FXIFY Review

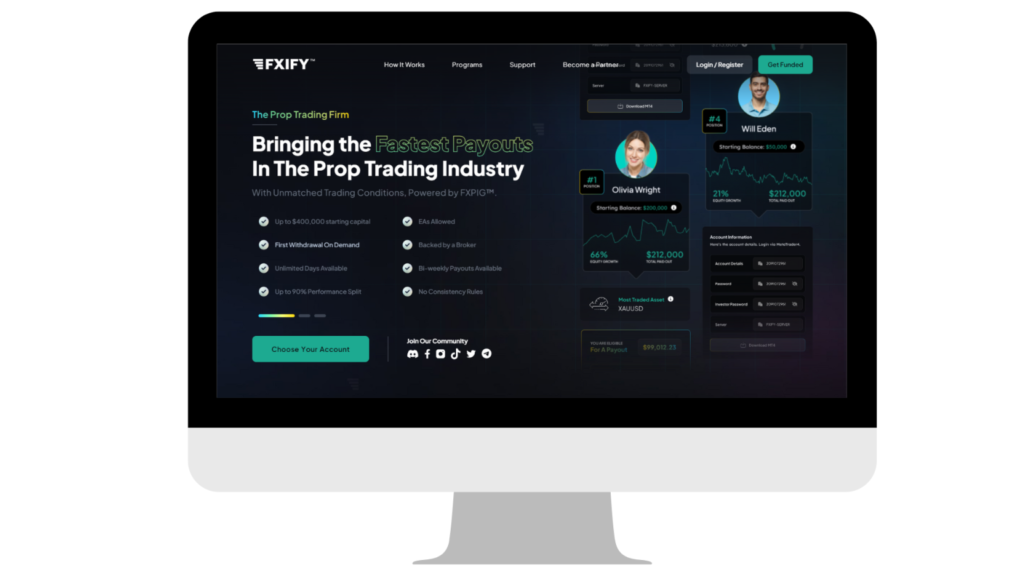

FXIFY is a company that identifies skilled traders by evaluating their discipline, focus, and consistent risk management in the financial markets. Traders are evaluated using one of three funding methods: two-step, one-step, or three-step. Successfully completing the evaluation qualifies traders for profit splits.

Pros

- Trustpilot rating is 4.3/5.

- Supporting clients located in the United States

- Three unique funding programs.

- Multiple Add-On Features

- Professional Trader Dashboard

- A wide range of trading instruments (forex pairs, commodities, indices, stocks, and cryptocurrencies).

- No maximum trading period or scaling plan.

- First payout on demand.

- Bi-weekly payouts with profit share ranging from 80% to 90%.

- Allows for overnight and weekend holding, news trading, balance-based drawdown, and many raw account types.

Cons

- The minimum trading day requirement is 5 days. Payout cycles are monthly but may be reduced to bi-weekly with the add-on.

- Trailing Drawdown for One-Phase Evaluation

- 5% Maximum Loss Rule for Three-Phase Evaluation

FXIFY is a firm that identifies skilled traders based on discipline, attention, and consistent risk management in financial markets. They put them via one of three accessible funding schemes. Traders may earn big earnings by managing account sizes up to $400,000 and receiving up to 90% profit splits. This may be performed via trading a variety of financial products such as FX pairings, commodities, indices, stocks, and cryptocurrencies.

Who is FXIFY?

FXIFY is a proprietary trading business founded in May 2023 under the official name FXIFY Solutions Limited. They are based in London, UK, and are run by co-founders David Bhidey and Peter Brown. FXIFY offers traders three account types: two-step assessment, one-step evaluation, and three-step evaluation while working with FXPIG as their broker.

FXIFY’s headquarters are located at Unit 1, 74 Back Church Lane, London, E1 1LX.

Who is the CEO of FXIFY?

David Bhidey and Peter Brown are co-founders of FXIFY.

David Bhidey, a co-founder of FXIFY, has a decade-long background in technology and e-commerce, having founded an online property firm. His interest in technology and finance inspired him to start trading five years ago, when he joined FXPIG as an Introducing Broker with Peter Brown. Together, they skillfully navigated the financial markets.

In the last four years, David has developed his proprietary trading talents and, with Peter, founded a premier proprietary trading business to fill a market need. Using his background, David hopes to make FXIFY a trader-centric success story that emphasizes profitability and honesty. His strategic vision directs the company’s operations, assuring its continued innovation and excellence in the financial markets.

Peter Brown, FXIFY‘s second co-founder, has more than a decade of e-commerce and marketing experience. His digital path has included working for agencies, starting his own business, and leading performance marketing and website development. Peter began personal trading five years ago and joined with David Bhidey as an Introducing Broker for FXPIG.

Their collaboration led to the creation of FXIFY, meeting an unmet market demand. Under Peter’s leadership, FXIFY quickly grew to prominence as a leading proprietary trading organization. Peter, who leads development and performance marketing, uses his experience in e-commerce and banking to fuel FXIFY‘s continued progress.

Funding Program Options

FXIFY provides its traders with three unique funding program options:

- Two-phase Evaluation

- One-phase Evaluation

- Three-phase Evaluation

Two-phase Evaluation

FXIFY’s Two-phase Evaluation allows traders to manage account sizes ranging from $5,000 to $400,000. The goal of the two-step evaluation process is to find skilled traders who are profitable and capable of managing risk efficiently. The Two-phase Evaluation enables you to trade with up to 1:30 leverage (1:50 with add-on).

| Account Size | Price |

| $5,000 | $59 |

| $10,000 | $89 |

| $15,000 | $119 |

| $25,000 | $199 |

| $50,000 | $379 |

| $100,000 | $499 |

| $200,000 | $999 |

| $400,000 | $1,999 |

At phase one of evaluation, you have to achieve a profit level of 10% with a daily loss of up to 4% without reaching a maximum trailing loss of 10%. With respect to time constraints, be advised that you don’t have any maximum number of trading days during the evaluation at phase one. But during the same, you need to have traded a minimum of five days of trading to go for the second phase.

Phase two of evaluation requires a trader to reach a profit target of 5% without exceeding the maximum daily loss of 4% or the maximum trailing loss of 10%. As far as time constraints are concerned, note that you have no maximum trading day requirements during phase two. However, you are required to trade a minimum of five trading days in order to proceed to a funded account.

Having passed both the evaluation stages, you receive a funded account with no minimum withdrawal. You will need to only adhere to the rules of a maximum daily loss of 4% and a maximum trailing loss of 10%. The first withdrawal from your funded account is on-demand, without a minimum amount and with no minimum trading days. Other withdrawals can also be made monthly, or bi-weekly if you have applied an add-on when buying your account. Based on the profit you generate in your funded account, your split of profit shall be 80% to 90%.

Add-ons for FXIFY’s Two-phase Evaluation

- Increased leverage to 1:50,

- With a 90% profit split,

- Bi-weekly payouts.

Performance Protection (qualifies you for a payment if you are in profit even if you exceed the daily drawdown).

Two-Phase Evaluation Scaling Plan

The Two-Phase Evaluation also includes a scalability strategy. If a trader has been profitable for at least two of the past three months, with an average return of 10% during that time period, you will be eligible for a 25% increase in account size.

Example:

- After three months, an eligible $100,000 account climbs to $125,000.

- After the next three months, an eligible $125,000 account will expand to $150,000.

- After the next three months, an eligible $150,000 account will climb to $175,000.

And so forth.

Two-phase Evaluation Trading Rules & Objectives

- Profit Target – To successfully complete an assessment phase, withdraw winnings, or scale their trading account, traders must reach a specified profit %. While Phase 2 calls for achieving a profit objective of 5%, Phase 1 has a 10% profit target. There are no set profit goals for funded accounts.

- Maximum Daily Loss – The most amount of money a trader may lose in a single trading day without violating their account. The maximum daily loss for all account sizes is 4%.

- Maximum Trailing Loss – The greatest trailing loss a trader may sustain without violating the account is determined by the difference between the highest account balance attained and the lowest point of the decline. The maximum trailing loss for all account sizes is 10%.

- Minimum Trading Days – The minimal time required to engage in trading before effectively completing an evaluation phase. Both assessment rounds require a minimum of five trading days.

One-phase Evaluation

FXIFY’s Traders may handle account sizes ranging from $5,000 to $400,000 with One-phase Evaluation. Finding skilled traders who can effectively manage risk during the one-step evaluation phase and turn a profit is the goal. You can trade with up to 1:30 leverage (or 1:50 with add-on) while using the One-phase Evaluation.

| Account Size | Price |

| $5,000 | $59 |

| $10,000 | $89 |

| $15,000 | $119 |

| $25,000 | $199 |

| $50,000 | $379 |

| $100,000 | $499 |

| $200,000 | $999 |

| $400,000 | $1,999 |

A trader must hit a 10% profit objective during the assessment phase without going over their 3% daily loss or 6% trailing loss limits. Regarding time constraints, keep in mind that during the assessment period, there are no maximum trading day limits. To go on to a funded account, though, you must trade for at least five trading days.

You are given a funded account with no minimum withdrawal limitations after passing the evaluation process. Only the 3% daily loss cap and the 6% trailing loss cap must be adhered to. All subsequent withdrawals can be made on a monthly basis, however your initial payment from your funded account is on-demand with no minimum amount or trading day constraints.

80% to 90% of your earnings will be divided, depending on how much you generate on your funded account.

Add-ons for FXIFY’s One-phase Evaluation

- Increased 90 percent profit split,

- Biweekly payouts,

- A 1:50 leverage

Performance Protection (entitles you to a payment even if you exceed the daily drawdown if you are in profit)

Evaluation in a Single-Phase Plan for Scaling

There is a scaling strategy for the One-phase Evaluation as well. An account size increase of 25% of the original account size will be granted to traders who have been profitable for at least two of the previous three months with an average return of 10% during that time.

For instance:

Three months later, a $100,000 account that qualifies rises to $125,000.

- An eligible $125,000 account grows to $150,000 after the next three months.

- An eligible $150,000 account rises to $175,000 after the next three months.

And so forth.

One-phase Evaluation Trading Rules & Objectives

- Profit Target – To successfully complete an assessment phase, withdraw winnings, or scale their trading account, traders must reach a specified profit %. For the assessment phase, a 10% profit objective is set. There are no set profit goals for funded accounts.

- Maximum Daily Loss – The most amount of money a trader may lose in a single trading day without violating their account. The maximum daily loss for all account sizes is 3%.

- Maximum Trailing Loss – The greatest trailing loss a trader may sustain without violating the account is determined by the difference between the highest account balance attained and the lowest point of the decline. The maximum trailing loss for all account sizes is 6%.

- Minimum Trading Days – The bare minimum of time you have to trade before you can successfully complete an assessment phase. A minimum of five trading days are required for the assessment phase.

Three-phase Evaluation

FXIFY’s with the help of the three-phase evaluation, traders may handle account sizes ranging from $5,000 to $400,000. Finding skilled traders who can effectively manage risk during the three-step assessment process and turn a profit is the goal. You can trade with up to 1:30 leverage (or 1:50 with add-on) while using the Three-phase Evaluation.

| Account Size | Price |

| $5,000 | $39 |

| $10,000 | $59 |

| $15,000 | $79 |

| $25,000 | $149 |

| $50,000 | $249 |

| $100,000 | $399 |

| $200,000 | $799 |

| $400,000 | $1,599 |

Phase one of the evaluation requires a trader to make a profit of 5% without exceeding their maximum daily loss of 5% or maximum loss of 5%. In regard to time constraints, note that you have no maximum trading day requirements during phase one. However, you must trade at least five trading days to move to phase two.

Evaluation phase two requires a trader to realize a profit of 5% without exceeding their 5% maximum daily loss or their 5% maximum loss rules. Time constraints To your advantage, you are not subject to any kind of maximum trading day limits during phase two. In fact, you are bound to trade at least five trading days in order to qualify for phase three.

Three other demands also place on the evaluation phase on the trader; reach a 5% profit target that does not break the rule of maximum loss at a 5% daily amount or the 5% maximum loss. Regarding the maximum trading day, you must know that in phase three, there are no constraints on this area. There is a mandatory minimum, however: to trade a minimum of five trading days to enter the funded account.

Completing all three stages of evaluation is rewarded by a funded account with no minimum withdrawal, so long as you respect the maximum of 5% in losses each day and max losses on any given day. You’ll also have an on-demand payout for your first withdrawal with no minimum withdrawal, as well as no minimum trading day requirement, whereas other withdrawals can be made monthly by applying an add-on during the purchase of your funded account. Your share of profit will be 80% up to 90% of the profit you generate on your funded account.

Add-ons for FXIFY’s Three-phase Evaluation

- Increased 90 percent profit split,

- Biweekly payouts,

- A 1:50 leverage

Performance Protection (entitles you to a payment even if you exceed the daily drawdown if you are in profit)

Three-phase Scaling Plan for Evaluation

There is a scaling strategy for the Three-phase Evaluation as well. An account size increase of 25% of the original account size will be granted to traders who have been profitable for at least two of the previous three months with an average return of 10% during that time.

For instance:

Three months later, a $100,000 account that qualifies rises to $125,000.

- An eligible $125,000 account grows to $150,000 after the next three months.

- An eligible $150,000 account rises to $175,000 after the next three months.

And so forth.

Three-phase Evaluation Trading Rules & Objectives

- Profit Target – To complete an assessment phase, withdraw winnings, or scale their trading account, traders must reach a specified profit %. Achieving a profit objective of 5% is necessary for Phase 1, Phase 2, and Phase 3. There are no set profit goals for funded accounts.

- Maximum Daily Loss – The most amount of money a trader may lose in a single trading day without violating their account. The maximum daily loss for all account sizes is 5%.

- Maximum Loss – The highest amount of money a trader may lose in total without violating the terms of the account. The maximum loss for all account sizes is 5%.

- Minimum Trading Days – The bare minimum of time you have to trade before you can successfully complete an assessment phase. Each of the three assessment stages has a minimum of five trade days.

What Makes FXIFY Different From Other Prop Firms?

FXIFY differs from most industry-leading prop firms because it provides three distinct account types: one-step, three-step, and two-step evaluations. They also provide several beneficial features, like raw spread accounts, endless trading time, on-demand initial withdrawals, and a plethora of add-on options.

Before traders are eligible for payments, they must successfully complete two steps of FXIFY‘s two-phase assessment strategy. Phase one and phase two profit targets are 10% and 5%, respectively, with daily and trailing loss limits of 4% and 10%. During any assessment phase, you are also not subject to any maximum trading day limitations. However, throughout each evaluation phase, you must trade for at least five calendar days. Additionally, the Two-phase Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The Two-phase Evaluation distinguishes it from other financing programs in the business primarily because it offers raw spread accounts, an infinite trading time, an on-demand initial withdrawal, and a plethora of add-on options.

Example of comparison between FXIFY & Funding Pips

| Trading Objectives | FXIFY | Funding Pips |

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 4% | 5% (Scaleable up to 7%) |

| Maximum Loss | 10% (Trailing) | 10% (Scaleable up to 14%) |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% up to 90% | 60% up to 100% + Monthly Salary |

Example of comparison between FXIFY & FundedNext

| Trading Objectives | FXIFY | FundedNext (Evaluation) |

| Phase 1 Profit Target | 10% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 10% (Trailing) | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: 4 WeeksPhase 2: 8 Weeks |

| Profit Split | 80% up to 90% | 80% up to 95% |

Example of comparison between FXIFY & Alpha Capital Group

| Trading Objectives | FXIFY | Alpha Capital Group |

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 4% | 5% |

| Maximum Loss | 10% (Trailing) | 10% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% up to 90% | 80% |

FXIFY’s A one-phase assessment is a one-step process that traders must finish successfully in order to be eligible for payments. With a daily maximum of 3% and a maximum trailing loss of 6%, the profit objective is 10%. Additionally, during the assessment period, there are no maximum trading day limitations. However, throughout the assessment phase, you must trade for at least five calendar days. Remember that traders may handle even bigger account sizes using the One-phase Evaluation’s special scaling strategy. The One-phase Evaluation differentiates out from other industry financing programs primarily because it offers raw spread accounts, an indefinite trading duration, an on-demand initial withdrawal, and a plethora of add-on options.

Example of comparison between FXIFY & Funded Trading Plus

| Trading Objectives | FXIFY | Funded Trading Plus |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 3% | 4% |

| Maximum Loss | 6% (Trailing) | 6% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 90% | 80% up to 100% |

Example of comparison between FXIFY & Blue Guardian

| Trading Objectives | FXIFY | Blue Guardian |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 3% | 4% |

| Maximum Loss | 6% (Trailing) | 6% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 90% | 85% |

Example of comparison between FXIFY & Goat Funded Trader

| Trading Objectives | FXIFY | Goat Funded Trader |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 3% | 4% |

| Maximum Loss | 6% (Trailing) | 6% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 90% | 75% up to 95% |

FXIFY’s Before being eligible for payments, traders must complete three steps of the three-phase assessment program. With a 5% daily maximum and a 5% maximum loss limit, the profit aim is 5% in phase one, 5% in phase two, and 5% in phase three. Additionally, you are not subject to any maximum trading day limitations throughout the review process. However, throughout each evaluation phase, you must trade for at least five calendar days. Additionally, the Three-phase Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The Three-phase Evaluation distinguishes out from other industry financing programs primarily because it offers raw spread accounts, an infinite trading duration, an on-demand initial withdrawal, and a plethora of add-on options.

Example of comparison between FXIFY & The Funded Trader

| Trading Objectives | FXIFY | The Funded Trader |

| Phase 1 Profit Target | 5% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Phase 3 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 5% | 10% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% | 75% up to 95% |

Example of comparison between FXIFY & MyFundedFX

| Trading Objectives | FXIFY | MyFundedFX |

| Phase 1 Profit Target | 5% | 6% |

| Phase 2 Profit Target | 5% | 6% |

| Phase 3 Profit Target | 5% | 6% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 5% | 8% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% | 80% |

Example of comparison between FXIFY & E8 Markets

| Trading Objectives | FXIFY | E8 Markets |

| Phase 1 Profit Target | 5% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Phase 3 Profit Target | 5% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 5% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% | 80% |

In conclusion, FXIFY differs from other industry-leading prop firms by providing a two-step evaluation, a one-step evaluation, and a three-step evaluation as distinct account kinds. They also provide several beneficial features, like raw spread accounts, endless trading time, on-demand initial withdrawals, and a plethora of add-on options.

Is Getting FXIFY Capital Realistic?

It is important to assess the feasibility of trading requirements when considering proprietary trading firms that match your forex trading style. Although a company may look good with a high percentage profit split on a well-funded account, the feasibility drops dramatically if they require significant monthly gains with low maximum drawdown percentages, greatly reducing the possibility of success. Furthermore, the evaluation of time limitations is essential, and unlimited time to trade is more favorable since there is no pressure from the constraints of time. Lastly, it is important to know all the trading rules at the evaluation stage and subsequent funding stages to avoid accidentally breaching your trading account terms.

Receiving capital from the Two-phase Evaluation is realistic primarily because of its average profit targets (10% in phase one and 5% in phase two) coupled with average maximum loss rules (4% maximum daily and 10% maximum trailing loss). There are no maximum trading day requirements while having a minimum trading day requirement of 5 calendar days. In addition, participants who successfully complete both rounds of evaluation are eligible for a payout with a favorable profit-sharing ratio of 80% to 90%.

A capital payout from the One-phase Evaluation is achievable primarily due to its average profit target at 10% along with average maximum loss rules at 3% maximum daily and 6% maximum trailing loss. This has a minimum trading day requirement at 5 calendar days while there are no maximum trading day requirements. Moreover, after the successful evaluation phase, participants get eligibility for payouts with a profitable advantage of 80% to 90%.

Receiving capital from the Three-phase Evaluation is realistic primarily due to its relatively modest profit targets, despite the additional evaluation phase (5% in phase one, 5% in phase two, and 5% in phase three) coupled with slightly below-average maximum loss rules (5% maximum daily and 5% maximum loss). It is worth noting that there are no maximum trading day requirements but a minimum of 5 calendar days, and after completing all three phases of evaluation, participants earn payouts with an attractive profit split of 80% to 90%.

After balancing all these factors, I can confidently recommend FXIFY since you have three different funding programs available, two-step evaluation, one-step evaluation, and three-step evaluation which all contain realistic trading objectives and conditions to qualify for payouts.

Payment Proof

FXIFY is a proprietary trading firm that was incorporated back in May 2023. There is a large community of traders who have reached the funded status and who successfully qualify to get a profit split.

While working with FXIFY and reaching funded status with the Two-phase Evaluation, One-phase Evaluation, or Three-phase Evaluation, you will be eligible to receive your first payout on demand. After your first payout, however, you will also be eligible to receive payouts if you exceed the initial account size every 30 calendar days (14 calendar days with add-on). Your profit split will comprise a generous 80% up to 90% based on the profit you have generated on your funded account.

The FXIFY payment proof can be obtained from many websites. First of all, there is Trustpilot where their traders comment concerning their experience while working with the company as well as the process of how they successfully received payouts. Then, there is the company’s Discord channel, on which you can find quite a lot of payout certificates issued by the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does FXIFY Use?

FXIFY is partnered with FXPIG as their broker.

FXPIG For traders looking for a stable trading experience, broker is a trustworthy and open platform. Focusing on providing fair and competitive trading conditions, it offers tight spreads, fast execution, and a wide range of trading instruments. FXPIG is a great option for traders of all experience levels because of its commitment to openness and customer happiness.

As for trading platforms, while you are working with FXIFY, they allow you to trade on MetaTrader 4, MetaTrader 5, or DXtrade.

Trading Instruments

As mentioned above, FXIFY is partnered with FXPIG, Additionally, depending on the trading instrument you are using, they enable you to trade a variety of trading instruments, such as FX pairs, commodities, indices, stocks, and cryptocurrencies, with leverage-up to 1:30 (1:50 with optional).

Forex Pairs

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | AUD/USD | CAD/CHF |

| CAD/JPY | CHF/JPY | EUR/AUD | EUR/CAD | EUR/CHF | EUR/GBP |

| EUR/JPY | EUR/MXN | EUR/NZD | EUR/TRY | EUR/USD | GBP/AUD |

| GBP/CAD | GBP/CHF | GBP/JPY | GBP/NZD | GBP/USD | NZD/CAD |

| NZD/CHF | NZD/JPY | NZD/USD | USD/CAD | USD/CHF | USD/CNH |

| USD/CZK | USD/DKK | USD/HKD | USD/HUF | USD/ILS | USD/JPY |

| USD/MXN | USD/NOK | USD/PLN | USD/SEK | USD/SGD | USD/TRY |

| USD/ZAR |

Commodities

| XAG/USD | XAU/EUR | XAU/USD | XPD/USD | XPT/USD |

| UKOil | USOil | NGAS |

Indices

| AUS200 | CHN50U | DE30 | DJ30 | ES35 |

| F40 | HKG50 | JPN225 | RUS2000 | STOXX50 |

| UK100 | US500 | US500 | USTEC | VIX |

Stocks

| AAL | AAPL | ABNB | AMZN | BABA |

| COIN | CSCO | DIS | EBAY | FB |

| F | GOOG | HD | INTC | JPM |

| MRNA | MSFT | NFLX | NKE | ORCL |

| PTON | PYPL | QCOM | SBUX | TSLA |

| UBER | WMT | XOM |

Cryptocurrencies

| ADA/USD | BCH/USD | BTC/USD | ETH/USD | LTC/USD |

| SOL/USD | XRP/USD | BTC/USDT | ETH/USDT |

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

| FOREX | 6 USD / LOT (All-in – 0 USD / LOT) |

| COMMODITIES | 6 USD / LOT (Only Metals)(All-in – 0 USD / LOT) |

| INDICES | 6 USD / LOT (All-in – 0 USD / LOT) |

| STOCKS | Raw & All-in / 0.3% on Stock CFDs |

| CRYPTO | 0 USD / LOT (All-in – 0 USD / LOT) |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

| MetaTrader 4 (All In) | FXPIG-Demo | 621238 | u6hdvDa | Click here |

| MetaTrader 4 (Raw) | FXPIG-DEMO | 625908 | f7YdUly | Click here |

| MetaTrader 5 (All In) | FXPIG-Server | 2100170634 | M@R7PcKd | Click here |

| MetaTrader 5 (Raw) | FXPIG-Server | 2100139002 | wxgb2tsw | Click here |

| DXtrade | – | – | – | Click here |

Education

FXIFY doesn’t provide their community with any extra instructional materials.

However, FXIFY gives all of its customers access to a well-designed trader dashboard, which improves risk management by giving them constant access to thorough data and goals. This increases user happiness by ensuring quick updates.

Trustpilot Feedback

FXIFY has gathered an excellent score on Trustpilot based on their community’s feedback.

On Trustpilot, FXIFY has received good comments and reviews about their company’s services from a wide range of their community. From a sizable pool of 2,382 evaluations, the company has earned an outstanding rating of 4.3 out of 5. Interestingly, 80% of these evaluations have given FXIFY the highest rating of 5 stars.

The first remark demonstrates the client’s happiness with the timely payments and top-rate proprietary trading experience. They said the procedure went well overall and was praiseworthy. Nevertheless, they observed a little lag in the financed account’s activation, which was ascribed to FXIFY’s adoption of email-based online contracts. Although this change originally resulted in a minor delay, the customer recognized that it may speed up subsequent procedures. In spite of this setback, FXIFY secured a position among the client’s top three preferred firms.

The commenter highlighted and described FXIFY’s services as an amazing experience, complimenting the business on its superb regulations and guidelines. They continued by calling FXIFY the friendliest proprietary trading company they had ever worked with. The customer expressed a sense of calm within the business and enjoyed being helped in keeping their attention on their profession as traders.

Social Media Statistics

FXIFY can also be found on numerous social media platforms.

| 30,000 Followers & 11,000 Likes | |

| 21,200 Followers | |

| Discord | 30,238 members |

| 45,300 Followers | |

| Telegram | 4,364 Members |

| TikTok | 1,212 Followers & 1,871 Likes |

Customer Support

| Live Chat | ✅ |

| support@fxify.com | |

| Discord | Discord Link |

| Telegram | Telegram link |

| FAQ | FAQ Link |

| Supported Languages | English |

Account Opening Process

- Registration Form – Register with FXIFY by entering your personal information on the registration form and then connecting into the trading dashboard.

- Choose Your Account – Select the trading platform, price feed type, add-ons, account size, and account type.

- Choose Your Payment Method – Payment options include PayPal, cryptocurrencies, and credit/debit cards.

Conclusion

In conclusion, FXIFY is a proprietary trading firm that is reputable and reliable. The firm offers traders a choice of three funding programs: the Two-phase Evaluation, which is a two-step process; the One-phase Evaluation, which is a one-step procedure; and the Three-phase Evaluation, which is a three-step procedure.

FXIFY’s Two-phase Evaluation is the industry-standard two-step evaluation which requires that two phases are completed before one is eligible to manage a funded account and earn 80% up to 90% profit splits. A trader has to reach a profit target of 10% in phase one and 5% in phase two before being successfully funded. These are reasonable trading goals given your 4% maximum daily and 10% maximum trailing loss rule you must abide by. In terms of time, you do not have a maximum trading day that needs to be met in either evaluation period. You must trade for at least 5 calendar days within each evaluation period. Lastly, you need to know that the Two-phase Evaluation has a scaling plan which allows you to upgrade your initial account balance.

One-phase Evaluation of FXIFY involves only one step, and the client will be eligible to work on a funded account earning 80% up to 90% profit splits, but in order to be funded, you need to achieve 10% profit. These are realistic trading objectives, considering you have a 3% maximum daily and 6% maximum trailing loss rules to follow. Regarding time limitations, you have no maximum trading day requirements during the evaluation phase. However, you are required to trade for a minimum of 5 calendar days during the evaluation phase. Finally, it’s essential to note that the One-phase Evaluation features a scaling plan, providing you with the opportunity to increase your initial account balance.

FXIFY’s Three-phase Evaluation is a three-step evaluation that requires the completion of three phases before becoming eligible to manage a funded account and earn 80% up to 90% profit splits. To be successfully funded, you have to achieve profit targets of 5% in phase one, 5% in phase two, and 5% in phase three. These are feasible trading goals, considering that you have a 5% maximum daily and 5% maximum loss rules. There is no maximum trading day restriction during each evaluation phase. However, you are mandated to trade for a minimum of 5 calendar days in each of the evaluation cycles. Lastly, note that the Three-phase Evaluation has a scaling plan; hence you stand a chance to double your initial account balance.

I would advise people looking for a reliable proprietary trading firm offering excellent trading conditions for various types of people with specific trading styles to consider FXIFY. They offer features to traders, such as an unlimited trading period, first withdrawal on-demand, numerous add-on features, and raw spread accounts. After considering all the features that FXIFY has in store for traders all around the world, they can certainly be considered one of the leading prop firms in the industry.

How do you feel about individual experience with FXIFY and services it provides? Do they align with trading conditions and services which you were looking for?

Let us know how you found our detailed FXIFY review, by commenting below!