experience that fills a vacuum for many traders around the world. They have developed a reputation as a trustworthy ally for traders all over the world, thanks to a proven track record of success.

Pros

- Excellent Trustpilot rating of 4.3/5

- Two Unique Funding Programs

- Professional Trader Dashboard

- Multiple Add-on Features

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

- Leverage Scaleable up to 1:100

- No Maximum Trading Day Requirements

- Scaling Plan

- Profit Share of 80% up to 90%

- First Payout After 14 Calendar Days

- Bi-weekly Payouts

- Overnight & Weekend Holding Allowed

- News Trading Allowed

Cons

- Low Starting Leverage of 1:10 on One-step Evaluation

- Trailing Drawdown on One-step Evaluation

- Minimum Trading Day Requirements

TradingFunds The firm takes great pride in offering a state-of-the-art prop trading experience that fills the void experienced by so many traders. Traders have the opportunity to earn tremendous profits, as they are empowered to manage account sizes up to $100,000 and can reap profit splits of up to 90%. This is achievable through trading on a wide range of financial instruments, which includes forex pairs, commodities, indices, and cryptocurrencies.

Who are TradingFunds?

TradingFunds TF Solutions LLC-FZ is a proprietary trading firm and was incorporated on the 22nd of February 2023. Their headquarters is located in Dubai, United Arab Emirates, and they operate under CEO Philip Hall. TradingFunds allows traders to select from two account types, a two-step evaluation, and a one-step evaluation, while working with a tier-1 liquidity provider with the best simulated real market trading conditions as their broker.TradingFunds’ headquarters are located at Emirates Financial Towers, Office 28, DIFC, Dubai, United Arab Emirates.

Who is the CEO of TradingFunds?

Philip Hall is the CEO of TradingFunds. Note that we will be adding more information about their CEO in the future. Stay tuned!

Funding Program Options

TradingFunds provides its traders with two unique funding program options:

- Two-step Evaluation

- One-step Evaluation

Two-step Evaluation

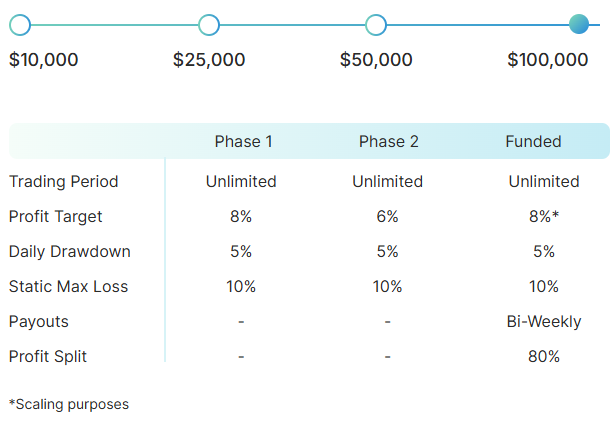

TradingFunds’ Account sizes by Two-step Evaluation Two-step Evaluation offers the possibility of managing account sizes between $10,000 and $100,000. It aims at finding successful traders who are profitable and efficiently manage risk during the two-step evaluation. With the Two-step Evaluation, you can trade with leverage of up to 1:30.

| Account Size | Price |

| $10,000 | $99 |

| $25,000 | $199 |

| $50,000 | $299 |

| $100,000 | $549 |

For the evaluation phase one, it means that you need to get a trading profit of 8% without exceeding your 5% maximum daily loss rule or your 10% maximum loss rule. For time limits, you have no maximum trading days for phase one. In fact, you must trade at least three trading days to be qualified for phase two.

In the second phase of evaluation, you are considered to have met your profit target of 6% without having gone over the established limits of 5% for maximum daily losses or 10% for maximum loss. As for time requirements, bear in mind that you don’t have any limit on the number of trading days in phase two. Still, you need to trade at least three trading days to move to a funded account.

Having passed the review, you get to earn a funded account that comes with no minimal withdrawal conditions. You only need to honor the 5% maximum loss in one trading day and the 10% maximum loss rule. Your first withdrawal is 14 calendar days from your day of opening the first position on the funded account; other withdrawals can also be submitted bi-weekly. Your profit split will be 80% up to 90% based on the profit you make on your funded account.

Add-ons for TradingFunds’ Two-step Evaluation

- 90% Profit Split

- Activate Scaling Level 6

- Weekly Payouts

Two-step Evaluation Scaling Plan

The Two-step Evaluation also has a plan of scaling. If you could achieve the 8% profit target, then you can scale your account to the next size from the available account size. Keep in mind that if you will decide to scale your account, you don’t have to forfeit your profits.

Example:

The profit target for the $100,000 funded account is 8%.

Week 1: Earn a profit of 4%.

Week 2: Result in 6% Return.

That is, the total generated profit for the last two weeks is 10%, making the account eligible for scaling as you reached the required 8% profit target.

Two-step Evaluation Trading Rules & Objectives

- Profit Target – Traders need to hit a targeted profit percentage to complete an evaluation phase, withdraw their profits, or expand their trading account. The profit target for Phase 1 is set at 8%, and the profit target for Phase 2 is set at 6%. Funded accounts do not have any profit targets associated with them.

- Maximum Daily Loss – That is the maximum loss limit of what a trader can lose in one trading day without breaching the account. The maximum daily loss for all account sizes is 5%.

- Maximum Loss – The maximum loss limit allowed to a trader to lose overall without breaching the account. The absolute maximum loss of the account sizes is 10%.

- Minimum Trading Days – The minimum trading period over which you must trade before successfully completing an evaluation period. Both evaluation periods have a minimum of 3 trading days.

- No Martingale – No type of martingale strategy may be used by the trader during their trading.

- No Hedging – The trader is restricted from using any hedging strategy in his trading.

One-step Evaluation

TradingFunds’ Account sizes of $10,000 up to $100,000 can be managed by traders with One-step Evaluation. The purpose is finding disciplined profitable traders capable of managing risks throughout one evaluation step. You can trade with leverage up to 1:10 through the One-step Evaluation.

| Account Size | Price |

| $10,000 | $99 |

| $25,000 | $199 |

| $50,000 | $299 |

| $100,000 | $549 |

The evaluation phase requires a trader to attain a profit target of 10% without exceeding their 4% maximum daily loss or 8% maximum trailing loss rules. In terms of time constraints, you are not given any maximum trading day requirements in phase one, but you do need to trade a minimum of four trading days to move on to a funded account.

You’re rewarded by finishing the evaluation stage with a funded account and no minimum requirements for withdrawal. You only need to be mindful of the maximum daily loss of 4% and the maximum trailing loss of 8%. Your first withdrawal is after 14 calendar days from the date you place your very first position on your funded account, and other withdrawals can also be made bi-weekly. Your profit split will be 80% up to 90% of the profit you make on your funded account.

Add-ons for TradingFunds’ One-step Evaluation

- 90% Profit Split

- Activate Scaling Level 6

- Weekly Payouts

One-step Evaluation Scaling Plan

The One-step Evaluation also has a scaling plan. If you can hit your 10% profit target, you will be able to scale up your account into the next available account size. Be aware that if you should scale an account, there would be no forfeiture of your profits.

Example:

The target return for the $100,000 funded investment will be 8%.

Week 1: Produce a profit of 4%.

Week 2: Make a profit of 6%.

The total generated profit during the last two weeks is 10%, which brings the account to its eligibility for scaling since you already met the required 8% in profit target.

One-step Evaluation Trading Rules & Objectives

- Profit Target – Successful completion of the evaluation phase, withdrawal of profits, or scaling the trading account requires achieving a defined profit percentage. The profit target in the evaluation phase is 10%. Funded accounts do not have any predefined profit targets.

- Maximum Daily Loss – The maximum amount a trader can incur on a single trading day without losing access to the account. The maximum daily loss for all account sizes is 4%.

- Maximum Trailing Loss – The maximum trailing loss is the difference between the highest account balance achieved and the lowest drawdown point reached during trading. All account sizes have a maximum trailing loss set at 8%.

- Minimum Trading Days – Minimum number of trading days required to complete a successful evaluation phase. All evaluation phases have a minimum trading day requirement of 4.

- No Martingale – Trades are not allowed to use any type of martingale strategy when they are trading.

- No Hedging – The use of any form of hedging strategy is prohibited in trades during their period of operation.

What Makes Trading Funds Different From Other Prop Firms?

TradingFunds differs from most industry-leading prop firms This is due to offering two unique account types, that is a two-step evaluation and a one-step evaluation. In addition, they also offer numerous favorable features, which include unlimited trading periods with a variety of add-on features.

The Two-step Evaluation of TradingFunds calls for a two-step evaluation in which the trader must complete two phases before being qualified for payouts. Profit target: Phase one is 8% and phase two is 6% with 5% maximum daily and 10% maximum loss rules. You also have no maximum trading day requirements during either evaluation phase. However, you are expected to trade for at least 3 calendar days in every evaluation phase. The Two-step Evaluation also has a different scale-up plan, making it possible for traders to handle even bigger account sizes. Compared to other funding programs inside the industry, the Two-step Evaluation stands out mainly for having an unlimited trading period and multiple add-on features.

Example of comparison between TradingFunds & Fintokei

| Trading Objectives | TradingFunds | Fintokei |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 6% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% up to 95% |

Example of comparison between TradingFunds & FundedNext

| Trading Objectives | TradingFunds | FundedNext |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 6% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% up to 95% |

Example of comparison between TradingFunds & Alpha Capital Group

| Trading Objectives | TradingFunds | Alpha Capital Group |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 6% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% |

TradingFunds’ One-step Evaluation is a one-step evaluation in which there needs to be success in the phase before traders are qualified for payouts. The profit target stands at 10% with no oversold conditions, a maximum daily and a maximum trailing loss rule standing at 4% and 8%. No maximum trading days will be required upon the evaluation phase. However, you must trade for at least four calendar days during the evaluation phase. In addition to the unique plan for scaling, One-step Evaluation also offers a plan for traders to manage an even larger account size. Compared with other funding programs in the industry, One-step Evaluation mainly stands out for having an unlimited trading period, no minimum trading day requirements, no maximum daily drawdown, and multiple add-on features.

Example of comparison between TradingFunds & PipFarm

| Trading Objectives | TradingFunds | PipFarm (Static) |

| Profit Target | 10% | 12% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 8% (Trailing) | 6% |

| Minimum Trading Days | 4 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% (90% with Add-on) | 70% up to 95% |

Example of comparison between TradingFunds & Funded Trading Plus

| Trading Objectives | TradingFunds | Funded Trading Plus |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 8% (Trailing) | 6% (Trailing) |

| Minimum Trading Days | 4 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% (90% with Add-on) | 80% up to 100% |

Example of comparison between TradingFunds & FXIFY

| Trading Objectives | TradingFunds | FXIFY |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 8% (Trailing) | 6% (Trailing) |

| Minimum Trading Days | 4 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% (90% with Add-on) | 80% up to 90% |

In conclusion, TradingFunds from industry-leading prop firms, differs in that it offers two kinds of account types: two-step evaluation and one-step evaluation. In addition, they provide numerous favorable features, such as an unlimited trading period and multiple add-on features.

Is Getting TradingFunds Capital Realistic?

When looking into proprietary trading firms that match your forex trading style, it’s also important to consider the achievability of trading requirements. For example, a company might look very attractive with a high percentage profit split on a generously funded account but lower in practicality if they demand high monthly gains with minimal maximum drawdown percentages, significantly lowering one’s chances of succeeding. Examine time constraints, which need to be unlimited because an unlimited trading period is much better and does away with the tension associated with time constraints. Finally, learn all the trading rules during an evaluation process or subsequent funding processes to avoid accidentally breaching your trading account terms.

Receiving capital from the Two-step Evaluation is realistic primarily because of below-average profit targets (8% in phase one and 6% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). However, there are no maximum trading day requirements with a minimum trading day requirement of 3 calendar days. Furthermore, after passing the two evaluation steps, participants receive payout opportunities with a favorable profit split of 80% to 90%.

Receiving capital from the One-step Evaluation is realistic primarily because of its average profit target of 10% coupled with an average maximum loss rule: 4% maximum daily and 8% maximum trailing loss. Of course, note that there are no maximum trading day requirements while having a minimum trading day requirement of 4 calendar days. Moreover, after completing the evaluation phase successfully, participants qualify for payouts that include a competitive profit share of 80% up to 90%.

Having considered all those factors, TradingFunds is highly recommended since you have two unique funding programs to choose from, a two-step evaluation and a one-step evaluation, which both feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

TradingFunds is a proprietary trading firm that was registered on February 22, 2023. They have a big team of traders who have gone funded and qualified for a profit split.

Working with TradingFunds and going funded through the Two-step Evaluation or One-step Evaluation will qualify you to receive your first payout after 14 calendar days. However, after the first payout, you also earn payouts whenever you exceed the initial account size. It will be every 14 calendar days thereafter. Your share of the profit generated on your funded account will be such that you can enjoy an outstanding 80% to 90% profit split.

For TradingFunds payment proof, you will find it on Trustpilot, where their traders comment on their experience working with the company as well as the process of how they successfully received payouts. Another source for proof of payout by TradingFunds can be found in their Discord channel, where you will find many payout certificates from their most successful traders.

Examples of payout certificates and payment proof are shown below in images.

Which Broker Does TradingFunds Use?

TradingFunds Doesn’t trade with any of the common broker brands. They partner with tier-1 liquidity for the best conditions in simulated real market trading conditions.

On the other hand, regarding trading platforms, during your work with TradingFunds, you are allowed to trade on TradeLocker.

Trading Instruments

As mentioned above, TradingFunds With tier-1 liquidity pairing with the best simulated real market trading conditions, they allow you to trade a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies with a leverage of up to 1:100, based on the trading instrument that you are trading.

Forex Pairs

| AUD/USD | EUR/USD | GBP/USD | NZD/USD | USD/CAD | USD/CHF |

| USD/JPY | AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | CAD/CHF |

| CAD/JPY | CHF/JPY | EUR/AUD | EUR/CAD | EUR/CHF | EUR/GBP |

| EUR/JPY | EUR/NZD | GBP/AUD | GBP/CAD | GBP/CHF | GBP/JPY |

| GBP/NZD | NZD/CAD | NZD/CHF | NZD/JPY | CAD/SGD | EUR/CZK |

| EUR/DKK | EUR/HKD | EUR/HUF | EUR/NOK | EUR/PLN | EUR/SEK |

| EUR/SGD | EUR/TRY | EUR/ZAR | GBP/DKK | GBP/NOK | GBP/SEK |

| NOK/SEK | USD/CNH | USD/CZK | USD/DKK | USD/HKD | USD/HUF |

| USD/ILS | USD/MXN | USD/NOK | USD/PLN | USD/RUB | USD/SEK |

| USD/SGD | USD/TRY | USD/ZAR |

Commodities

| COPPER | XAG/USD | XAU/EUR | XAU/USD | XPT/USD |

| NGAS | UKOil | USOil | SOYBEANS | WHEAT |

| COFFEE | COCOA |

Indices

| DAX | DOLLAR | ESP35 | EUSTX50 | FRA40 |

| JPN225 | NAS100 | SPX500 | UK100 | US30 |

Cryptocurrencies

| ADA/USD | AVA/USD | BAT/USD | BCH/USD | BNB/USD |

| BTC/USD | DASH/USD | DOGE/USD | DOT/USD | EOS/USD |

| ETC/USD | ETH/USD | IOTA/USD | LTC/USD | NEO/USD |

| OMG/USD | SHB/USD1000 | SOL/USD | TRX/USD | XLM/USD |

| XMR/USD | XRP/USD | ZEC/USD |

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

| FOREX | 4 USD / LOT |

| COMMODITIES | 7 USD / LOT (Only Metals) |

| INDICES | 0 USD / LOT |

| CRYPTO | 0 USD / LOT |

Spread Account

To check the live spreads, log in to the trading account below.

| Platform | Server | Login Number | Password | Download Platform |

| TradeLocker | TFUNDS | support@forexpropreviews.com | Bk9Utzb=<xxU | Download |

Education

TradingFunds provides its community with a detailed News section with educational content.Also, TradingFunds has a structured trading dashboard where you can track your progress. This will make it even easier for you to keep risk management under control and track any changes in your evaluation or funded account.

Trading Dashboard

Trustpilot Feedback

TradingFunds has gathered an excellent score on Trustpilot based on their community’s feedback.

On Trustpilot, TradingFunds has a big variety of their community commenting and providing positive feedback regarding the company’s services. The firm has achieved an average rating of 4.3 out of 5 from a vast pool of 211 reviews. Interestingly, 72% of these reviews have given TradingFunds the highest rating of 5 stars.

The client claimed to have a pleasant experience with TradingFunds and specifically pointed out the customer support as helpful. They started receiving proper answers to several questions before the account purchase. Upon trading for a couple of weeks, the client claimed that they were going to pass their challenge soon.

The client shows enthusiasm for TradingFunds, They note that the streamlined 1-step phase challenge with no daily drawdowns is appreciated. They like the speed of feedback from the platform, sharing a good experience with the reception of a funded account within less than 24 hours after passing the challenge. The client expresses readiness to start withdrawing and has an overall good perspective regarding his experience with TradingFunds.

Social Media Statistics

TradingFunds can also be found on numerous social media platforms.

Customer Support

| Live Chat | ✅ |

| support@tradingfunds.com | |

| Discord | Discord link |

| Telegram | ❌ |

| FAQ | FAQ Link |

| Supported Languages | English, Arabic, Dutch, French, German, Italian, Japanese, Persian, Portuguese, Spanish |

Account Opening Process

Registration Form – Fill out the registration form with your personal details, and login to the trading dashboard of TradingFunds.

Choose Your Account – Account Type, Account Size, Add-ons

Choose Your Payment Method – Use credit/debit card or PayPal or Cryptocurrency payment method.

Conclusion

In conclusion, TradingFunds is a professional and reliable proprietary trading company that offers traders the possibility to select one of two funding programs: Two-step Evaluation, being a two-step evaluation, and One-step Evaluation, which is a one-step evaluation.

Two-step Evaluation offered by TradingFunds represents an industry-standard two-step evaluation, completing two stages before being qualified for trading a funded account and enjoying 80% up to 90% profit splits. Traders need to achieve profit goals of 8% in phase one and 6% in phase two to be successfully funded.

These are achievable trading goals, given you have a 5% maximum daily and 10% maximum loss rules you have to work under. When it comes to time limits, you have no maximum trading day requirements during either evaluation phase. You are, however, required to trade for at least 3 calendar days in each evaluation phase. Lastly, it is important to point out that the Two-step Evaluation has a scaling plan, which gives you the chance to boost the initial balance of your account.

TradingFunds‘ One-step Evaluation

The One-step Evaluation offered by TradingFunds is a one-step evaluation that requires one phase to be completed before it qualifies you to manage a funded account and makes you eligible for 80% up to 90% profit splits. One must attain a profit target of 10% to be funded successfully. Such are realistic trading objectives by considering you have rules for a maximum daily and maximum trailing loss of 4% and 8%, respectively. On the aspect of time requirements, you do not have any max trading day requirements during the evaluation phase. You must, however, trade for a minimum of 4 calendar days during the evaluation phase. Lastly, it must be highlighted that the One-step Evaluation has a scaling plan, so you can scale your initial account balance.

I would advise anyone looking for a reliable and proprietary trading firm that can offer the best trading conditions for various types of unique traders to definitely consider TradingFunds. They provide traders with unique features, such as an unlimited period of trading and multiple add-on features. Considering everything TradingFunds offers to traders around the globe, they are indeed one of the most desirable choices within the Prop trading industry.

What do you think about TradingFunds and the services that this company provides? Are they what you were looking for in trading conditions and services?

Tell us in the comments if you liked our comprehensive review of TradingFunds!