FunderPro Review

By enabling traders to trade with reduced risks, FunderPro, a proprietary trading company, is revolutionizing the way traders engage with financial markets. Their obstacles have been thoughtfully crafted to give traders with varying degrees of experience an equal chance to succeed without restricting their options.

Pros

- Excellent 4.2/5 Trustpilot rating

- Three Distinct Funding Initiatives

- Dashboard for Professional Traders

- A Wide Range of Trading Tools (Cryptocurrencies, Commodities, Indices, and Forex Pairs)

- Use up to 1:200 in leverage

- There are no minimum

- maximum trading day requirements.

- Plan for Scaling

- Initial Payment After Turning a Profit

- Daily On-Demand Payments

- 80% Profit Share

- Permitted for Overnight Holding

Cons

- High Profit Objective Needs

- Swing Evaluation

- Low Leverage Equity-based Daily Drawdown Lot Size Limit

- One lot for every $10,000 in trading capital

- Absence of News Trading

FunderPro feels that traders should be empowered by not having their successful pathways restricted. To provide every trader the chance to handle substantial sums of money, they have created difficulties. With the ability to handle account sizes up to $200,000 and receive 80% profit splits, traders can make significant earnings. Trading a variety of financial assets, such as commodities, indices, FX pairings, and cryptocurrencies, can help achieve this.

Who is FunderPro?

FunderPro is a privately held trading company that was established in February 2023 under the legal name FunderPro Ltd. CEO Gary Mullen is in charge of them, and they are based in Malta.Along with being connected with a tier-1 liquidity provider that gives them direct market access as their broker, FunderPro offers traders three different account kinds, two two-step evaluations, and a one-step assessment.

FunderPro’s headquarters are located at 30/1, Kenilworth Court, Sir Augustus Bartolo Street, Ta’Xbiex XBX1093, Malta.

Who is the CEO of FunderPro?

Gary Mullen is the CEO of FunderPro. According to him, he and his group have put a lot of effort into developing a challenge that would be “a game changer” for the proprietary trading business sector. This is because they have removed all of the intricate trading regulations and given traders an infinite amount of time to finish the task.

He and his team are thrilled to provide traders from all around the world with the chance to demonstrate their trading prowess and exchange their funds for actual capital gains. Furthermore, he thinks that all of the extra tools that FunderPro provides will aid traders in enhancing their trading performance, which means that they will begin to see greater outcomes when using them.

FunderPro was introduced to the market by Red Acre Group, a pioneering fintech giant with state-of-the-art technology at the core of its business model. Red Acre Group is a prominent authority in a number of cutting-edge fields, such as blockchain and fintech. For companies looking to outsource experts to take their operations to the next level, the firm provides exceptional business solutions. Red Acre Ltd.’s main goal is to reduce the difficulties of managing a company and to create platforms, strategies, and long-term solutions that will maximize performance and success.

Funding Program Options

FunderPro provides its traders with three unique funding program options:

- Regular Evaluation

- Swing Evaluation

- Fast Track

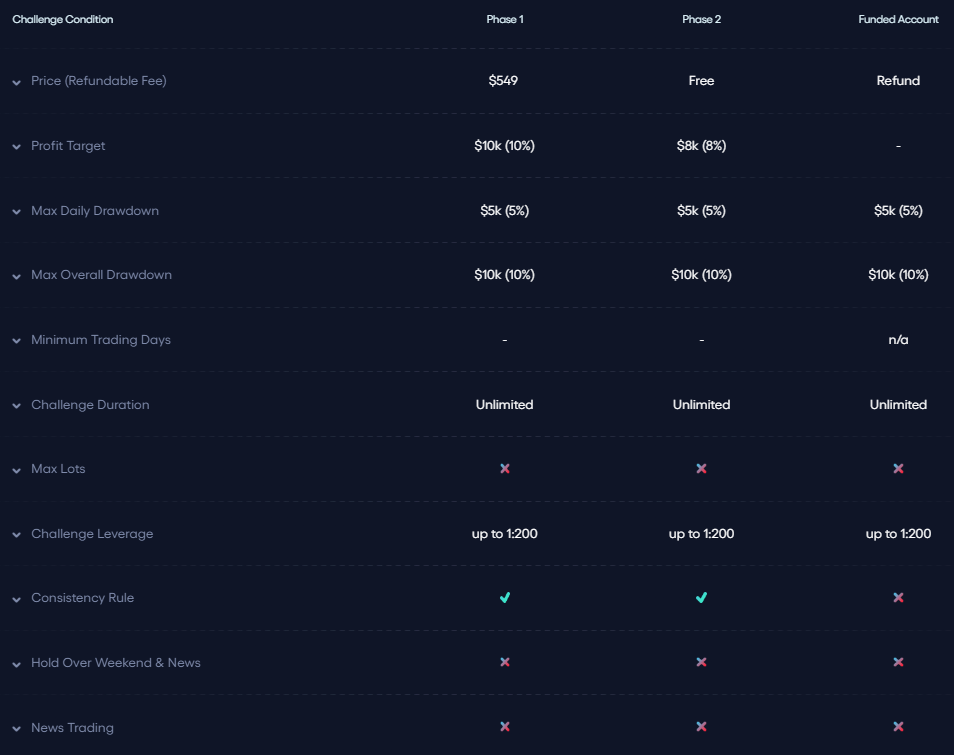

Regular Evaluation

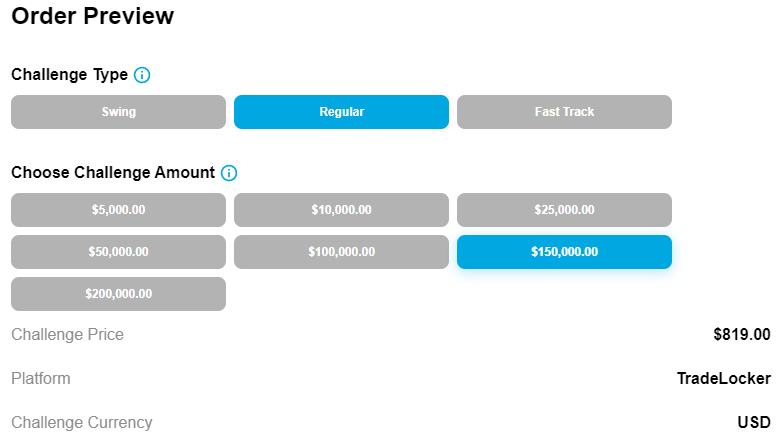

FunderPro’s Traders can handle account sizes ranging from $5,000 to $200,000 with Regular Evaluation. Finding skilled traders who can effectively manage risk over the two-step evaluation phase and turn a profit is the goal. You can trade with up to 1:200 leverage while using the Regular Evaluation.

| Account Size | Price |

|---|---|

| $5,000 | $79 |

| $10,000 | $139 |

| $25,000 | $249 |

| $50,000 | $349 |

| $100,000 | $549 |

| $150,000 | $819 |

| $200,000 | $1,099 |

In the first evaluation phase, a trader must hit a 10% profit target without going over their 10% maximum loss or 5% maximum daily loss guidelines. Regarding time constraints, keep in mind that during phase one, there are no minimum or maximum trading day requirements. You only need to meet the 10% profit goal without going over the maximum daily or maximum loss limit guidelines to go on to phase two.

In the second evaluation phase, a trader must hit an 8% profit target without going over their 5% daily loss or 10% maximum loss limits. Regarding time constraints, keep in mind that during phase two, there are no minimum or maximum trading day requirements. You only need to meet the 8% profit goal without going over the maximum daily or maximum loss limit guidelines to go on to funded status.

You are given a funded account with a $100 minimum withdrawal amount after passing both evaluation stages. Only the 10% maximum loss and 5% maximum daily loss guidelines must be followed. If you are successful in making a profit, you can get your first payout on the first day. You can also request withdrawals on a daily basis, as needed. Depending on how much money you make in your funded account, you will receive an 80% profit split.

Regular Evaluation Scaling Plan

Regular Evaluation also has a scaling plan. If a trader is profitable in the last three months with a 10% return in each month over the three months, then you will become eligible for an account size increase equal to 50% of the account size.

Example:

- After 3 Months: A qualified $100,000 account increases to $150,000.

- After the Next 3 Months: A qualified $150,000 account increases to $225,000.

- After the Next 3 Months: A qualified $225,000 account increases to $337,500.

And so on…

Regular Evaluation Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 10%, whereas Phase 2 requires reaching a profit target of 8%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 10%.

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 2-minute period both before and after the announcement of particular news.

- Lot Size Limit – Limitation of lot sizes for specific trading instruments. These are, in most cases, set based on the initial account balance of your trading account. Please refer to the following lot size limitations in the spreadsheet below.

- Consistency Rule – Mandates traders to maintain uniformity in various aspects such as position sizes, risk management, losses, gains, and more. This implies that the account results should not exhibit significant variations in their characteristics. The profits earned on your best trading day should not exceed 45% of your total profits. (Only applies to both Evaluation phases)

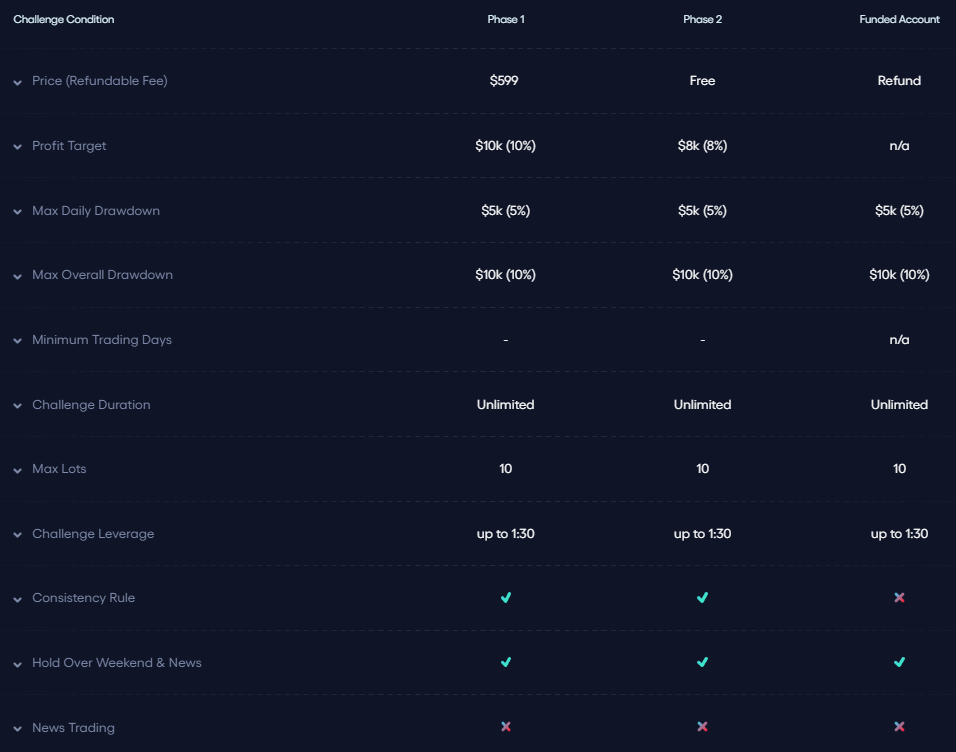

Swing Evaluation

FunderPro’s Through Swing Evaluation, traders can control account sizes between $5,000 and $200,000. Finding skilled traders who can effectively manage risk over the two-step evaluation phase and turn a profit is the goal. You can trade with up to 1:30 leverage when using the Swing Evaluation.

| Account Size | Price |

|---|---|

| $5,000 | $89 |

| $10,000 | $149 |

| $25,000 | $269 |

| $50,000 | $379 |

| $100,000 | $599 |

| $150,000 | $899 |

| $200,000 | $1,199 |

In the first evaluation phase, a trader must hit a 10% profit target without going over their 10% maximum loss or 5% maximum daily loss guidelines. Regarding time constraints, keep in mind that during phase one, there are no minimum or maximum trading day requirements. You only need to meet the 10% profit goal without going over the maximum daily or maximum loss limit guidelines in order to go on to phase two.

In the second evaluation phase, a trader must hit an 8% profit target without going over their 5% daily loss or 10% maximum loss limits. Regarding time constraints, keep in mind that during phase two, there are no minimum or maximum trading day requirements. You only need to meet the 8% profit goal without going over the maximum daily or maximum loss limit guidelines in order to go on to funded status.

You are given a funded account with a $100 minimum withdrawal amount after passing both evaluation stages. Only the 10% maximum loss and 5% maximum daily loss guidelines must be followed. If you are successful in making a profit, you can get your first payout on the first day. You can also request withdrawals daily, as needed. Depending on how much money you make on your funded account, you will receive an 80% profit split.

Swing Evaluation Scaling Plan

Swing Evaluation also has a scaling plan. If a trader is profitable in the last three months with a 10% return in each month over the three-month period, then you will become eligible for an account size increase equal to 50% of the account size.

Example:

- After 3 Months: A qualified $100,000 account increases to $150,000.

- After the Next 3 Months: A qualified $150,000 account increases to $225,000.

- After the Next 3 Months: A qualified $225,000 account increases to $337,500.

And so on…

Swing Evaluation Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 10%, whereas Phase 2 requires reaching a profit target of 8%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 10%.

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 2-minute period both before and after the announcement of particular news.

- Lot Size Limit – Limitation of lot sizes for specific trading instruments. These are, in most cases, set based on the initial account balance of your trading account. Please refer to the following lot size limitations in the spreadsheet below.

- Consistency Rule – Mandates traders to maintain uniformity in various aspects such as position sizes, risk management, losses, gains, and more. This implies that the account results should not exhibit significant variations in their characteristics. The profits earned on your best trading day should not exceed 45% of your total profits. (Only applies to both Evaluation phases)

| Account Size | Lot Size Limitation |

|---|---|

| $5,000 | 0.5 Lots |

| $10,000 | 1 Lot |

| $25,000 | 2.5 Lots |

| $50,000 | 5 Lots |

| $100,000 | 10 Lots |

| $150,000 | 15 Lots |

| $200,000 | 20 Lots |

Fast Track

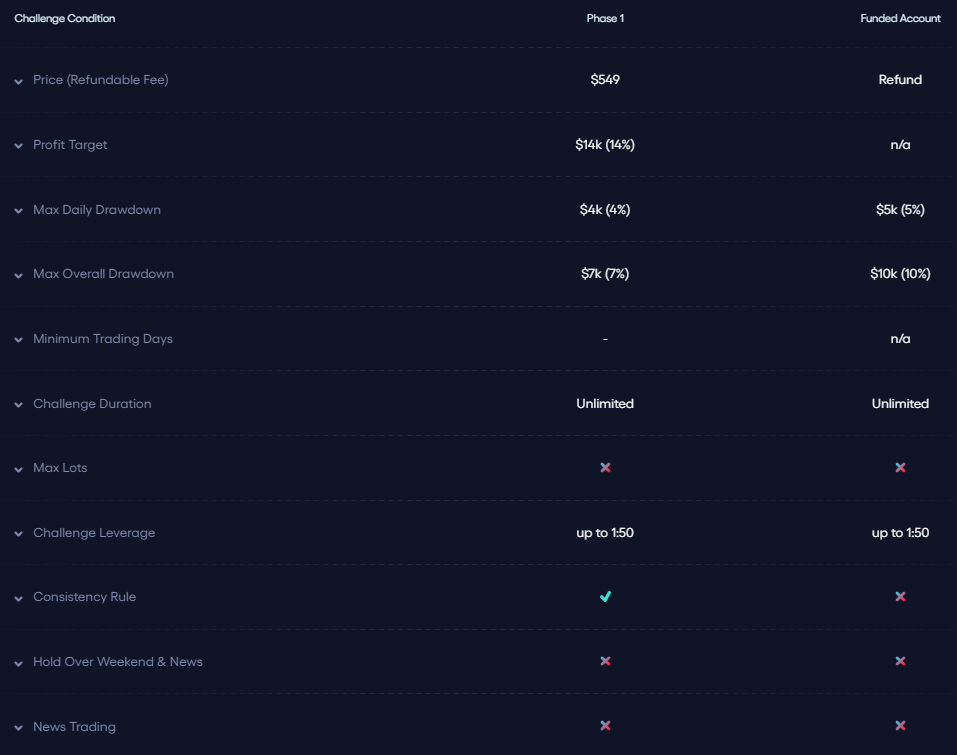

FunderPro’s Fast Track gives traders the ability to handle account sizes between $5,000 and $200,000. During a one-step review phase, the goal is to find profitable, disciplined traders who can effectively manage risk. You can trade with leverage up to 1:50 on the Fast Track.

| Account Size | Price |

|---|---|

| $5,000 | $79 |

| $10,000 | $139 |

| $25,000 | $249 |

| $50,000 | $349 |

| $100,000 | $549 |

| $150,000 | $819 |

| $200,000 | $1,099 |

The evaluation phase requires a trader to reach a profit target of 14% while not surpassing their 4% maximum daily loss or 7% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase one. To proceed to funded status, you are only required to reach the 14% profit target without breaching the maximum daily or maximum loss limit rules.

By completing the evaluation phase, you are awarded a funded account where you have a minimum withdrawal amount of $100. You must only respect the 5% maximum daily loss and 10% maximum loss rules. Your first payout can be on day one if you manage to generate a profit, while all other withdrawals can also be submitted on a daily, on-demand basis. Your profit split will be 80% based on the profit you make on your funded account.

Fast Track Scaling Plan

Fast Track also has a scaling plan. If a trader is profitable in the last three months with a 10% return in each month over the three months, then you will become eligible for an account size increase equal to 50% of the account size.

Example:

- After 3 Months: A qualified $100,000 account increases to $150,000.

- After the Next 3 Months: A qualified $150,000 account increases to $225,000.

- After the Next 3 Months: A qualified $225,000 account increases to $337,500.

And so on…

Fast Track Trading Rules & Objectives

- Profit Target –To complete an evaluation phase, withdraw winnings, or scale their trading account, traders must reach a specified profit 2%. The evaluation phase’s profit target is 14%. There are no set profit goals for funded accounts.

- Maximum Daily Loss – The highest amount of money a trader can lose in a single trading day without violating their account. The maximum daily loss for all account sizes is 4% while the account is being evaluated and 5% after it is financed.

- Maximum Loss – The highest amount that a trader can lose in total without violating the terms of the account. The maximum loss for all account sizes is 7% while being evaluated and 10% after funding.

- No News Trading – During high-impact news announcements, trading is not allowed.

- Consistency Rule – Requires traders to remain consistent in a number of areas, including position sizing, risk management, gains, and losses. This suggests that there shouldn’t be any notable differences in the account results’ attributes. Your best trading day’s earnings shouldn’t account for more than 45% of your entire earnings. (This applies only to the evaluation stage.)

What Makes FunderPro Different From Other Prop Firms?

FunderPro differs from most industry-leading prop firms because it provides three distinct account types: a one-step evaluation, two two-step evaluations, and one. They also offer a lot of beneficial features, like an infinite trading term, no minimum trading day requirements, the ability to withdraw money right away after reaching funded status, and future payouts that can be requested.

FunderPro’s Before traders are eligible for rewards, they must successfully complete two phases of the Regular Evaluation evaluation. With a daily maximum of 5% and a maximum loss of 10%, the profit aim is 10% in phase one and 8% in phase two. During either assessment phase, you are also not subject to any maximum trading day requirements. However, throughout each evaluation phase, you must trade for at least five calendar days. Additionally, the Regular Evaluation offers a special scaling strategy that enables traders to handle even bigger account sizes. The Regular Evaluation is unique among industry financing programs primarily because it offers a limitless trading duration, no minimum trading day criteria, a first withdrawal on the day following gaining funded status, and on-demand future payouts.

Example of comparison between FunderPro & Funding Pips

| Trading Objectives | FunderPro | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 8% | 5% |

| Maximum Daily Loss | 5% | 5% (Scaleable up to 7%) |

| Maximum Loss | 10% | 10% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 60% up to 100% + Monthly Salary |

Example of comparison between FunderPro & FXIFY

| Trading Objectives | FunderPro | FXIFY |

|---|---|---|

| Phase 1 Profit Target | 10% | 10% |

| Phase 2 Profit Target | 8% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 75% up to 90% |

Example of comparison between FunderPro & FundedNext

| Trading Objectives | FunderPro | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 8% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 95% |

FunderPro’s Before traders can be eligible for rewards, they must complete two phases of the Swing Evaluation. With a daily maximum of 5% and a maximum loss of 10%, the profit aim is 10% in phase one and 8% in phase two. During either assessment phase, you are also not subject to any maximum trading day requirements. However, throughout each evaluation phase, you must trade for at least five calendar days. Additionally, the Swing Evaluation offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. The Swing Evaluation is distinct from other industry funding programs primarily because to its unrestricted trading time, lack of minimum trading day criteria, first withdrawal on the day following obtaining funded status, and on-demand future payouts.

Example of comparison between FunderPro & E8 Markets

| Trading Objectives | FunderPro | E8 Markets |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 8% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

Example of comparison between FunderPro & Funded Trading Plus

| Trading Objectives | FunderPro | Funded Trading Plus (Premium) |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 8% | 5% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 8% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% up to 100% |

Example of comparison between FunderPro & Alpha Capital Group

| Trading Objectives | FunderPro | Alpha Capital Group |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 8% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% | 80% |

FunderPro’s Before being eligible for payments, traders must finish a single phase of the Fast Track review process. With a 4% daily maximum and a 7% maximum loss rule during the evaluation and a 5% daily maximum and a 10% maximum loss rule after funding, the profit target is 14%. Additionally, during the evaluation phase, there are no minimum or maximum trading day limitations. Additionally, the Fast Track offers a special scaling strategy that enables traders to handle increasingly bigger account sizes. A first withdrawal from day one after reaching funded status, an unlimited trading time, no minimum trading day limitations, and on-demand future payouts are the major features that set Fast Track apart from other fundraising schemes in the industry.

Example of comparison between FunderPro & Goat Funded Trader

| Trading Objectives | FunderPro | Goat Funded Trader |

|---|---|---|

| Profit Target | 14% | 10% |

| Maximum Daily Loss | 4% (5% Once Funded) | 4% |

| Maximum Loss | 7% (10% Once Funded) | 6% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 75% up to 95% |

Example of comparison between FunderPro & Blue Guardian

| Trading Objectives | FunderPro | Blue Guardian |

|---|---|---|

| Profit Target | 14% | 10% |

| Maximum Daily Loss | 4% (5% Once Funded) | 4% |

| Maximum Loss | 7% (10% Once Funded) | 6% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 85% |

Example of comparison between FunderPro & PipFarm

| Trading Objectives | FunderPro | PipFarm (Trailing) |

|---|---|---|

| Profit Target | 14% | 12% |

| Maximum Daily Loss | 4% (5% Once Funded) | 3% |

| Maximum Loss | 7% (10% Once Funded) | 12% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 70% up to 95% |

In conclusion, FunderPro differs from other industry-leading prop firms by providing a one-step evaluation, two two-step evaluations, and three distinct account kinds. They also offer a lot of beneficial features, like an infinite trading term, no minimum trading day requirements, the ability to withdraw money right away after reaching funded status, and future payouts that can be requested.

Is Getting FunderPro Capital Realistic?

It is essential to evaluate the achievability of trading requirements when considering proprietary trading firms that align with your forex trading style. While a company may appear attractive with a high percentage profit split on a generously funded account, the practicality decreases if they demand substantial monthly gains with minimal maximum drawdown percentages, significantly reducing the likelihood of success. Additionally, examining time constraints is crucial, with an unlimited trading period being more advantageous as it eliminates the pressure associated with time constraints. Lastly, it is essential to acquaint yourself with all trading rules during the evaluation process and subsequent funding stages to mitigate the risk of accidentally violating your trading account terms.

- Receiving capital from the Regular Evaluation is realistic primarily due to its slightly above-average profit targets (10% in phase one and 8% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly while sticking to the consistency rule or proceed at your preferred trading pace. Furthermore, upon successfully completing both evaluation phases, participants qualify for payouts featuring an advantageous profit split of 80%.

- Receiving capital from the Swing Evaluation is realistic primarily due to its slightly above-average profit targets (10% in phase one and 8% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly while sticking to the consistency rule or proceed at your preferred trading pace. Furthermore, upon successfully completing both evaluation phases, participants qualify for payouts featuring an advantageous profit split of 80%.

- Receiving capital from the Fast Track is realistic primarily due to its slightly above-average profit target of 14% coupled with average maximum loss rules (4% maximum daily and 7% maximum loss, which becomes 5% maximum daily and 10% maximum loss once funded). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly while sticking to the consistency rule or proceed at your preferred trading pace. Furthermore, upon successfully completing the evaluation phase, participants qualify for payouts featuring an advantageous profit split of 80%.

After considering all the factors, FunderPro is highly recommended since you have three unique funding programs to choose from, two two-step evaluations and a one-step evaluation, which all feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

FunderPro is a February 2023-incorporated proprietary trading company. They have a sizable trading community that has attained funded status and is eligible for a profit split.

If you are able to turn a profit while using FunderPro and achieving funded status through the Regular Evaluation, Swing Evaluation, or Fast Track, you will be entitled to get your first reimbursement right away. On the other hand, you will be entitled for daily, on-demand rewards following your initial payout. Based on the profit you have made on your funded account, you will receive a hefty 80% profit share.

When it comes to FunderPro oayment evidence is available on many websites. As an illustration, consider Trustpilot, where traders leave comments about their interactions with the business and the steps they took to get paid. An additional source of evidence of payment for FunderPro is their Discord channel and YouTube channel, where you can find numerous payout certificates and interviews of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does FunderPro Use?

FunderPro is partnered with a liquidity provider that grants them direct market access as their broker.

As for trading platforms, while you are working with FunderPro, they allow you to trade on TradeLocker.

Trading Instruments

As previously stated, FunderPro is a broker with direct market access through a partnership with a liquidity provider. You can trade a variety of trading instruments with leverage up to 1:200, depending on the trading instrument and the evaluation you are taking part in, including forex pairs, commodities, indices, and cryptocurrencies.

Forex Pairs

| EUR/CAD | CAD/JPY | CHF/JPY | EUR/CHF | EUR/GBP | EUR/JPY |

| EUR/USD | GBP/CAD | GBP/CHF | GBP/JPY | GBP/USD | USD/CHF |

| USD/JPY | AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | AUD/USD |

| CAD/CHF | EUR/AUD | EUR/NOK | EUR/NZD | EUR/SEK | EUR/SGD |

| GBP/AUD | GBP/NZD | NZD/CAD | NZD/CHF | NZD/JPY | NZD/USD |

| USD/NOK | USD/SEK | USD/SGD | EUR/HUF | USD/BRL | USD/CNH |

| USD/HUF | USD/MXN | USD/TRY | USD/ZAR | EUR/CZK | EUR/PLN |

| EUR/ZAR | GBP/ZAR | EUR/TRY |

Commodities

| XAU/USD | XAU/EUR | XAG/USD | WTI | BRENT |

| NGAS | COPPER | CPT/USD | CORN | SOYBEANS |

| WHEAT |

Indices

| AUS200 | ESTX50 | FRA40 | GER40 | UK100 |

| JPN225 | NAS100 | SPX500 | US30 | CHINA50 |

| HK50 | SPAIN35 | VIX | US2000 | TAIEX |

Cryptocurrencies

| BTC/USD | ETH/USD | LTC/USD | BCH/USD |

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | 7 USD / LOT |

| COMMODITIES | 7 USD / LOT |

| INDICES | 7 USD / LOT |

| CRYPTO | 7 USD / LOT |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| TradeLocker | – | – | – | Click here |

Education

FunderPro provides its community with a detailed Blog with educational content, such as the following five categories:

- Education

- Inspiration

- Market Insights

- News

- Sponsorships

Furthermore, FunderPro gives traders a well-organized dashboard with all the real-time data related to their trading goals, which facilitates risk management.

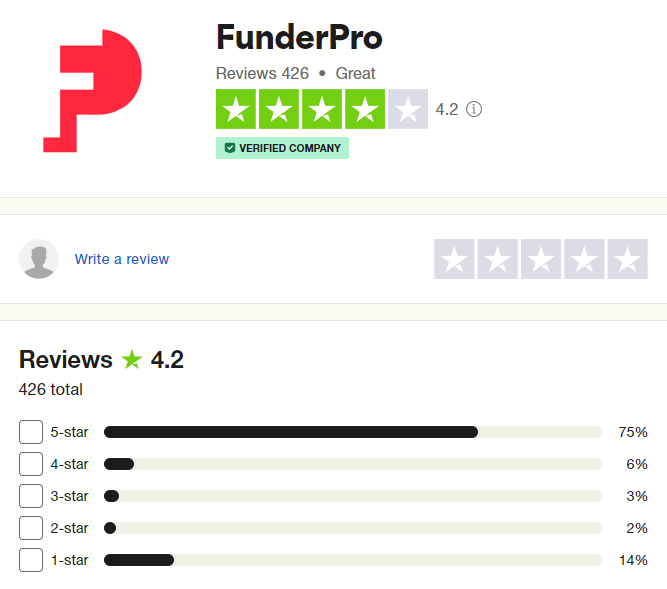

Trustpilot Feedback

FunderPro has gathered a great score on Trustpilot based on their community’s feedback.

Many members of the FunderPro community have left comments and given positive reviews of the company’s services on Trustpilot. From a sizable pool of 426 evaluations, the company has earned an outstanding rating of 4.2 out of 5. Remarkably, FunderPro has received the highest rating of five stars in 75% of these evaluations.

The customer support at FunderPro is commended by the client for its superiority in diagnosing and fixing access problems with the challenge account. They say they are confident in the level of service they received from FunderPro, even though they haven’t passed the review yet.

The customer praises FunderPro’s outstanding dashboard and platform, emphasizing the company’s reliable support and help—even easing account transfers across brokers to improve the user experience. They rank FunderPro as an excellent proprietary trading company and show a high degree of trust in them.

Social Media Statistics

| 2,200 Followers & 1,400 Likes | |

| 15,500 Followers | |

| Telegram | 1,459 Members |

| 5,580 Followers | |

| YouTube | 3,030 Subscribers |

| TikTok | 840 Followers & 7,007 Likes |

| Discord | 8,400 Members |

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Discord | Discord Link |

| Telegram | Telegram Link |

| FAQ | FAQ Link |

| Supported Languages | English |

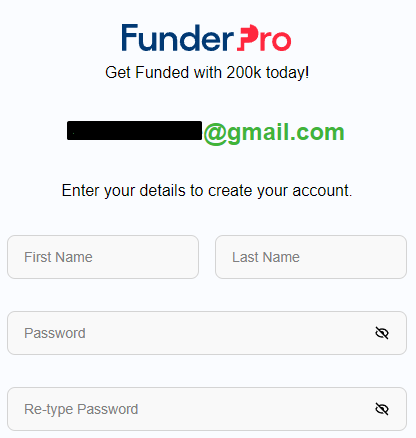

Account Opening Process

- Registration Form – Register with FunderPro by entering your personal information on the registration form and then accessing the trading dashboard.

- Choose Your Account – Choose your account type and account size.

- Choose Your Payment Method – Select between paying with a cryptocurrency or a credit/debit card.

Conclusion

In conclusion, FunderPro is a respectable and trustworthy proprietary trading company that offers traders three funding programs: the Fast Track, a one-step evaluation, and the Regular and Swing Evaluation, two-step evaluations.

FunderPro’s To manage a funded account and receive 80% profit splits, one must successfully complete two phases of the industry-standard Regular review review. To be effectively funded, traders need to meet profit goals of 10% in phase one and 8% in phase two. Given that you have a 10% maximum loss and a 5% daily maximum to adhere to, these are reasonable trading goals. In terms of time constraints, you are not subject to a minimum or maximum number of trading days during either assessment phase, so you are free to trade at your own speed without feeling rushed. Last but not least, it’s critical to remember that the Regular Evaluation offers a scaling plan that lets you raise your starting account amount.

FunderPro’s Before becoming qualified to handle a funded account and get 80% profit splits, candidates must pass the industry-standard two-phase Swing Evaluation. To be effectively funded, traders need to meet profit goals of 10% in phase one and 8% in phase two. Given that you have a 10% maximum loss and a 5% daily maximum to adhere to, these are reasonable trading goals. In terms of time constraints, you are not subject to a minimum or maximum number of trading days during either assessment phase, so you are free to trade at your own speed without feeling rushed. Lastly, it’s important to remember that the Swing Evaluation has a scaling plan that allows you to raise your original account amount.

FunderPro’s To be eligible to manage a funded account and get 80% profit splits, a single phase of the Fast Track evaluation must be completed. For traders to be successfully supported, they need to hit a profit target of 14%. Given that you have a 4% maximum daily and 7% maximum loss rule to adhere to during the assessment and a 5% maximum daily and 10% maximum loss rule after funding, these are reasonable trading goals. When it comes to time constraints, you are not subject to any minimum or maximum trading day criteria during the assessment phase, so you are free to trade at your own pace. Lastly, it’s important to remember that the Fast Track has a scaling strategy that allows you to grow your original account.

I would recommend FunderPro to individuals seeking a reputable proprietary trading firm that provides exceptional trading conditions catering to a diverse range of individuals with unique trading styles. They provide traders with unique features, such as an unlimited trading period, no minimum trading day requirements, a first withdrawal from day one after achieving funded status, and on-demand future payouts. After considering everything FunderPro has to offer to traders worldwide, they can be considered an excellent choice for anyone who has a well-developed trading strategy and is looking to acquire profits slowly on a consistent basis.

What are your individual opinions on FunderPro and the services they offer?

Do they align with the trading conditions and services you’ve been seeking?

Let us know if you enjoyed our detailed FunderPro review by commenting below!

Leave a Reply