Direct Funded Trader Review

Direct Funded Trader is a proprietary trading firm that has created unique funding opportunities for traders from all over the world. They have a broad vision that includes cutting-edge technology and modern solutions for traders seeking to advance their careers.

Pros

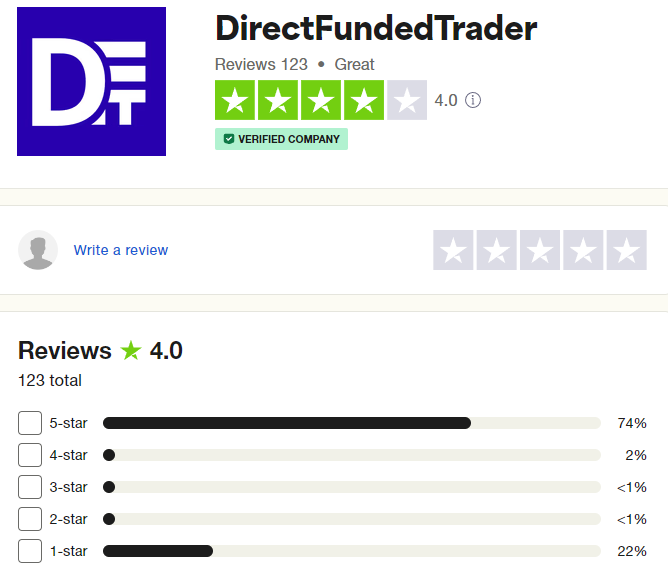

- Great Trustpilot Rating of 4.0/5

- Two Different Funding Programs

- Trading Professional Dashboard

- High Degree of Trading Instruments: More Than 100 Available-Forex Pairs, Commodities, Indices, Stocks, Cryptocurrencies

- Leverage reaches 1:100

- There is no limit trading term

- Scaling Plan

- Payment is made every other week

- 80% profit

- $3 cashback is credited per traded lot as Cashback during the Review Stages

- Over-night Holding

- Weekend holding accepted except for Standard fast funding

- News trading is also acceptable

Cons

- Low Leverage with Aggressive Fast Funding

- No Weekend Holding on Standard Fast Funding

- Minimum Trading Day Requirements of 5 Days

Direct Funded Trader is one of the fastest-evolving prop trading companies in the industry. They have a vast vision that encompasses innovative technology and modern solutions for traders who are seeking opportunities to take the next step in their trading careers. Traders have the opportunity to manage account sizes up to $200,000 and take home profit splits of 80%. This is achievable by trading forex pairs, commodities, indices, stocks, and cryptocurrencies.

Who are Direct Funded Trader?

Direct Funded Trader A proprietary trading firm with the name of GFT GROUP LLC that was incorporated on 28th February, 2023. They have a location in Dubai, United Arab Emirates, and they have been managed by their Chief Executive Officer Arthur Kaziu. Direct Funded Trader provides traders with the opportunity to choose between two account types, a two-step evaluation and a one-step evaluation, while being partnered with Blueberry Markets as their broker.

Direct Funded Trader’s headquarters are located at Business Center 1, M Floor, The Meydan Hotel, Nad Al Sheba, Dubai, United Arab Emirates.

Who is the CEO of Direct Funded Trader?

Arthur Kaziu is the CEO of Direct Funded Trader. Note that we will be adding more information about their CEO in the future. Stay tuned!

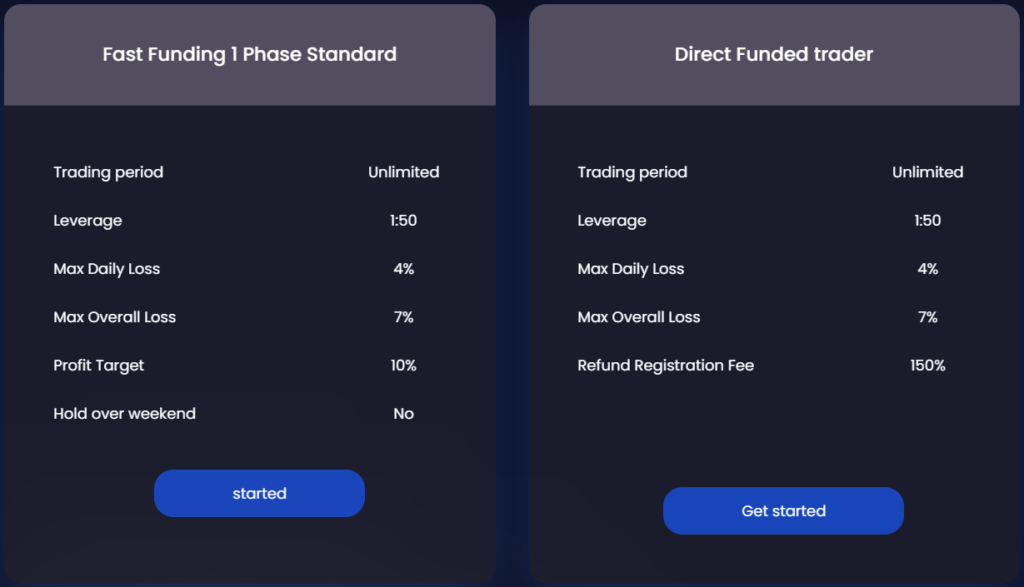

Funding Program Options

Direct Funded Trader provides its traders with two unique funding program options:

- Evaluation Program

- Fast Funding

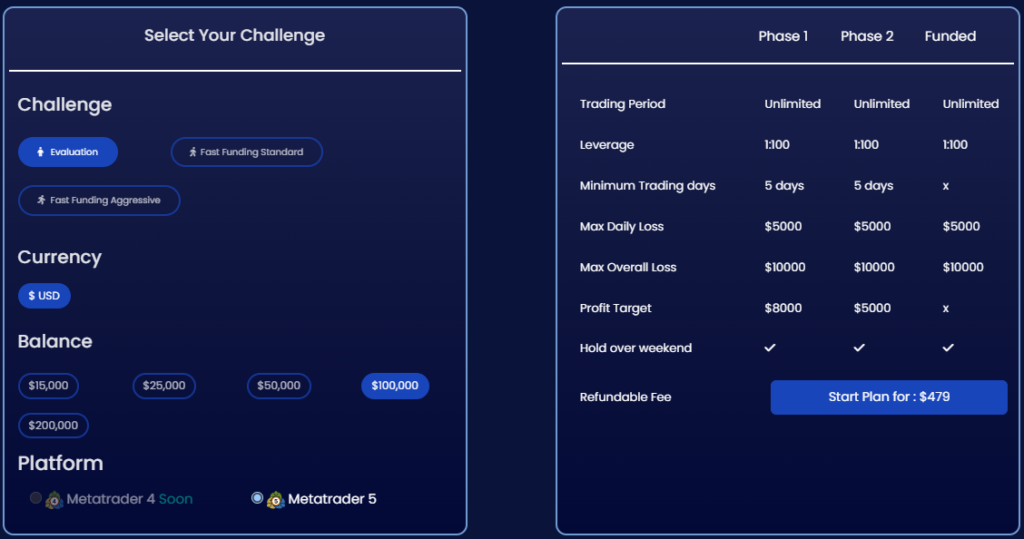

Evaluation Program

Direct Funded Trader’s Evaluation Program gives you access to trading with account size from $15,000, up to $200,000. It is seeking to identify the most potentially talented profitable traders who also can effectively manage risk over time during the two-step process of evaluation. The trade is possible with up to 1:100 leverage in the Evaluation Program.

| Account Size | Price |

| $15,000 | $100 |

| $25,000 | $199 |

| $50,000 | $299 |

| $100,000 | $479 |

| $200,000 | $979 |

Phase one of the evaluation requires the trader to have reached an 8% profit level, and not more than the maximum 5% loss of the day, or more than 10% of the maximum loss. The time limits you have include that you need not observe a maximum trading day in phase one, but you must make at least five trading days to qualify for phase two.

Phase two evaluation calls for a trader to attain a profit of 5% without violating the rules that include 5% maximum loss per day or a maximum of 10% losses. Time constraints The key is to indicate that there is no restriction to your trading day as far as phase two is concerned. However, you have to trade for at least five days to advance to a funded account.

By completing both evaluation phases, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 5% maximum daily loss and 10% maximum loss rules. Your first payout is 30 calendar days from the day you place your first position on your funded account, while all other withdrawals can be submitted bi-weekly. On funded account profit, you earn a split of 80%. As such, there is also an additional cashback of $3 per lot traded that the evaluation made.

Evaluation Program Scaling Plan

The Evaluation Program also has a scaling plan. Once you have made a 25% profit, then you will qualify for an increase in account size to equal 50% of the initial account size.

- After Achieving a Profit of 25%: A qualified $100,000 account grows to $150,000.

- After the Subsequent 25% Profit: A qualified $150,000 account grows to $200,000.

- After the Subsequent 25% Profit: A qualified $200,000 account grows to $250,000.

Evaluation Program Trading Rules & Objectives

- Profit Target – To close an evaluation phase, withdraw profits, or scale up the trading account, a trader needs to have a profit percentage that was designated at the start of the account opening process. Profit targets are 8% for Phase 1, 5% for Phase 2, and there is no specified profit target for Funded accounts.

- Maximum Daily Loss – The maximum amount of loss that a trader is allowed to incur on a single trading day without defaulting the account. Every account size has a maximum daily loss at 5%.

- Maximum Loss – The overall maximum loss limit a trader is allowed to incur without defaulting the account. All account sizes have a maximum loss at 10%.

- Minimum Trading Days – This is the minimum number of trading days you have to undertake before you successfully complete the evaluation phase. Both evaluation phases are covered by a minimum trading day condition, which is 5 days in total.

- Stop-loss Required – Before entering into a trade, the trader must place a stop loss for all their positions. (Only when on a funded account. And it must be placed within 30 seconds of execution otherwise the account will be closed)

- No Martingale – Traders are not allowed to use any type of martingale system in their trading practices.

Fast Funding

Direct Funded Trader’s Fast Funding offers traders the opportunity to manage account sizes of $15,000 and up to $100,000. The goal is to look for disciplined traders who can be profitable and effectively manage their risk over a one-step evaluation period. Fast Funding is of two types: Standard and Aggressive. The standard Fast Funding allows you to trade with leverage of up to 1:50. Nevertheless, the Aggressive Fast Funding allows you to trade using the leverage of up to 1:30. The only difference other than that is that it permits you to keep your open positions over the weekend whereas the Standard Fast Funding asks for closing all of your positions by the end of the business week.

| Account Size | Price (Standard) | Price (Aggressive) |

| $15,000 | $150 | $190 |

| $25,000 | $280 | $320 |

| $50,000 | $350 | $390 |

| $100,000 | $590 | $620 |

In the evaluation phase, the trader is required to achieve a profit target of 10% but not exceed their maximum loss of 4% in any trading day or maximum loss of 7%. Concerning time restrictions, note that you are not limited to any trading day but must trade at least five trading days to proceed to a funded account.

By finishing the evaluation phase, you receive a funded account free of minimum withdrawal requirements. There are only two rules to comply with: do not exceed your maximum 4% of loss daily and your loss will not exceed 7%. You can make the first withdrawal in 30 days after placing your first position on the funded account you opened. All other requests may be made bi-weekly. You will earn a profit share of 80% of what you earn in your funded account. For this lot traded during evaluation, you will also be rewarded with $3 in cashback.

Fast Funding Scaling Plan

Fast Funding also possesses a scaling plan. And if you are able to generate a 25 percent profit, then you’ll be eligible for an increase in the account size equal to 50 percent of your initial account size.

- A qualified $100,000 account increases to $150,000 after generating a 25 percent profit.

- And then, after the subsequent 25 percent profit, a qualified $150,000 account increases to $200,000.

- And again, after the next 25 percent profit, a qualified $200,000 account increases to $250,000.

Fast Funding Trading Rules & Objectives

- Profit Target – Traders should get a predetermined profit rate percentage for successful completion of the evaluation phase, withdrawal of the profit, or trade volume scaling. The 10% profit target is placed during the evaluation phase. There is no specific profit target for any type of funded account.

- Maximum Daily Loss – A trader is allowed to incur an ultimate loss within a single day for breaching the account in this aspect. All accounts have 4% maximum daily loss.

- Maximum Loss – This refers to the total amount that the trader is permitted to lose without violating the account. All accounts have a minimum loss of 7%.

- Minimum Trading Days – This is the shortest period for which you are obligated to trade before you can successfully complete the evaluation phase. The minimum trading days in the evaluation phase are 5.

- No Weekend Holding – Traders are not allowed to carry trades over the weekend. All trades have to be closed before the close of the market on Friday. (Aggressive Fast Funding is an exception that can carry trades over the weekend)

- Stop-loss Required – A trader must put a stop-loss on every position before making any trade. This is only for the funded account and should be placed within 30 seconds of the execution, otherwise the account will be closed.

- No Martingale – No form of martingale strategy is allowed for use in trading by the traders.

What Makes Direct Funded Trader Different From Other Prop Firms?

Direct Funded Trader differs from most industry-leading prop firms Because they offer two distinct account types: a two-step evaluation and a one-step evaluation. In addition, they also offer a number of favorable features that include an unlimited trading period, a $3 cashback feature for each lot traded during the evaluation periods, and bi-weekly withdrawal.

Direct Funded Trader‘s Evaluation Program is a two-step evaluation that makes traders eligible for payouts only after they complete two phases. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rule. You also have no maximum trading day requirements during either evaluation phase. However, you are obliged to trade for at least 5 calendar days in each evaluation phase. The Evaluation Program also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Evaluation Program stands out mainly for having an unlimited trading period, a $3 cashback feature for each lot traded during the evaluation phases, and bi-weekly withdrawals.

Example of comparison between Direct Funded Trader & Fintokei

| Trading Objectives | Direct Funded Trader | Fintokei |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% | 80% up to 95% |

Example of comparison between Direct Funded Trader & Funded Trading Plus

| Trading Objectives | Direct Funded Trader | Funded Trading Plus (Advanced) |

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% (Trailing) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% | 80% up to 100% |

Example of comparison between Direct Funded Trader & FundedNext

| Trading Objectives | Direct Funded Trader | FundedNext (Evaluation) |

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: 4 WeeksPhase 2: 8 Weeks |

| Profit Split | 80% | 80% up to 95% |

Direct Funded Trader’s Fast Funding is an evaluation that is done in one go, whereby you need to pass a single phase to qualify for payouts. The target profit is 10%, with 4% maximum day and 7% maximum loss rules. You also do not have a maximum trading day requirement during the evaluation period. However, you are obligated to trade a minimum of at least 5 calendar days during the evaluation period. Fast Funding, while having a unique scaling plan, allows traders to be on top of even larger account sizes. Beyond that, it mainly ranks as one of the more desirable funding programs within the industry by carrying an unlimited trading period, each lot traded during evaluation being rewarded with a cash back of $3, and bi-weekly withdrawal frequency.

Example of comparison between Direct Funded Trader & FundedNext

| Trading Objectives | Direct Funded Trader | FundedNext (One-step Stellar) |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 7% | 6% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 80% up to 95% |

Example of comparison between Direct Funded Trader & PipFarm

| Trading Objectives | Direct Funded Trader | PipFarm (Static) |

| Profit Target | 10% | 12% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 7% | 6% |

| Minimum Trading Days | 5 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 70% up to 95% |

Example of comparison between Direct Funded Trader & MyFundedFX

| Trading Objectives | Direct Funded Trader | MyFundedFX |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% (Scaleable up to 6%) |

| Maximum Loss | 7% | 6% (Trailing)(Scaleable up to 12%) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% | 80% up to 92.75% |

In conclusion, Direct Funded Trader differs from other industry-leading prop firms They offer two unique account types: a two-step evaluation and a one-step evaluation. In addition, they also provide numerous favorable features, such as an unlimited trading period, a $3 cashback feature for each lot traded during the evaluation phases, and bi-weekly withdrawals.

Is Getting Direct Funded Trader Capital Realistic?

It is very important to assess the achievability of trading requirements when considering proprietary trading firms that fit your style of forex trading. Although a company may be attractive with a high percentage profit split on a well-funded account, the practicality drops if they demand large monthly gains with low maximum drawdown percentages, significantly reducing the chances of success. Another important aspect is the time constraint, where unlimited trading period is more favorable since it eliminates the pressure associated with time constraints. Lastly, it is important to familiarize yourself with all trading rules during the evaluation process and subsequent funding stages to avoid accidentally violating your trading account terms.

Receiving capital from the Evaluation Program is realistic primarily due to its below-average profit targets (8% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). Of course, there is no maximum trading day requirement but a minimum trading day requirement of 5 calendar days. Additionally, at the end of both evaluation stages, participants are eligible to receive payments with a very favorable profit share of 80%.

Receiving capital from Fast Funding is realistic only because of its average profit target of 10% along with slightly above-average maximum loss rules of 4% maximum daily and 7% maximum loss. In addition, there are no maximum trading day requirements; however, there is a minimum trading day requirement of 5 calendar days. Additionally, after completing the evaluation phase successfully, users become eligible for payouts carrying an attractive profit split of 80%.

Considering all the aspects involved, Direct Funded Trader can be highly recommended for use since you have two distinctive funding programs to work through, a two-step evaluation as well a one-step evaluation, both with realistic trading goals and requirements for the potential payout.

Payment Proof

Direct Funded Trader It is a proprietary trading firm incorporated on February 28, 2023. It has a large community of traders who have reached funded status and successfully qualified for a profit split.

While working with Direct Funded Trader and reaching the funded status of the Evaluation Program or Fast Funding, you will qualify for the first payout after 30 calendar days. However, after the first payout, you will be qualified for payouts if you exceed the initial account size every 14 calendar days. Profit split will make up an 80% generous one based on the profit which you have generated in your funded account.

There are numerous websites that have Direct Funded Trader payment proof. For instance, Trustpilot has comments from their traders about their experience working with the company and the process through which they were able to receive payouts successfully. The other source of payment proof for Direct Funded Trader is their Discord channel, where you can find numerous payout certificates of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

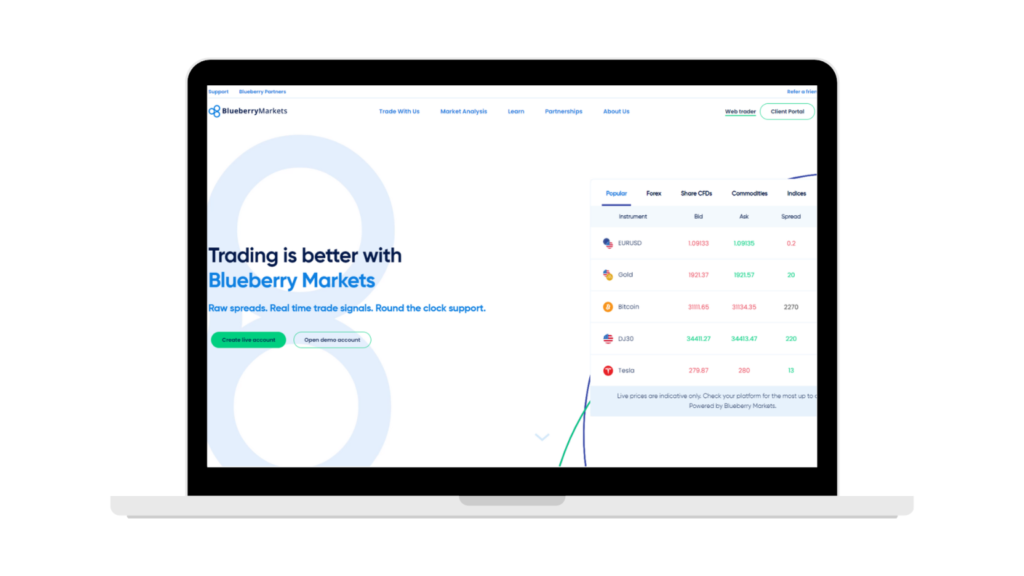

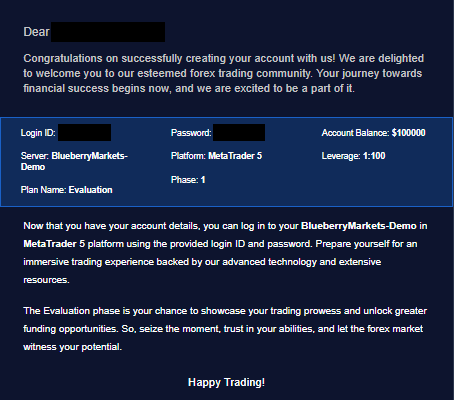

Which Brokers Does Direct Funded Trader Use?

Direct Funded Trader is partnered with Blueberry Markets as their broker.

Blueberry Markets is an ASIC-regulated online Forex broker providing access to trading financial instruments to thousands of traders all across the globe. They have a passion for providing traders with a superior trading platform, ultra-tight spreads, and a committed 24/7 customer support team. Learn more about Blueberry Markets by reading our in-depth Review.

As for trading platforms, while you are working with Direct Funded Trader, they allow you to trade on MetaTrader 4 and MetaTrader 5.

Trading Instruments

As mentioned above, Direct Funded Trader is partnered with Blueberry Markets, and they allow you to trade a wide range of trading instruments, which include forex pairs, commodities, indices, stocks, and cryptocurrencies with a leverage of up to 1:100, depending on the trading instrument that you are trading and the funding program that you are participating in.

Forex Pairs

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/USD | CAD/CHF | CAD/JPY |

| CHF/JPY | EUR/AUD | EUR/CAD | EUR/CHF | EUR/GBP | EUR/JPY |

| EUR/USD | GBP/AUD | GBP/CAD | GBP/CHF | GBP/JPY | GBP/USD |

| USD/CAD | USD/CHF | USD/JPY | AUD/CNH | AUD/NZD | CAD/SGD |

| EUR/NOK | EUR/NZD | EUR/SEK | EUR/TRY | GBP/NZD | NZD/CAD |

| NZD/CHF | NZD/JPY | NZD/SGD | NZD/USD | SGD/JPY | USD/CNH |

| USD/HKD | USD/MXN | USD/NOK | USD/PLN | USD/SEK | USD/SGD |

| USD/TRY | USD/ZAR | CHF/SGD | CNH/JPY | EUR/CNH | EUR/HKD |

| EUR/MXN | EUR/ZAR | GBP/CNH | GBP/HKD | GBP/NOK | GBP/SEK |

| GBP/SGD | NOK/JPY | NOK/SEK | NZD/CNH | USD/THB | ZAR/JPY |

Commodities

| XAG/USD | XAU/AUD | XAU/CNH | XAU/EUR | XAU/GBP |

| XAU/SGD | XAU/USD | XPT/USD | XPD/USD | UKBRENT |

| USWTI |

Indices

| AU200 | DJ30 | FR40 | GER30 | JP225 |

| NAS100 | SP500 | STOXX50 | UK100 | CHINAH |

| HK50 | NETH25 | USDIndex | VIXIndex |

Cryptocurrencies

| ADA/USD | BCH/USD | BTC/USD | DOT/USD | EOS/USD |

| ETH/USD | LNK/USD | LTC/USD | XLM/USD | XRP/USD |

As mentioned above, Direct Funded Trader It also allows you to trade a wide range of stocks. To view the full list, please refer to the Spread Account below, which will enable you to log into the MetaTrader 5 trading platform and view the complete list of available stocks.

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

| FOREX | 7 USD / LOT |

| COMMODITIES | 7 USD / LOT |

| INDICES | 7 USD / LOT |

| STOCKS | 7 USD / LOT |

| CRYPTO | 7 USD / LOT |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

| MetaTrader 5 | BlueberryMarkets-Live | 6045367 | +qG8BzEj | Click here |

Education

Direct Funded Trader does not provide any educational content on its website.

Nonetheless, Direct Funded Trader has their community commenting and providing positive feedback regarding their company services. The firm has achieved an impressive rating of 4.0 out of 5 from a pool of 123 reviews. Notably, 74% of these reviews have been awarded.

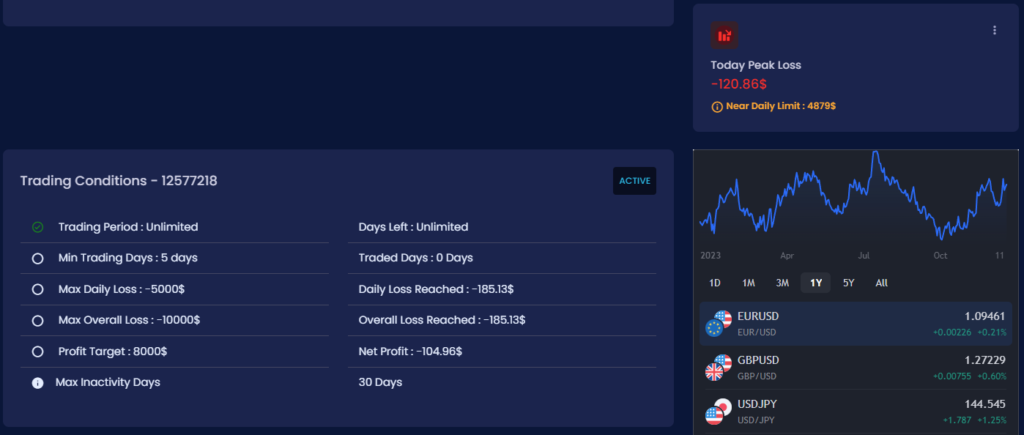

Direct Funded Trader Trading Dashboard

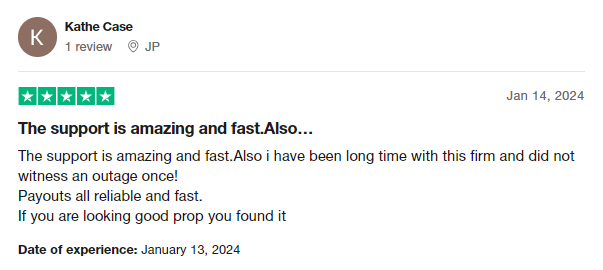

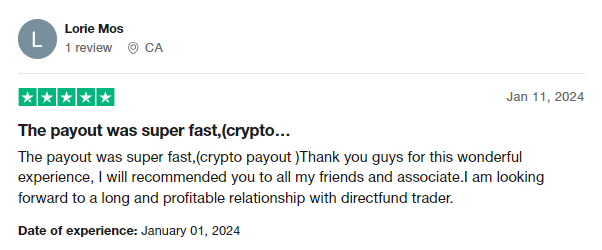

Trustpilot Feedback

Direct Funded Trader has gathered a great score on Trustpilot based on their community’s feedback.

On Trustpilot, Direct Funded Trader has their community commenting and providing positive feedback on services that their company renders. The firm has rated a fantastic 4.0 out of 5 coming from a pool of 123 reviews. Interestingly, 74% of these reviews have bestowed Direct Funded Trader the highest rating of 5 stars.

The client highlights the exceptional and prompt support from Direct Funded Trader, emphasizing the absence of any outages during their long-term association with the firm. They also note the reliability and speed of payouts, concluding that if someone is in search of a reliable proprietary trading firm, Direct Funded Trader fits the criteria.

The client expresses satisfaction with Direct Funded Trader, paying back super fast, especially on cryptocurrencies. They are appreciative of the good experience they had and promise to advise friends and associates on this platform. The comment is then concluded by the wish of a long and lucrative partnership with Direct Funded Trader, indicating a positive and promising outlook for future interactions.

Social Media Statistics

Direct Funded Trader can also be found on numerous social media platforms.

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Phone | ❌ |

| Discord | Discord Link |

| Telegram | Telegram Link |

| FAQ | FAQ Link |

| Help Center | ❌ |

| ❌ | |

| Messenger | ❌ |

| Supported Languages | English |

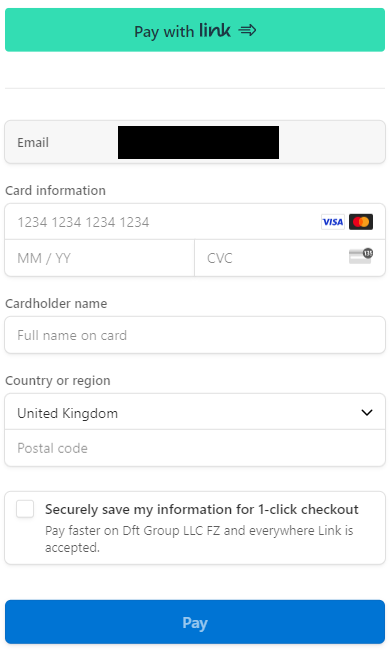

Account Opening Process

- Registration Form – Registration through Direct Funded Trader Fill out the registration form and log into the trading dashboard.

- Choose Your Account – Select your account type, account size, and trading platform.

- Choose Your Payment Method – Select credit/debit card or cryptocurrency payment method once you have successfully applied our discount code.

- Receive Login Credentials – Find an email with a greeting from Direct Funded Trader and you can access the login credentials for your new purchased trading account.

Conclusion

In conclusion, Direct Funded Trader is a proprietary trading firm, that is reputable and trustworthy in providing traders with the chance to choose between two funding programs: the Evaluation Program, a two-step evaluation, and Fast Funding, a one-step evaluation.

Direct Funded Trader’s Evaluation Program is the industry-standard two-step evaluation requiring completion of two phases before becoming eligible to manage a funded account and earn 80% profit splits. Traders must achieve profit targets of 8% in the first phase and 5% in the second to be considered successfully funded. Those are achievable trading objectives given that you have a maximum loss of 5% daily and 10% overall loss rules to adhere to. Concerning time constraints, you don’t have maximum trading days during either the first or second evaluation phases. However, you must trade for at least 5 calendar days in each evaluation phase. Finally, the Evaluation Program has a scaling plan, so you will be able to raise your initial account balance.

Direct Funded Trader’s Fast Funding is a one-step evaluation. To become eligible for a funded account and 80% profit splits, you will have to complete one phase of evaluation. Traders need to hit a profit target of 10% to be considered successfully funded. These are achievable trading goals, factoring in that you are using a 4% maximum daily and 7% maximum loss rule to follow. In terms of time limits, you have no restrictions for maximum trading days in the testing phase. However, during the testing phase, you have to trade for at least 5 calendar days. Last but not least, it must be pointed out that Fast Funding offers a scaling plan which would enable you to double up your initial account balance.

I would personally suggest the Direct Funded Trader for a legitimate proprietary trading firm for which I could seek in seeking ideal trading conditions to match their variety of different styles in traders. They offer unique features to the traders, which include an unlimited trading period, cashback of $3 per lot traded during the evaluation phases, and bi-weekly withdrawals. Considering everything that Direct Funded Trader offers the traders all over the world, they are a highly in-demand choice in the world of prop trading.

What are your personal views on Direct Funded Trader and the services they offer?

Do they meet the trading conditions and services that you have been looking for?

Share with us if you liked our in-depth review of Direct Funded Trader by commenting below!

Leave a Reply