Lux Trading Firm Review

Lux Trading Firm is a leading proprietary firm, with offices in London and Bratislava, Slovakia. They specialize in assisting experienced prop traders and are committed to assisting them in excelling by providing the tools and capital they require to compete in volatile market conditions.

Pros

- Great Trustpilot rating of 4.1/5

- Two unique funding programs.

- Features include a free trial,

- Professional trading dashboard,

- Scaling plan,

- 75% profit share.

- Allows for overnight and

- Weekend holding, as well as news trading.

Cons

- Low leverage, up to 1:30.

- Mandatory Stop Loss

- Minimum trading day requirements: 29 days (15 days for swing traders).

- Trailing Maximum Drawdown

Lux Trading Firm encourages traders by allowing them to make more money by managing large amounts of capital. Traders can make substantial profits by managing account sizes of up to $1,000,000 and receiving 75% profit splits. This can be accomplished by trading a variety of financial instruments such as forex pairs, commodities, indices, stocks, and futures.

Who is Lux Trading Firm?

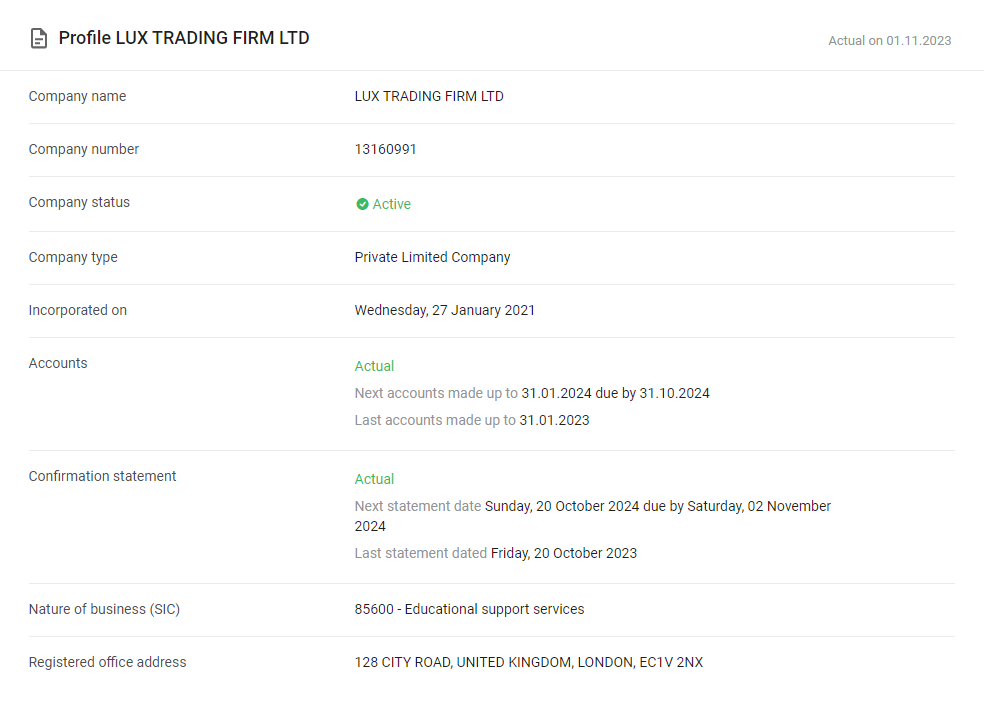

Lux Trading Firm is a proprietary trading firm with the legal name Lux Trading Firm Ltd that was incorporated on the 27th of January 2021. They are located in London, UK, as well as in Dubai, United Arab Emirates. Lux Trading Firm provides traders with the opportunity to choose between two account types, a one-step evaluation, and a two-step evaluation while developing their own The Lux Broker brokerage.

Lux Trading Firm’s headquarters are located at 128 City Road, London EC1V 2NX, United Kingdom.

Funding Program Options

Lux Trading Firm provides its traders with two unique funding program options:

- Two-step Evaluation

- One-step Evaluation

Two-step Evaluation

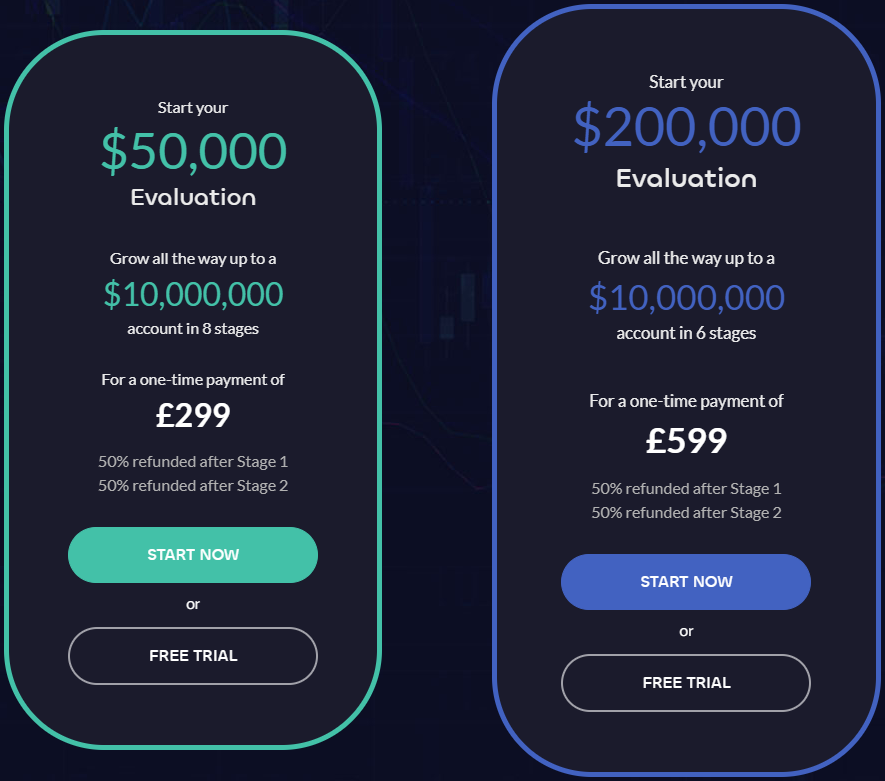

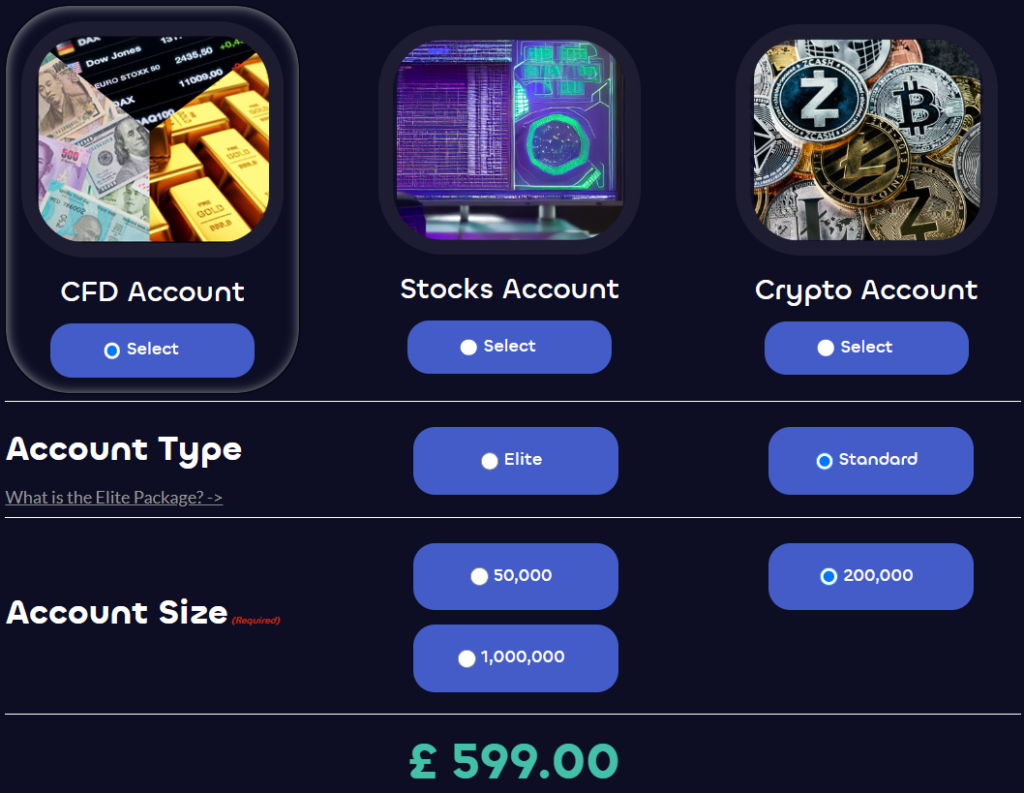

Lux Trading Firm’s Two-step Evaluation allows traders to manage account sizes ranging from $50,000 to $200,000. The goal is to identify disciplined traders who are profitable and can manage risk effectively during a one-step evaluation process. The Two-Step Evaluation enables you to trade with up to 1:30 leverage.

| Account Size | Price |

|---|---|

| $50,000 | £299 |

| $200,000 | £599 |

During the first evaluation phase, a trader must meet a 6% profit target while staying within their 6% maximum trailing loss rule. When it comes to time limits, keep in mind that there are no maximum trading days during phase one. To proceed to phase two, you must trade for at least 29 trading days (15 calendar days for swing traders). After completing the first evaluation phase, you will be eligible for a 50% refund of your initial one-time fee.

In the second evaluation phase, a trader must hit a 4% profit target without going over their 5% maximum trailing loss rule. Regarding time constraints, keep in mind that during phase two, there are no minimum or maximum trading day requirements. You only need to meet the 4% profit goal without going over the maximum trailing loss limit rule in order to move on to funded status. You can also receive a second 50% refund of your initial one-time fee after finishing the second evaluation phase.

You are given a funded account with no minimum withdrawal requirements after passing both evaluation stages. Only the 6% maximum trailing loss rule needs to be followed. All subsequent withdrawals can be made on a monthly basis, but your first payout occurs 30 calendar days after the day you place your first position on your funded account. Depending on how much money you make on your funded account, you will receive a 75% profit split.

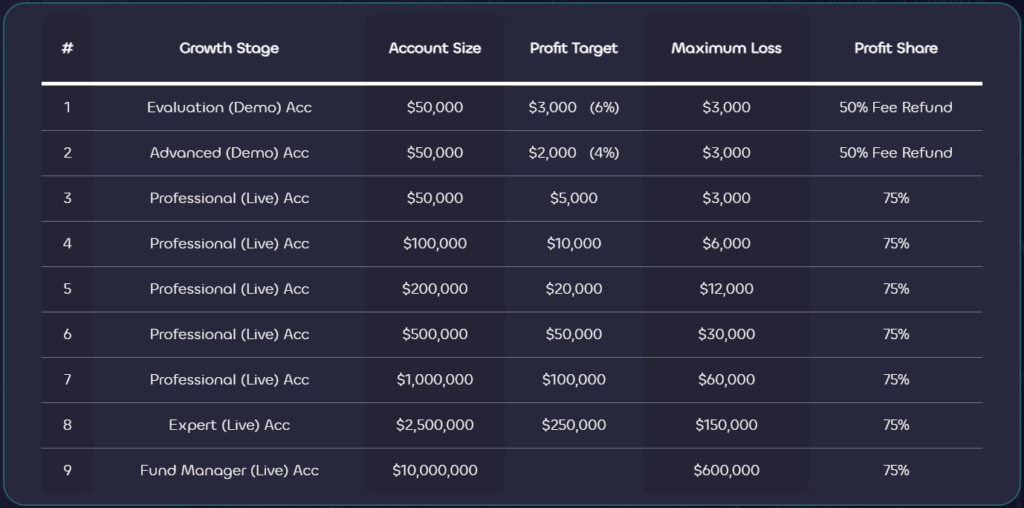

Two-step Evaluation Scaling Plan

There is a scaling strategy for the Two-step Evaluation as well. A trader can grow their account to the next possible account size if they are able to meet a 10% profit target. Please be aware that you won’t have to give up your earnings if you choose to scale your account.

Two-step Evaluation Trading’s Rules & Objectives

- Profit Target – To successfully complete an evaluation phase, withdraw winnings, or scale their trading account, traders must reach a specified profit %. While Phase 2 calls for achieving a profit target of 4%, Phase 1 has a profit target of 6%. There are no set profit goals for funded accounts.

- Maximum Trailing Loss – The maximum trailing loss a trader can sustain without violating the account is determined by the difference between the highest account balance attained and the lowest point of the decline. The maximum trailing loss for all account sizes is 6%.

- Minimum Trading Days – The bare minimum of time you have to trade before you can successfully complete an assessment phase. While assessment phase two has no minimum trading day restrictions, evaluation phase one requires a minimum of 29 trading days (15 calendar days for swing traders).

- Stop-loss Required – The trader is required to set a stop-loss on every position before starting a transaction. Each trading instrument’s minimum stop-loss distance is shown in the following Document.

- No Martingale – It is against the law for traders to use any kind of martingale method when trading.

- Consistency Rule – Requires traders to remain consistent in a number of areas, including position sizing, risk management, gains, and losses. This suggests that there shouldn’t be any notable differences in the account results’ attributes. When trading during the evaluation stage, you should maintain consistency in the amount of risk you take on each trade. The overall risk must also be the same when there are several trades.

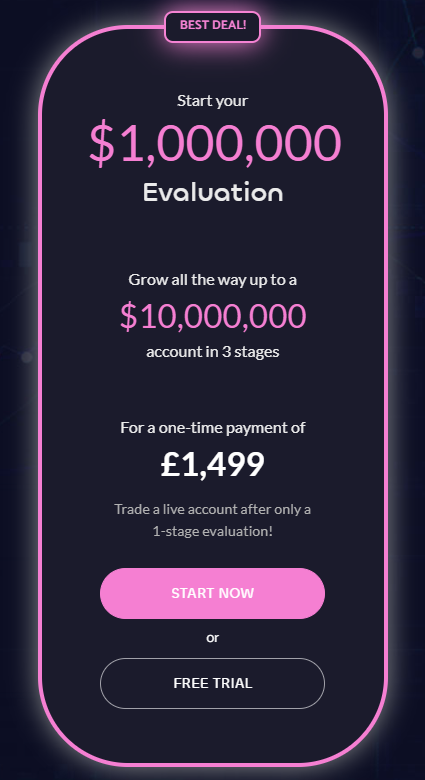

One-step Evaluation

Lux Trading Firm’s One-step evaluation gives traders the ability to handle $1,000,000 account sizes. During a one-step review phase, the goal is to find profitable, disciplined traders who can effectively manage risk. You can trade with up to 1:30 leverage when using the One-step Evaluation.

| Account Size | Price |

|---|---|

| $1,000,000 | £1,499 |

A trader must hit a 15% profit target during the evaluation phase without going over their 6% maximum trailing loss guideline. Regarding time constraints, keep in mind that during phase one, there are no criteria for the maximum number of trading days. To go on to funded status, though, you must trade for at least 29 trading days (15 calendar days for swing traders).

You are given a funded account with no minimum withdrawal requirements after passing the evaluation process. Only the 6% maximum trailing loss regulation needs to be followed. All subsequent withdrawals can be made on a monthly basis, but your first payout occurs 30 calendar days after the day you place your initial position on your funded account. Depending on how much money you make on your funded account, you will receive a 75% profit share.

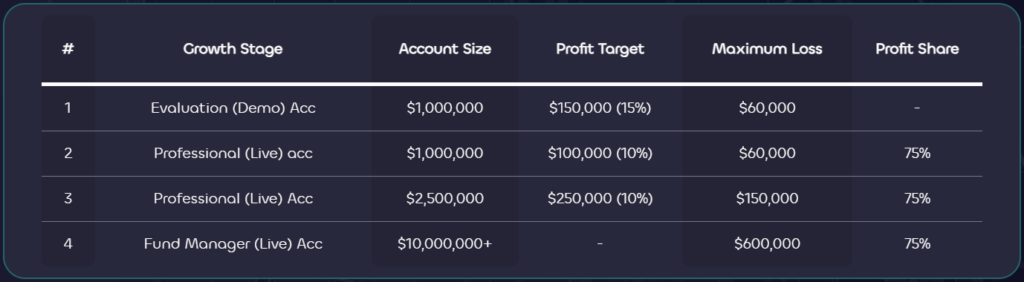

One-step Evaluation Scaling Plan

A scaling strategy is also included in the One-step Evaluation. A trader can grow their account to the next possible account size if they are able to meet a 10% profit target. Please be aware that you won’t have to give up your earnings if you choose to scale your account.

One-step Evaluation Trading Rules & Objectives

- Profit Target – To successfully complete an evaluation phase, withdraw winnings, or scale their trading account, traders must reach a specified profit %. For the evaluation phase, a 15% profit target is set. There are no set profit goals for funded accounts.

- Maximum Trailing Loss – The maximum trailing loss a trader can sustain without violating the account is determined by the difference between the highest account balance attained and the lowest point of the decline. The maximum trailing loss for all account sizes is 6%.

- Minimum Trading Days – The bare minimum of time you have to trade before you can successfully complete an assessment phase. A minimum of 29 trading days are required for the evaluation phase (15 calendar days for swing traders).

- Stop-loss Required – The trader is required to set a stop-loss on every position before starting a transaction. Each trading instrument’s minimum stop-loss distance is shown in the following Document.

- No Martingale – It is against the law for traders to use any kind of martingale method when trading.

- Consistency Rule – Requires traders to remain consistent in a number of areas, including position sizing, risk management, gains, and losses. This suggests that there shouldn’t be any notable differences in the account results’ attributes. When trading during the evaluation stage, you should maintain consistency in the amount of risk you take on each trade. The overall risk must also be the same when there are several trades.

What Makes Lux Trading Firm Different From Other Prop Firms?

Lux Trading Firm differs from most industry-leading prop firms because it provides two distinct account types: one-step and two-step evaluations. Moreover, they offer several beneficial characteristics, like an unlimited trading period, no minimum trading day restrictions (Phase two of Two-step Evaluation), no maximum daily drawdown rule, a scaling plan up to $10,000,000, and account sizes up to $1,000,000 (One-step Evaluation).

Lux Trading Firm’s Before traders can be eligible for payments, they must successfully complete two phases of the two-step evaluation. Phase one and phase two profit targets are 6% and 4%, respectively, with a maximum trailing loss rule of 6%. During either assessment phase, you are also not subject to any maximum trading day requirements. In phase two, there are no minimum trading day restrictions, but in phase one, you must trade for at least 29 trading days (15 calendar days for swing traders). Additionally, the Two-step Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The Two-step Evaluation differs from other industry funding programs primarily because it has no minimum trading day limitations and an unrestricted trading duration, phase two, no maximum daily drawdown rule, and a scaling plan up to $10,000,000.

Example of comparison between Lux Trading Firm & Funding Pips

| Trading Objectives | Lux Trading Firm | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 6% | 8% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | ❌ | 5% (Scaleable up to 7%) |

| Maximum Loss | 6% (Trailing) | 10% (Scaleable up to 14%) |

| Minimum Trading Days | Phase One: 29 Calendar Days (Swing Traders: 15 Calendar Days) Phase Two: No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 75% | 80% up to 100% + Monthly Salary |

Example of comparison between Lux Trading Firm & FundedNext

| Trading Objectives | Lux Trading Firm | FundedNext (Evaluation) |

|---|---|---|

| Phase 1 Profit Target | 6% | 10% |

| Phase 2 Profit Target | 4% | 5% |

| Maximum Daily Loss | ❌ | 5% |

| Maximum Loss | 6% (Trailing) | 10% |

| Minimum Trading Days | Phase One: 29 Calendar Days (Swing Traders: 15 Calendar Days) Phase Two: No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: 4 Weeks Phase 2: 8 Weeks |

| Profit Split | 75% | 80% up to 90% |

Example of comparison between Lux Trading Firm & E8 Markets

| Trading Objectives | Lux Trading Firm | E8 Markets |

|---|---|---|

| Phase 1 Profit Target | 6% | 8% |

| Phase 2 Profit Target | 4% | 4% |

| Maximum Daily Loss | ❌ | 4% |

| Maximum Loss | 6% (Trailing) | 8% (Scaleable to 14%) |

| Minimum Trading Days | Phase One: 29 Calendar Days (Swing Traders: 15 Calendar Days) Phase Two: No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 75% | 80% |

Lux Trading Firm’s One-step Evaluation: Before traders can receive rewards, they must successfully finish a single part of the evaluation. With a maximum trailing loss rule of 6%, the profit aim is 15%. Additionally, during the evaluation phase, there are no maximum trading day requirements. However, throughout the evaluation phase, you must trade for at least 29 trading days (15 calendar days for swing traders). Additionally, the One-step Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The One-step Evaluation is unique among industry funding programs due to its unrestricted trading time, no daily maximum drawdown limitation, scaling plan up to $10,000,000, and account sizes up to $1,000,000.

Example of comparison between Lux Trading Firm & PipFarm

| Trading Objectives | Lux Trading Firm | PipFarm (Trailing) |

|---|---|---|

| Profit Target | 15% | 12% |

| Maximum Daily Loss | ❌ | 3% |

| Maximum Loss | 6% (Trailing) | 12% (Trailing) |

| Minimum Trading Days | 29 Calendar Days (Swing Traders: 15 Calendar Days) | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 75% | 70% up to 95% |

Example of comparison between Lux Trading Firm & MyFundedFX

| Trading Objectives | Lux Trading Firm | MyFundedFX |

|---|---|---|

| Profit Target | 15% | 10% |

| Maximum Daily Loss | ❌ | 4% (Scaleable up to 6%) |

| Maximum Loss | 6% (Trailing) | 6% (Trailing)(Scaleable up to 12%) |

| Minimum Trading Days | 29 Calendar Days (Swing Traders: 15 Calendar Days) | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 75% | 80% up to 92.75% |

Example of comparison between Lux Trading Firm & The Funded Trader

| Trading Objectives | Lux Trading Firm | The Funded Trader |

|---|---|---|

| Profit Target | 15% | 10% |

| Maximum Daily Loss | ❌ | 3% (4% with Add-on) |

| Maximum Loss | 6% (Trailing) | 6% (Trailing)(7% with Add-on) |

| Minimum Trading Days | 29 Calendar Days (Swing Traders: 15 Calendar Days) | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 75% | 80% up to 90% |

In conclusion, Lux Trading Firm differs from other industry-leading prop firms by providing a one-step evaluation and a two-step evaluation, two distinct account types. Moreover, they offer several beneficial characteristics, like an unlimited trading period, no minimum trading day restrictions (Phase two of Two-step Evaluation), no maximum daily drawdown rule, a scaling plan up to $10,000,000, and account sizes up to $1,000,000 (One-step Evaluation).

Is Getting Lux Trading Firm Capital Realistic?

When looking at proprietary trading companies that fit your forex trading style, it’s critical to assess how achievable the trading needs are. If a business demands large monthly earnings with low maximum drawdown percentages, it becomes less feasible and less likely to succeed, even though it may seem appealing with a high % profit share on a generously funded account. It’s also important to look at time limits; an unlimited trading period is better because it removes the pressure that comes with time constraints. In order to reduce the possibility of inadvertently breaking the terms of your trading account, it is crucial that you familiarize yourself with all trading regulations both during the evaluation phase and the ensuing financing phases.

- The Two-step Evaluation’s below-average profit targets (6% in phase one and 4% in phase two) and average maximum loss restrictions (6% maximum trailing loss) make it reasonable to receive funds from it. It’s crucial to remember that phase one has a minimum trading day requirement of 29 calendar days (15 calendar days for swing traders), phase two has no minimum trading day requirements, and phase three has no maximum trading day requirements. Additionally, individuals who successfully complete both evaluation rounds are eligible for rewards with a favorable 75% profit split.

- The One-step Evaluation’s somewhat above-average 15% profit aim and average maximum loss rule (6% maximum trailing loss) make it realistic to receive funds from it. There is a minimum trading day requirement of 29 calendar days (15 calendar days for swing traders), however there are no maximum trading day limitations. Additionally, participants are eligible for rewards with a favorable 75% profit split after passing the evaluation step.

After considering all the factors, Lux Trading Firm is highly recommended since you have two unique funding programs to choose from, a one-step evaluation and a two-step evaluation, which both feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

Lux Trading Firm is a private trading company that was established on January 27, 2021. They have a sizable trading community that has attained funded status and is eligible for a profit split.

After 30 calendar days of working with Lux Trading Firm and achieving funded status through the Two-step or One-step Evaluation, you will be qualified to get your first payout. However, if you surpass your initial account size every 30 calendar days after your initial payout, you will also be eligible for rewards. Based on the profit you have made on your funded account, a substantial 75% will make up your profit share.

You can locate Lux Trading Firm payment proof on several websites. As an illustration, consider Trustpilot, where traders leave comments about their interactions with the business and the steps they took to get paid. Another source of payment proof for Lux Trading Firm is their YouTube channel, where you can find numerous trader interviews of their most successful traders.

Which Broker Does Lux Trading Firm Use?

Lux Trading Firm doesn’t use any of the popular broker brands for trading. Rather, they’ve created their own The Lux Broker.

As for trading platforms, while working with Lux Trading Firm, they allow you to trade on The Lux Trader or Match-Trader.

Trading Instruments

As mentioned above, Lux Trading Firm has developed The Lux Broker, and depending on the trading instrument you are trading, they let you to trade a variety of trading products with leverage of up to 1:30, including FX pairs, commodities, indices, stocks, and futures.

Forex Pairs

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NOK | AUD/NZD | AUD/PLN |

| AUD/SEK | AUD/SGD | AUD/USD | CAD/CHF | CAD/JPY | CHF/HUF |

| CHF/JPY | CHF/NOK | CHF/PLN | CHF/SEK | CHF/SGD | EUR/AUD |

| EUR/CAD | EUR/CHF | EUR/CZK | EUR/DKK | EUR/GBP | EUR/HKD |

| EUR/HUF | EUR/JPY | EUR/MXN | EUR/NOK | EUR/NZD | EUR/PLN |

| EUR/SEK | EUR/SGD | EZR/TRY | EUR/USD | EUR/ZAR | GBP/AUD |

| GBP/CAD | GBP/CHF | GBP/DKK | GBP/HUF | GBP/JPY | GBP/MXN |

| GBP/NOK | GBP/NZD | GBP/PLN | GBP/SEK | GBP/SGD | GBP/TRY |

| GBP/USD | GBP/ZAR | HKD/JPY | NOK/JPY | NOK/SEK | NZD/CAD |

| NZD/CHF | NZD/HUF | NZD/JPY | NZD/SGD | NZD/USD | PLN/JPY |

| SEK/JPY | SGD/JPY | USD/CAD | USD/CHF | USD/CNH | USD/CZK |

| USD/DKK | USD/HKD | USD/HUF | USD/ILS | USD/JPY | USD/MXN |

| USD/NOK | USD/PLN | USD/RUB | USD/SEK | USD/SGD | USD/THB |

| USD/TRY | USD/ZAR | ZAR/JPY |

Commodities

| UKOil | USOil | NGAS | XAG/AUD | XAG/EUR |

| XAG/USD | XAL/USD | XAU/AUD | XAU/EUR | XAU/USD |

| XPD/USD | XPT/USD |

Indices

| AUS200 | CH50 | US30 | SPA35 | STOXX50 |

| FR40 | GER40 | HKD | JPN225 | NE25 |

| US100 | RUS2000 | US500 | SWI20 | UK100 |

As previously said, you can trade a variety of stocks and futures with Lux Trading Firm. To see the whole list, please visit the List of All Symbols.

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | Commission Fees Vary |

| COMMODITIES | Commission Fees Vary |

| INDICES | Commission Fees Vary |

| STOCKS | Commission Fees Vary |

| FUTURES | Commission Fees Vary |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| Match-Trader | – | – | – | Click here |

Education

Lux Trading Firm provides its community with a detailed Blog with valuable educational articles.

Lux Trading Firm also provides its community with a free trial option, enabling users to become acquainted with its trading guidelines and platform while getting a feel for what it’s like to trade with the business.

Last but not least, Lux Trading Firm provides a cutting-edge trading dashboard to monitor your trading results. This may be quite helpful both when you are managing a funded account and during assessment phases.

Trustpilot Feedback

Lux Trading Firm has gathered a great score on Trustpilot based on their community’s feedback.

On Trustpilot, Lux Trading Firm has received good comments and reviews about their company’s services from a wide range of their community. From a sizable pool of 642 evaluations, the company has earned an outstanding rating of 4.1 out of 5. Remarkably, Lux Trading Firm has received the highest rating of five stars in 78% of these evaluations.

The client praises Lux Trading Firm’s MT5 platform in the first comment, describing it as a link between conventional and cutting-edge trading. They use tools and cryptocurrency to convey the platform’s richness, resulting in a singular experience that is both grounded in the past and focused on the future.

The client shares a positive experience with Lux Trading Firm, showcasing their smooth payout and effective cash-out procedure. Notwithstanding my initial anxiety, the Lux team made the process simple, and the money arrived sooner than anticipated. They recommend Lux Trading Firm as a reliable platform that delivers on payouts.

Social Media Statistics

| 4,600 Followers & 3,400 Likes | |

| 2.241 Followers | |

| 3,647 Followers | |

| YouTube | 6,380 Subscribers |

| Discord | 4,277 Members |

Customer Support

| Live Chat | ✅ |

| [email protected] [email protected] [email protected] | |

| Phone | Marketing & Sales: +44 (0)20 7167 8107 Management: +382 325 40312 Administration: +971 4 4070582 |

| Discord | Discord Link |

| FAQ | FAQ Link |

| Supported Languages | English |

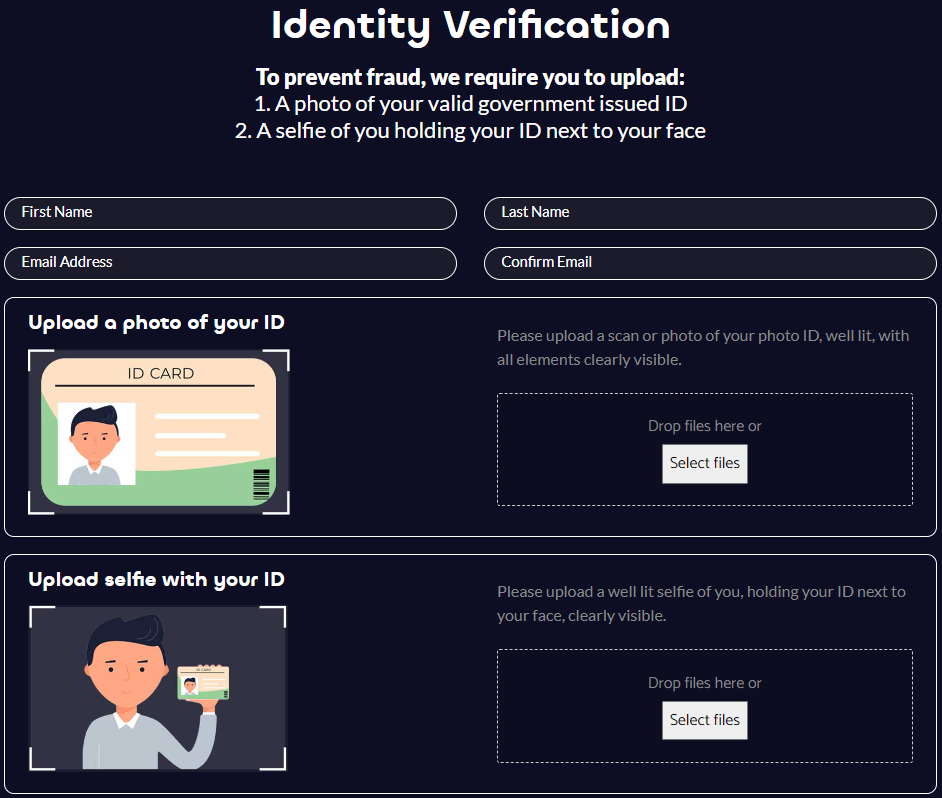

Account Opening Process

- Registration Form – Create an account with Lux Trading Firm by entering your personal information on the registration form and accessing the trading dashboard.

- Choose Your Account – Choose your account type and account size.

Conclusion

In conclusion, Lux Trading Firm offers traders the option to select between two funding programs: the One-step Evaluation, which is a one-step evaluation, and the Two-step Evaluation, which is a two-step evaluation. is a respectable and reliable proprietary trading company.

Lux Trading Firm’s Before becoming qualified to manage a funded account and get 75% profit splits, candidates must successfully complete two steps of the industry-standard two-step evaluation. To be effectively funded, traders need to meet profit goals of 6% in phase one and 4% in phase two. Given that you must adhere to a maximum trailing loss rule of 6%, these trading goals are reasonable. In terms of time constraints, neither evaluation phase has a maximum number of trading days required. In phase one, you must trade for at least 29 calendar days (15 calendar days for swing traders), but in phase two, there are no minimum trading day requirements. Lastly, it’s important to remember that the Two-step Evaluation has a scaling plan that gives you the chance to to increase your initial account balance.

On the other hand, Lux Trading Firm’s One-step Evaluation is a one-step evaluation that requires the completion of a single phase before becoming eligible to manage a funded account and earn 75% profit splits. Traders must reach a profit target of 15% to become successfully funded. These are realistic trading objectives, considering you have a 6% maximum trailing loss rule to follow. Regarding time limitations, you have no maximum trading day requirements during the evaluation phase. However, you are required to trade for a minimum of 29 calendar days (15 calendar days for swing traders). Finally, it’s essential to note that the One-step Evaluation features a scaling plan, providing you with the opportunity to increase your initial account balance.

I would recommend Lux Trading Firm to anyone looking for a respectable proprietary trading company that offers outstanding trading circumstances to a wide variety of people with different trading preferences. A scaling plan up to $10,000,000, account sizes up to $1,000,000 (One-step Evaluation), no minimum trading day requirements (Phase two of Two-step Evaluation), and an endless trading time are some of the special benefits they provide traders. Taking into account all that Lux Trading Firm has to offer traders around the globe, they can be regarded as a great option for anyone with a solid trading plan who wants to make steady, gradual earnings.

What are your individual opinions on Lux Trading Firm and the services they offer?

Do they align with the trading conditions and services you’ve been seeking?

Let us know if you enjoyed our detailed Lux Trading Firm review by commenting below!

Leave a Reply