The Trading Pit Review

The Trading Pit wants to become the new global benchmark for investing and trading. They empower traders with the information and tools that are important in becoming successful partners of the organization. They think that working together with traders is the only way to flourish and develop as a team.

Pros

- Excellent 4.0/5 Trustpilot rating

- Three Distinct Funding Initiatives

- Dashboard for Professional Traders

- An extensive range of trading instruments, including stocks, commodities, forex pairs, indices, and cryptocurrencies

- Plan for Scaling

- There is no maximum trading period, and the first payout occurs 14 calendar days later.

- Future Payouts Every Two Weeks

- 80% of the profits from Prime One-phase and Prime Two-phase evaluations

- 50% to 80% profit share on traditional two-phase evaluation for overnight and weekend holding Permitted Drawdown on Prime One-phase and Prime Two-phase Evaluations based on Balance

Cons

- Low Initial Profit Share of 50% or 60% on Classic Two-phase Evaluation; Minimum Trading Day Requirements of 5 Days; Trailing Drawdown on Classic Two-phase Evaluation

- Absence of News Trading

The Trading Pit aims to become the new international norm for trading and investing. They give traders the skills and resources they need to succeed as the company’s partners. With the option to handle account sizes up to $100,000 and get up to 80% profit splits, traders have the chance to make significant earnings. Trading a variety of financial products, such as equities, indices, commodities, FX pairs, and cryptocurrencies, can help achieve this.

Who is The Trading Pit?

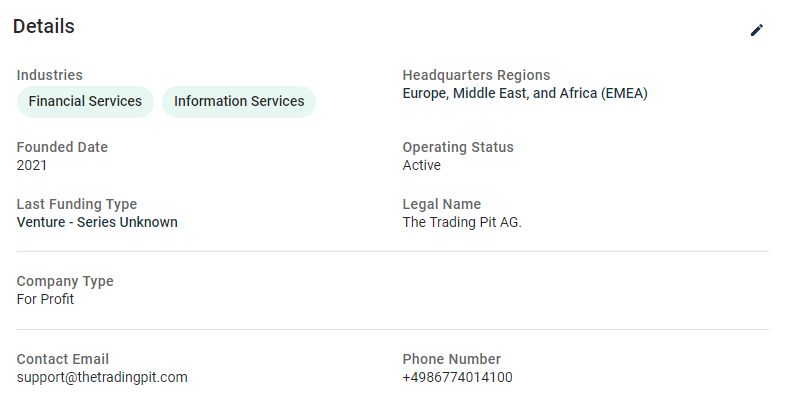

The Trading Pit is a privately held trading company that was established in February 2022 under the legal name The Trading Pit Challenge GmbH. They are run by CEO Thomas Heyden and have locations in Vaduz, Liechtenstein, Limassol, Cyprus, and Alcobendas, Madrid.The Trading Pit gives traders the option to select from three different account types, a two-step assessment, and two one-step evaluations while being partnered with FXFlat and GBE Brokers as their broker.

The Trading Pit headquarters are located at Landstrasse, 63 9490 Vaduz, Liechtenstein.

Who is the CEO of The Trading Pit?

Thomas Heyden is the CEO of The Trading Pit, who earned a degree from Johann-Wolfgang-Goethe University after studying capital market theory, insurance, and finance. He has experience working for international investment houses and German banks as a licensed financial analyst.

For his own regulated business, Thomas has started and run several investment funds. In 2009, he also won the German Fund Award for his investment fund.

He was in charge of hedging commodity price risks for significant German corporations and the biggest European public transportation operators in addition to his work in the trading and fund management sectors. For medium-sized firms in Germany, he is a highly sought-after lecturer on commodities prices and foreign exchange concerns.

Funding Program Options

The Trading Pit provides its traders with three unique funding program options:

- Prime Two-phase Evaluation

- Prime One-phase Evaluation

- Classic One-phase Evaluation

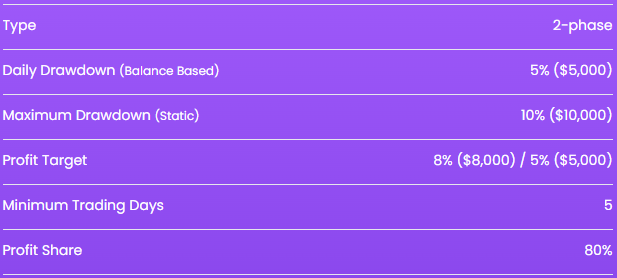

Prime Two-phase Evaluation

Traders can handle account sizes ranging from $5,000 to $100,000 with The Trading Pit’s Prime Two-phase Evaluation. Finding skilled traders who can effectively manage risk over the two-step evaluation phase and turn a profit is the goal. You can use up to 1:50 leverage while trading using the Prime Two-phase Evaluation.

| Account Size | Price |

|---|---|

| $5,000 | €49 |

| $10,000 | €99 |

| $20,000 | €199 |

| $50,000 | €349 |

| $100,000 | €569 |

In the first evaluation phase, a trader must hit an 8% profit target without going over their 5% daily loss or 10% maximum loss limits. Regarding time constraints, keep in mind that during phase one, there are no criteria for the maximum number of trading days. However, to move on to phase two, you must trade for at least five trading days.

In the second evaluation phase, a trader must hit a 5% profit target without going over their 10% maximum loss or 5% maximum daily loss guidelines. Regarding time constraints, keep in mind that during phase two, there are no criteria for the maximum number of trading days. To go on to a funded account, though, you must trade for at least five trading days.

You are given a funded account with a $100 minimum withdrawal amount after passing both evaluation stages. Only the 10% maximum loss and 5% maximum daily loss guidelines must be followed. All withdrawals can be made every two weeks, but your first payout occurs 14 calendar days after the day you place your first position on your funded account. Depending on how much money you make in your funded account, you will receive an 80% profit split.

Prime Two-phase Evaluation Scaling Plan

There is a scaling strategy for the Prime Two-phase Evaluation as well. A trader will be eligible for an account size increase of 25% of the original account size if they have had an actively funded account for at least two months, get at least two payouts, and accumulate a total profit of at least 10%. It’s also important to remember that every fourth scale-up will be your significant turning point. The 25% increase in account size will thereafter be based on your new balance at that time.

Prime Two-phase Evaluation Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 8%, whereas Phase 2 requires reaching a profit target of 5%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 10%.

- Minimum Trading Days – The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. Both evaluation phases have a minimum trading day requirement of 5 days.

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 2-minute period both before and after the announcement of particular news.

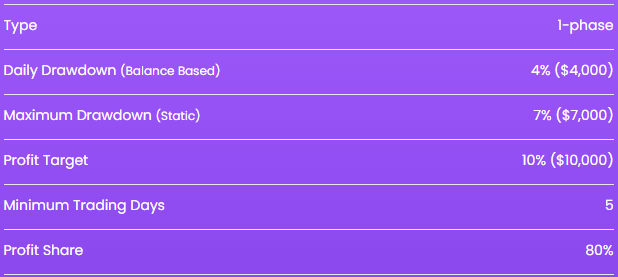

Prime One-phase Evaluation

Traders can handle account sizes ranging from $5,000 to $200,000 with The Trading Pit’s Prime One-phase Evaluation. Finding skilled traders who can effectively manage risk during the one-step evaluation phase and turn a profit is the goal. With the Prime One-phase Evaluation, you can trade with leverage as high as 1:50.

| Account Size | Price |

|---|---|

| $5,000 | €49 |

| $10,000 | €99 |

| $20,000 | €199 |

| $50,000 | €349 |

| $100,000 | €569 |

| $200,000 | €1,139 |

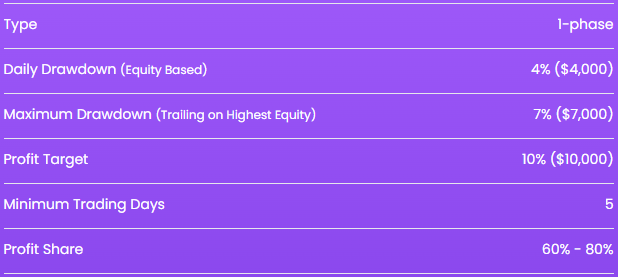

A trader must hit a 10% profit target throughout the evaluation period without going over their 4% daily loss or 7% maximum loss guidelines. Regarding time constraints, keep in mind that during the assessment period, there are no maximum trading day requirements. To go on to a funded account, though, you must trade for at least five trading days.

You are given a funded account with a $100 minimum withdrawal amount after passing the evaluation step. Only the 4% daily loss cap and the 7% maximum loss cap must be adhered to. All withdrawals can be made every two weeks, but your first payout occurs 14 calendar days after the day you place your first position on your funded account. Depending on how much money you make on your funded account, you will receive an 80% profit split.

Prime One-phase Evaluation Scaling Plan

The Prime One-phase Evaluation also has a scaling plan. If a trader has an actively funded account for at least two months and receives a minimum of two payouts while accumulating a total profit of at least 10%, then you will become eligible for an account size increase equal to 25% of the initial account size. It is also worth noting that every 4th scale-up will serve as your major milestone. Your new balance at that point will become the new basis for the 25% account size increase.

Prime One-phase Evaluation Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for the evaluation phase is 10%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 4%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 7%.

- Minimum Trading Days – The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. The evaluation phase has a minimum trading day requirement of 5 days.

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 2 minutes both before and after the announcement of particular news.

Classic One-phase Evaluation

Traders can handle account sizes ranging from $10,000 to $100,000 with The Trading Pit’s Classic One-phase Evaluation. During a one-step review phase, the goal is to find profitable, disciplined traders who can effectively manage risk. You can trade with leverage up to 1:50 when using the Classic One-phase Evaluation.

| Account Size | Price |

|---|---|

| $10,000 | €99 |

| $20,000 | €179 |

| $50,000 | €399 |

| $100,000 | €999 |

A trader must hit a 10% profit target during the assessment period without going over their 4% daily loss or 7% trailing loss limits. Regarding time constraints, keep in mind that during the assessment period, there are no maximum trading day requirements. To go on to a funded account, though, you must trade for at least five trading days.

You are given a funded account with a $100 minimum withdrawal amount after passing the evaluation step. Only the 4% daily loss cap and the 7% trailing loss cap must be adhered to. All withdrawals can be made every two weeks, but your first payout occurs 14 calendar days after the day you place your first position on your funded account. The profit you make on your $10,000 or $20,000 funded account will determine your profit split, which will be 50% to 70%. The profit you make on your $50,000 or $100,000 funded account will determine your profit split, which will be 60% to 80%.

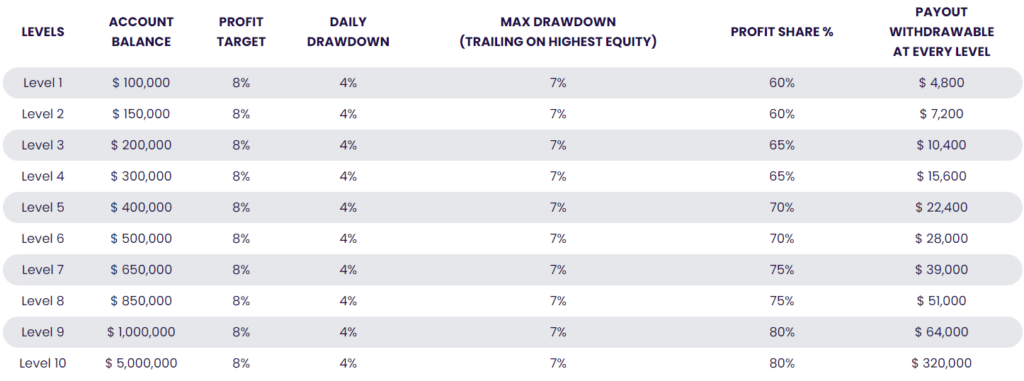

Classic One-phase Evaluation Scaling Plan

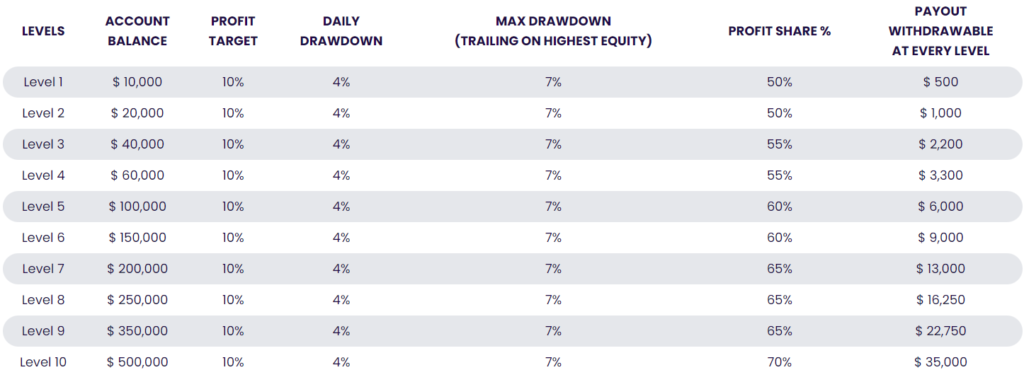

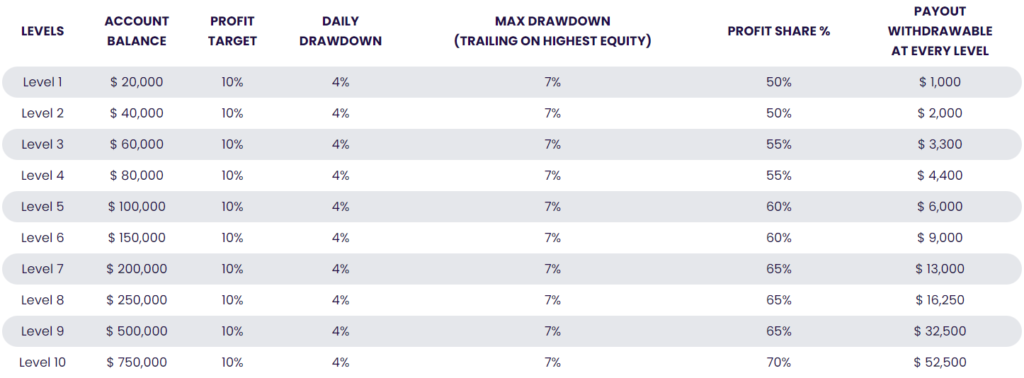

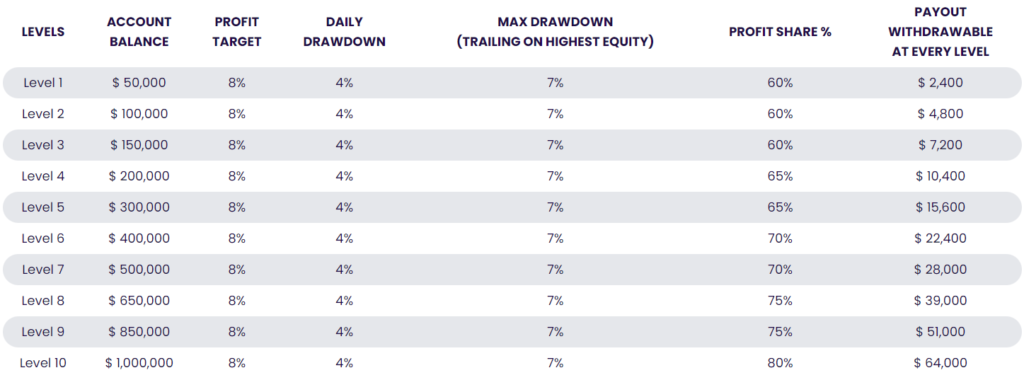

There is a scaling strategy for the Classic One-phase Evaluation as well. For your $10,000 or $20,000 funded accounts, you must meet a 10% profit target; for your $50,000 or $100,000 funded accounts, you must meet an 8% profit target. It’s also important to keep in mind that, depending on the size of the account you are trading on, the scaling can range from $500,000 to $5,000,000.

$10k Scaling Plan

$20k Scaling Plan

$50k Scaling Plan

$100k Scaling Plan

Classic One-phase Evaluation Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for the evaluation phase is 10%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 4%.

- Maximum Trailing Loss – The difference between the highest achieved account balance and the lowest point of the drawdown determines the maximum trailing loss a trader is allowed to lose without breaching the account. All account sizes have a maximum trailing loss of 7%.

- Minimum Trading Days – The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. The evaluation phase has a minimum trading day requirement of 5 days.

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 2 minutes both before and after the announcement of particular news.

What Makes The Trading Pit Different From Other Prop Firms?

The Trading Pit differs from most industry-leading prop firms because it provides three distinct account types: two one-step evaluations and a two-step evaluation. Furthermore, they offer some advantageous characteristics, including an indefinite trading term, a first payout that occurs after 14 calendar days, future payouts that occur every two weeks, and a scaling plan that ranges from $500,000 to $5,000,000.

Eligibility for rewards is contingent upon traders completing two steps of The Trading Pit’s Prime Two-phase Evaluation. Phase one and phase two profit targets are 8% and 5%, respectively, with daily maximums of 5% and 10%. During either assessment phase, you are also not subject to any maximum trading day requirements. However, throughout each evaluation phase, you must trade for at least five calendar days. Additionally, the Prime Two-phase Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The Prime Two-phase Evaluation differs from other industry funding schemes primarily because to its unrestricted trading term, initial reward after 14 calendar days, bi-weekly future payouts, and a scaling plan ranging from $500,000 up to $5,000,000.

Comparison between The Trading Pit & FundedNext

| Trading Objectives | The Trading Pit | FundedNext (Evaluation) |

|---|---|---|

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: 4 Weeks Phase 2: 8 Weeks |

| Profit Split | 80% | 80% up to 95% |

Comparison between The Trading Pit & Funding Pips

| Trading Objectives | The Trading Pit | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% (Scaleable up to 7%) |

| Maximum Loss | 10% | 10% (Scaleable up to 14%) |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 60% up to 100% + Monthly Salary |

Comparison between The Trading Pit & Alpha Capital Group

| Trading Objectives | The Trading Pit | Alpha Capital Group |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

Before traders can be eligible for payments, they must successfully pass a single phase of The Trading Pit’s Prime One-phase Evaluation. With a daily maximum of 4% and a maximum trailing loss of 7%, the profit target is 10%. Additionally, during the evaluation phase, there are no maximum trading day requirements. However, throughout the evaluation phase, you must trade for at least five calendar days. Remember that traders can handle even bigger account sizes with the Classic One-phase Evaluation’s special scaling strategy. The Classic One-phase Evaluation differs from other industry funding programs primarily because to its bi-weekly future rewards, an indefinite trading time, a scaling strategy, and a first payout after 14 calendar days.

Comparison between The Trading Pit & FTUK

| Trading Objectives | The Trading Pit | FTUK |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 7% | 8% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | 4 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 50% up to 80% |

Comparison between The Trading Pit & City Traders Imperium

| Trading Objectives | The Trading Pit | City Traders Imperium |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | ❌ |

| Maximum Loss | 7% | 6% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 50% up to 100% + Monthly Salary |

Comparison between The Trading Pit & Funded Trading Plus

| Trading Objectives | The Trading Pit | Funded Trading Plus |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 7% | 6% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 80% up to 100% |

Before traders can be eligible for payments, they must complete a single phase of The Trading Pit’s Classic One-phase Evaluation. With a daily maximum of 4% and a maximum trailing loss of 7%, the profit target is 10%. Additionally, during the evaluation phase, there are no maximum trading day requirements. However, throughout the evaluation phase, you must trade for at least five calendar days. Remember that traders can handle even bigger account sizes with the Classic One-phase Evaluation’s special scaling strategy. The Classic One-phase Evaluation differs from other industry funding programs primarily because of its bi-weekly future rewards, an indefinite trading time, a scaling strategy, and a first payout after 14 calendar days ranging from $500,000 up to $5,000,000.

Comparison between The Trading Pit & PipFarm

| Trading Objectives | The Trading Pit | PipFarm (Static) |

|---|---|---|

| Profit Target | 10% | 12% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 7% (Trailing) | 6% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 70% ($10,000 & $20,000) 60% up to 80% ($50,000 & $100,000) | 70% up to 95% |

Comparison between The Trading Pit & Goat Funded Trader

| Trading Objectives | The Trading Pit | Goat Funded Trader |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 7% (Trailing) | 6% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 70% ($10,000 & $20,000) 60% up to 80% ($50,000 & $100,000) | 75% up to 95% |

Comparison between The Trading Pit & FXIFY

| Trading Objectives | The Trading Pit | FXIFY |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 7% (Trailing) | 6% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 70% ($10,000 & $20,000) 60% up to 80% ($50,000 & $100,000) | 75% up to 90% |

To sum up, The Trading Pit offers three distinct account types—two one-step assessments and a two-step evaluation—which sets it apart from other top prop organizations in the industry. Furthermore, they offer many advantageous characteristics, including an indefinite trading term, a first payout that occurs after 14 calendar days, future payouts that occur every two weeks, and a scaling plan that ranges from $500,000 to $5,000,000.

Is Getting The Trading Pit Capital Realistic?

When looking at proprietary trading companies that fit your forex trading style, it’s critical to assess how achievable the trading needs are. If a business demands large monthly earnings with low maximum drawdown percentages, it becomes less feasible and less likely to succeed, even though it may seem appealing with a high % profit share on a generously funded account. It’s also important to look at time limits; an unlimited trading period is better because it removes the pressure that comes with time constraints. To reduce the possibility of inadvertently breaking the terms of your trading account, it is crucial that you familiarize yourself with all trading regulations both during the evaluation phase and the ensuing financing phases.

- The Prime Two-phase Evaluation’s below-average profit targets (8% in phase one and 5% in phase two) and average maximum loss restrictions (5% maximum daily and 10% maximum loss) make it reasonable to receive funds from it. It’s crucial to remember that there is a minimum trading day requirement of five calendar days, but there are no maximum limits. Additionally, individuals who successfully complete all assessment rounds are eligible for rewards with a favorable 80% profit split.

- The Prime One-phase Evaluation’s average profit aim of 10% and average maximum loss regulations (4% maximum daily and 7% maximum loss) make it reasonable to receive funds from it. It’s crucial to remember that there is a minimum trading day requirement of five calendar days, but there are no maximum limits. Additionally, participants are eligible for rewards with a favorable 80% profit split after passing the evaluation step.

- The Classic One-phase Evaluation’s average profit aim of 10% and average maximum loss rules (4% maximum daily and 7% maximum trailing loss) make it reasonable to receive funds. It’s crucial to remember that there is a minimum trading day requirement of five calendar days, but there are no maximum limits. Additionally, participants are eligible for payments with a favorable profit share of 50% up to 70% on $10,000 or $20,000 account sizes and 60% up to 80% on $50,000 or $100,000 account sizes after passing the evaluation process.

After weighing all the variables, The Trading Pit comes highly recommended because it offers three distinct funding programs, including two one-step evaluations and a two-step evaluation, all of which have realistic trading goals and requirements for award eligibility.

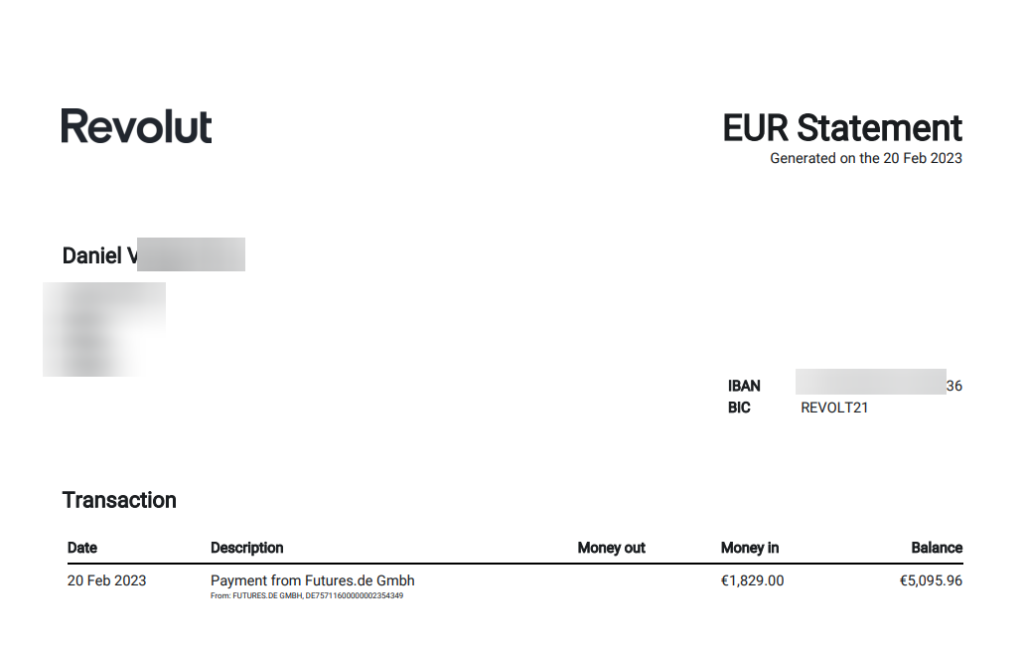

Payment Proof

The Trading Pit is a proprietary trading firm that was incorporated in February 2022. They have a large community of traders who have reached funded status and successfully qualify for a profit split.

You will be entitled to earn your first payout of at least $100 after 14 calendar days while working with The Trading Pit and achieving funded status with the Prime Two-phase Evaluation, Prime One-phase Evaluation, or Classic One-phase Evaluation. However, if you surpass the $100 minimum withdrawal amount every 14 calendar days after your initial payout, you will also be eligible for rewards. While the Classic One-Phase Evaluation will give you a generous profit split of 50% up to 70% on your $10,000 or $20,000 account size and 50% up to 80% on your $50,000 account size, your profit split will consist of a generous 80% based on the profit that you generated on your funded Prime Two-phase Evaluation and Prime One-phase Evaluation or $100,000 account size.

You can locate The Trading Pit payment proof on a number of websites. As an illustration, consider Trustpilot, where traders leave comments about their interactions with the business and the steps they took to get paid. Another source of payment proof of The Trading Pit is their Discord channel and YouTube channel, where you can find numerous payout certificates and interviews of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does The Trading Pit Use?

The Trading Pit is partnered with FXFlat and GBE Brokers as their broker.

FXFlat is a top-tier internet brokerage. This liquidity provider, which has its main office in Germany, provides traders with high levels of dependability. Initially, they were a Forex and CFD broker. They have since grown, though, and are now providing their traders with the full range of financial products and asset classes.

GBE Brokers is a CFD broker that is regulated and has an office in the Port of Hamburg, Germany. They have a youthful, competent staff that has been purposefully assembled in a multicultural manner to allow traders to take use of their vast and global banking and financial industry expertise.

As for trading platforms, while you are working with The Trading Pit, they allow you to trade on MetaTrader 4 or MetaTrader 5 if you choose FXFlat, and if you choose GBE Brokers, you also have the option to trade on MetaTrader 4 or MetaTrader 5.

Trading Instruments

As mentioned above, The Trading Pit is partnered with FXFlat and GBE Brokers, and they let you trade a variety of trading products, such as equities, commodities, FX pairings, indices, and cryptocurrencies, with leverage as high as 1:20, depending on the trading instrument.

FX Flat Forex Pairs

| AUD/USD | EUR/USD | GBP/USD | USD/CAD | USD/CHF | USD/JPY |

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | AUD/SGD | CAD/CHF |

| CAD/JPY | CHF/JPY | EUR/AUD | EUR/CAD | EUR/CHF | EUR/DKK |

| EUR/GBP | EUR/HKD | EUR/JPY | EUR/NOK | EUR/NZD | EUR/PLN |

| EUR/SEK | EUR/SGD | EUR/TRY | EUR/ZAR | GBP/AUD | GBP/CAD |

| GBP/CHF | GBP/DKK | GBP/JPY | GBP/NOK | GBP/NZD | GBP/SEK |

| GBP/SGD | NOK/SEK | NZD/CAD | NZD/CHF | NZD/JPY | NZD/USD |

| SGD/JPY | USD/CZK | USD/DKK | USD/HKD | USD/HUF | USD/MXN |

| USD/NOK | USD/PLN | USD/SEK | USD/SGD | USD/TRY | USD/ZAR |

FX Flat Commodities

| GOLD | GOLDm | SILVER | SILVERm | BRENTcash |

| WTIcash |

FX Flat Indices

| AUS200 | STOXX50 | F40 | DE40 | HK50 |

| JP225 | N25 | ES35 | SWI20 | UK100 |

| US500 | USTEC | US30 | US30mini |

FX Flat Cryptocurrencies

| BTC/USD | LTC/EUR | LTC/USD | RIP/USD | BCC/USD |

| DSH/USD | ETH/USD | ADA/USD | DOT/USD | LINK/USD |

| EOS/USD |

GBE Broker Forex Pairs

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NOK | AUD/NZD | AUD/SEK |

| AUD/SGD | AUD/USD | CAD/CHF | CAD/JPY | CHF/JPY | CHF/NOK |

| CHF/PLN | EUR/AUD | EUR/CAD | EUR/CHF | EUR/GBP | EUR/HKD |

| EUR/HUF | EUR/JPY | EUR/MXN | EUR/NZD | EUR/PLN | EUR/NOK |

| EUR/SEK | EUR/SGD | EUR/TRY | EUR/USD | GBP/AUD | GBP/CAD |

| GBP/CHF | GBP/DKK | GBP/JPY | GBP/NOK | GBP/NZD | GBP/PLN |

| GBP/SEK | GBP/SGD | GBP/USD | GBP/ZAR | HKD/JPY | MXN/JPY |

| NOK/JPY | NOK/SEK | NZD/CAD | NZD/CHF | NZD/JPY | NZD/SGD |

| NZD/USD | SEK/JPY | SGD/JPY | TRY/JPY | USD/CAD | USD/CHF |

| USD/CNH | USD/CZK | USD/DKK | USD/HKD | USD/HUF | USD/JPY |

| USD/MXN | USD/NOK | USD/PLN | USD/RUB | USD/SEK | USD/SGD |

| USD/TRY | USD/ZAR | ZAR/JPY | EUR/CZK |

GBE Brokers Commodities

| XAU/EUR | XAU/USD | UKOil | WTIOil | USOil |

| XPD/USD | XPT/USD | XAG/EUR | XAG/USD |

GBE Brokers Indices

| AUS200 | F40 | STOXX50 | UK100 | US500 |

| USTEC | HK50 | DE40 | NE25 | DJ30 |

| ES35 | SWI20 | JP225 |

GBE Brokers Cryptocurrencies

| BTC/USD | BCH/USD | BTC/JPY | ETH/USD | LTX/USD |

| DOT/USD | EOS/USD | LINK/USD | XMR/USD | ADA/USD |

| DGO/USD | XLM/USD |

You can trade a variety of equities at The Trading Pit, as was previously indicated. Please use the Spread Account below to see the entire list of stocks that are available. This account will let you to log into the MetaTrader 4 or MetaTrader 5 trading platform.

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | Prices vary |

| COMMODITIES | Prices vary |

| INDICES | Prices vary |

| STOCKS | Prices vary |

| CRYPTO | Prices vary |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 4 | FXFlatMT4-DemoServer | 3001017 | as1234as | Click here |

| MetaTrader 5 | FXFlatMT5-DemoServer | 101009 | as1234as | Click here |

Education

The Trading Pit provides its community with a detailed Blog with valuable educational articles.

Additionally, The Trading Pit also provides its community with the following educational and trading tools:

- Ebooks

- Webinars

- Podcasts

- Videos

- Infographics

- Glossary

- Press Releases

- LiveSquawk

- StereoTrader

- Economic Calendar

- CME Heatmap

Lastly, The Trading Pit also provides traders with a well-developed trading dashboard, making it easier to follow your trading progress with the numerous live statistics of all trading objectives.

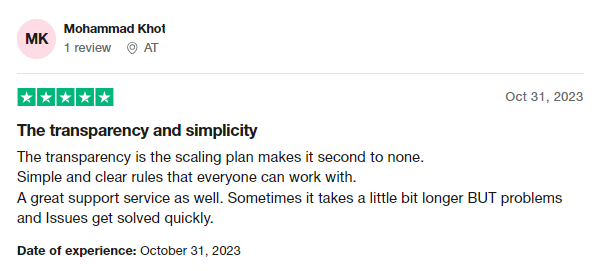

Trustpilot Feedback

The Trading Pit has gathered a great score on Trustpilot based on their community’s feedback.

On Trustpilot, The Trading Pit has received good comments and reviews about their company’s services from a wide range of their community. From a sizable pool of 370 evaluations, the company has earned an outstanding rating of 4.0 out of 5. Remarkably, The Trading Pit has received the highest rating of five stars in 79% of these evaluations.

The client compliments The Trading Pit for its unmatched transparency in the scaling plan in the first comment. They value the regulations’ accessibility and clarity, which make them easy to understand. The customer also praises the great support service, pointing out that although response times can occasionally be a little slower, problems and concerns are handled effectively and promptly.

The customer praises the services, follow-up, and methodical approach that The Trading Pit has put in place to give traders the greatest experience in the business, calling their time there outstanding. They use all of The Trading Pit’s resources and assistance in the hopes of pursuing a long-term trading profession.

Social Media Statistics

| 61,000 Followers & 61,000 Likes | |

| 7,639 Followers | |

| 4,248 Followers | |

| 4,513 Followers | |

| YouTube | 2,310 Subscribers |

| – | |

| TikTok | 385 Followers & 2,000 Likes |

| Discord | 3,889 Members |

| Telegram | 1,084 Members |

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Phone | +4232379000 |

| Discord | Discord Link |

| Telegram | Telegram Link |

| FAQ | FAQ Link |

| Help Center | ❌ |

| ❌ | |

| Messenger | ❌ |

| Supported Languages | English |

Account Opening Process

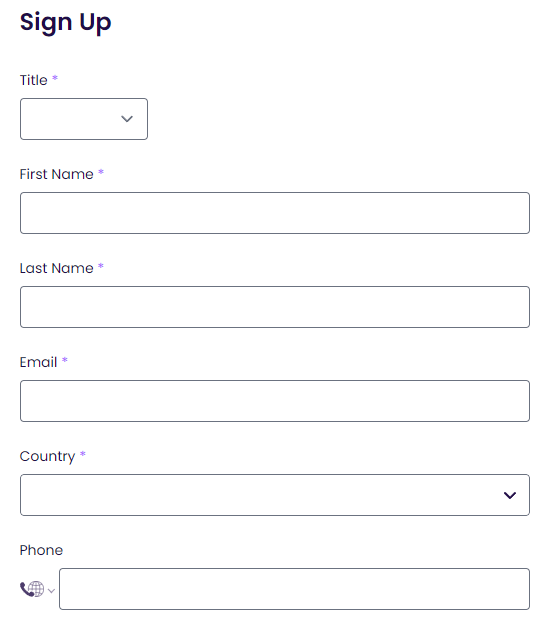

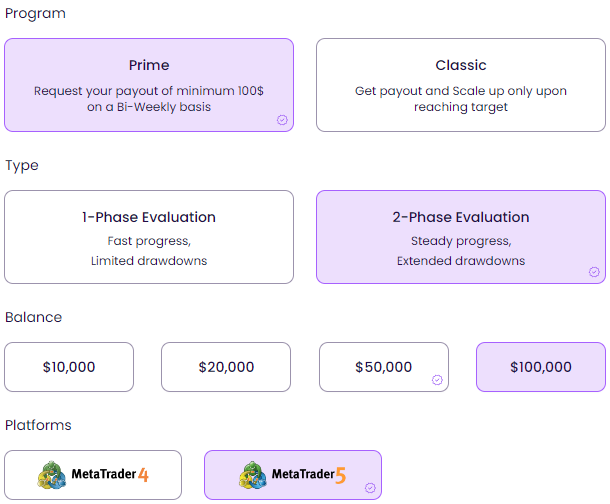

- Registration Form – Register with The Trading Pit through our affiliate link by filling out the registration form with your personal details and logging into the trading dashboard.

- Choose Your Account – Select the trading platform, account size, and account type.

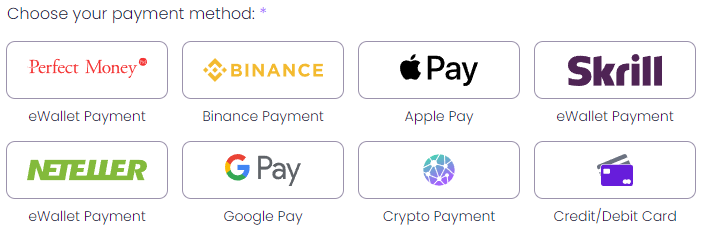

- Choose Your Payment Method – Select among cryptocurrencies, credit/debit cards, Perfect Money, Binance, Skrill, Neteller, Apple Pay, and Google Pay.

Conclusion

In conclusion, The Trading Pit is a respectable and reliable proprietary trading company that offers traders three funding options: the Prime One-phase Evaluation and Classic One-phase Evaluation, which are one-step challenges, and the Prime Two-phase Evaluation, which is a two-step challenge.

Before becoming qualified to manage a funded account and get 80% profit splits, candidates must pass The Trading Pit’s Prime Two-phase Evaluation, an industry-standard two-step assessment. To be effectively funded, traders need to meet profit goals of 8% in phase one and 5% in phase two. Given that you have a 10% maximum loss and a 5% daily maximum to adhere to, these are reasonable trading goals. In terms of time constraints, neither evaluation phase has a maximum number of trading days required. However, throughout each evaluation phase, you must trade for at least five calendar days. Lastly, it’s important to remember that the Prime Two-phase Evaluation contains a scaling plan that allows you to raise the initial amount in your account.

Before becoming qualified to manage a funded account and get 80% profit splits, candidates must successfully complete The Trading Pit’s Prime One-phase Evaluation, a one-step assessment. To be successfully funded, traders need to hit a 10% profit target. With a daily limit of 4% and a maximum loss of 7% to adhere to, these are reasonable trading goals. In terms of deadlines, you are not subject to a limited number of trading days during the assessment stage. However, throughout the evaluation phase, you must trade for at least five calendar days. Lastly, it’s important to remember that the Prime One-phase Evaluation contains a scalability plan that allows you to raise the initial amount in your account.

Completing a single phase of The Trading Pit’s Classic One-phase Evaluation is a prerequisite for managing a funded account and receiving profit splits ranging from 50% to 80%. To be successfully funded, traders need to hit a 10% profit target. Given that you must adhere to a 4% daily maximum and a 7% maximum trailing loss rule, these are reasonable trading goals. In terms of deadlines, you are not subject to a limited number of trading days during the assessment stage. However, throughout the evaluation phase, you must trade for at least five calendar days. Lastly, it’s important to remember that the Classic One-phase Evaluation offers a scaling plan that allows you to raise the initial amount in your account.

I would suggest The Trading Pit to anyone looking for a respectable proprietary trading company that offers outstanding trading conditions to a wide variety of people with different trading preferences. They provide traders with advantageous features like a scaling plan that ranges from $500,000 to $5,000,000. They also offer an unlimited trading term, a first reward after 14 calendar days, and bi-weekly future payouts. The Trading Pit is undoubtedly a popular option in the prop trading sector when taking into account everything they have to offer traders worldwide.

What are your opinions on The Trading Pit and its services?

Do they align with the trading conditions and services you’ve been seeking?

Let us know if you enjoyed our detailed The Trading Pit review by commenting below!

Leave a Reply