Hexa Prop Review

Hexa Prop is a property firm that focuses on long-term partnerships and providing clients with a stable and dependable financial base. By focusing on personalized support and innovative strategies, they enable their clients to confidently and successfully navigate the complexities of the financial markets.

Pros

- Three Unique Funding Programs

- Professional Trader Dashboard

- High Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

- No Commission Fees (Except Forex Pairs & Metals)

- Leverage up to 1:50

- Scaling Plan

- Quick Goal Bonus Feature

- No Maximum Trading Period

- 90% Profit Split Add-on Option

- Bi-weekly Future Payouts

- 80% up to 90% Profit Split (Depending on Challenge Type)

- Overnight & Weekend Holding Allowed

- News Trading Allowed During Evaluation Phases on Duplex & Triplex Challenges

- EAs Allowed (Except on Simplex Challenge)

Cons

- First Payout After 30 Calendar Days

- Minimum Trading Day Requirements

- Trailing Drawdown on Simplex Challenge

- News Trading Prohibited Once Funded

Hexa Prop is a prop firm that aims to build long-term relationships with its clients, establishing a solid and stable financial base. Their focus is on building long-term relationships that enable their clients to achieve their financial goals. Traders can earn a significant amount of money and can have the flexibility of managing an account size of up to $200,000 with profit splits up to 90%. It is possible by trading a range of financial instruments such as forex pairs, commodities, indices, and cryptocurrencies.

Who are Hexa Prop?

Hexa Prop is a company that specializes in proprietary trading whose legal name is Hexa Prop Ltd. They were incorporated on the 1st of March 2024, and can be found in Malta under the management of CEO Andras Kovacs. Hexa Prop offers a choice of three account types, a two-step evaluation, a one-step evaluation, and a three-step evaluation while being partnered with a tier-1 liquidity provider with the best simulated real market trading conditions as their broker.

Hexa Prop’s headquarters are located at ADD Malta Level 2, Hardrocks Business Park, Triq Burmarrad, Naxxar, NXR 6345 Malta.

Who is the CEO of Hexa Prop?

Andras Kovacs is the CEO of Hexa Prop. Note that we will be adding more information about their CEO in the future. Stay tuned!

Funding Program Options

Hexa Prop offers its clients three different funding program choices:

- Duplex Challenge

- Simplex Challenge

- Triplex Challenge

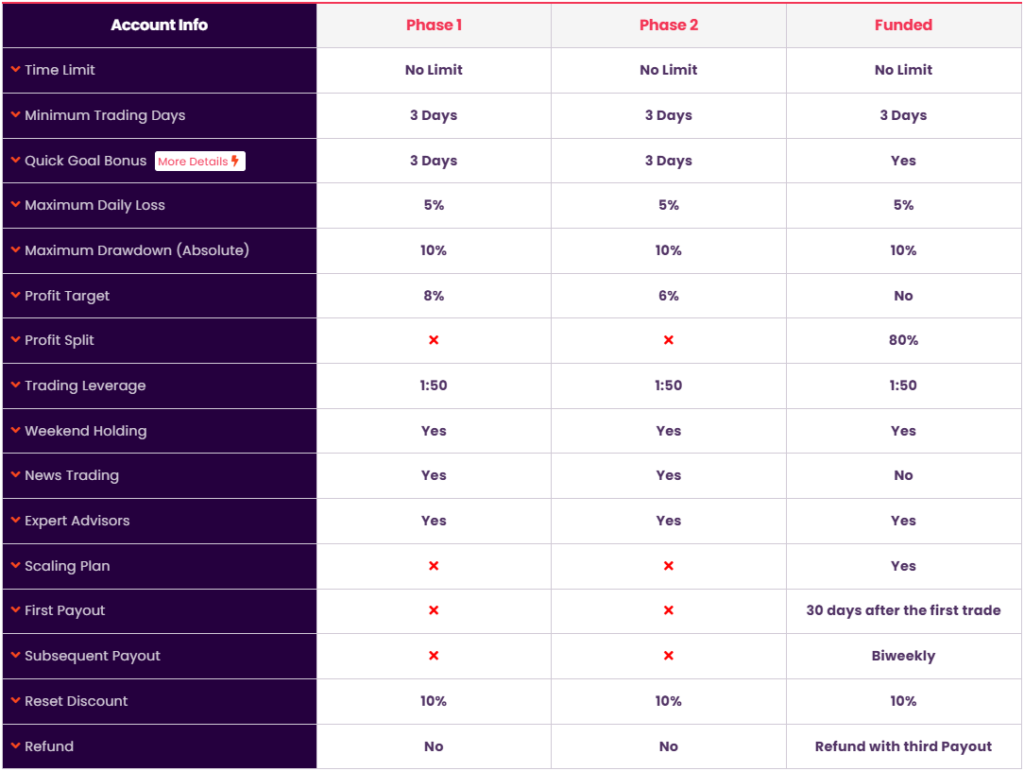

Duplex Challenge

Hexa Prop’s Duplex Challenge: This is an opportunity offered to traders to manage their account sizes ranging from $10,000 up to $200,000. The goal is to discover talented traders who are profitable and can effectively manage risk for the two-step evaluation period. Using the Duplex Challenge allows you to trade with a leverage of up to 1:50.

| Account Size | Price |

| $10,000 | $98 |

| $25,000 | $198 |

| $50,000 | $296 |

| $100,000 | $536 |

| $200,000 | $1,074 |

Evaluation phase one will require a trader to achieve an 8% profit while not exceeding their 5% maximum daily loss or 10% maximum loss rules. In terms of time constraints, note that you have no maximum trading day requirements during phase one. However, you must trade at least three trading days to advance to phase two.

Phase two of the evaluation requires a trader to achieve a profit target of 6% without exceeding their 5% maximum daily loss or 10% maximum loss rules. As for time constraints, you do not have any maximum trading day requirements during phase two. However, you are required to trade at least three trading days to move on to a funded account.

By passing both evaluation phases, you receive a funded account, with a minimum withdrawal amount of $500. You only need to honor the 5% maximum daily loss and 10% maximum loss rules. Your first payout on your funded account occurs after 30 calendar days, but all other withdrawals may be submitted bi-weekly. Your profit split will be 80% (90% with add-on) based on the profit made by you on your funded account.

Add-ons for Hexa Prop’s Duplex Challenge

- 90% Profit Split

Duplex Challenge Scaling Plan

The Duplex Challenge also possesses a scaling plan. Discipline and successfully trading traders have an opportunity for growing trading capitals up to a maximum allotment amount of $2.5 million USD. For having met set conditions, traders can apply to increase an account size level to amounts equal to 30% percent of a starting account size every four months. Scale is not automatic. A scale must be requested by the trader.

To qualify for a balance increase, the trader must satisfy certain conditions within a four-month cycle. First, the trader must make a net profit of at least 15% of the initial account balance by the end of the fourth month. For instance, on a $100,000 account, the trader must have a minimum balance of $115,000 to qualify. The second condition is that while up to two months within the four-month cycle can be loss-making, the last month must be profitable.

In addition to profitability, there must be at least three withdrawals during the four-month cycle. The withdrawals can be made at any time and will not affect scaling eligibility. Additionally, the account balance must not go below the initial account size at the time of the scaling request. Finally, increases in scaling are not automatic. Traders must apply for evaluation.

Example:

- After 4 Months: A qualified $100,000 account increases to $130,000.

- After the Next 4 Months: A qualified $140,000 account increases to $160,000.

- After the Next 4 Months: A qualified $180,000 account increases to $190,000.

- And so on….

Duplex Challenge Trading Rules & Objectives

- Profit Target – In order to be able to successfully close the evaluation phase, withdraw earnings or scale a trading account, traders must hit a defined profit percentage. For Phase 1, the target profit is set at 8%, whereas for Phase 2, it must be 6%. No such defined profit targets are required of funded accounts.

- Maximum Daily Loss – The maximum loss allowed to a trader in one trading day without violating the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss allowed to a trader overall without violating the account. All account sizes have a maximum loss of 10%.

- Minimum Trading Days – The minimum trading day period by which you must make trades before successfully completing the evaluation period. Both types of evaluation periods have a minimum 3-day trading day requirement, and, once funded, you’ll also have a minimum of 3 trading days requirement.

- No News Trading – Trading is not allowed on high-impact news announcements. This means that it is not possible to enter a new trade or close a current trade on the subject instrument during the 3-minute window both leading up to and following the announcement of specific news. (Available on funded accounts only)

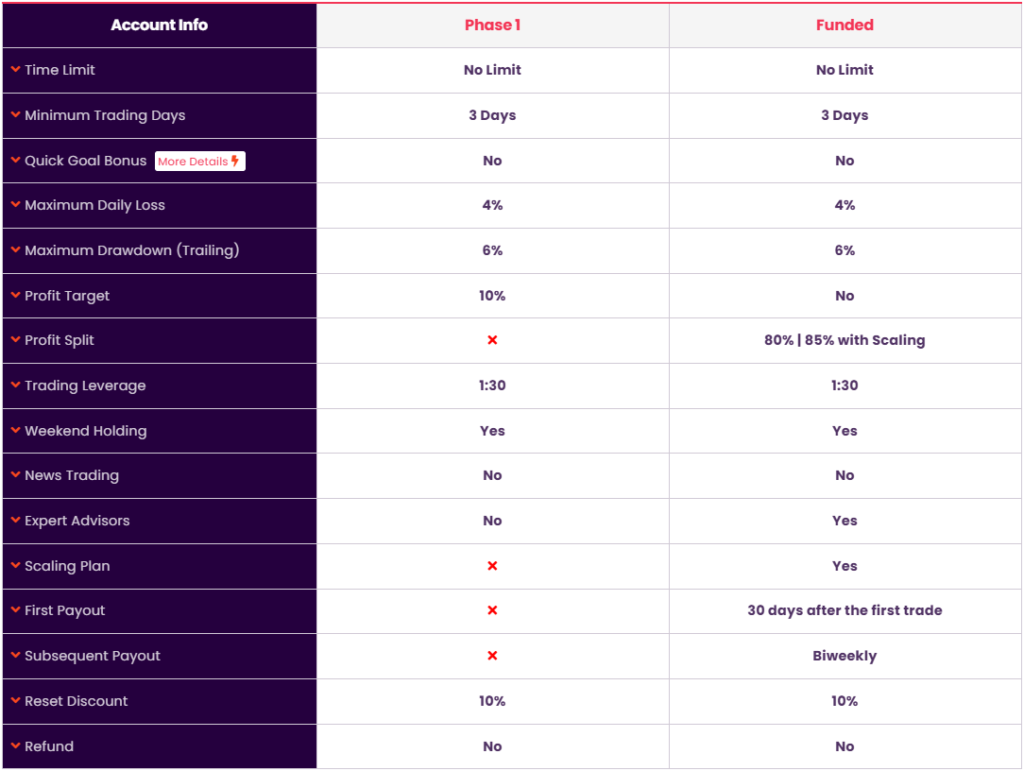

Simplex Challenge

Hexa Prop’s Simplex Challenge offers the chance to manage account sizes from $10,000 to $200,000. The goal is to find good traders who are profitable and can efficiently manage risk throughout the one-step evaluation period. With the Simplex Challenge, you can trade with leverage up to 1:30.

| Account Size | Price |

| $10,000 | $96 |

| $25,000 | $196 |

| $50,000 | $310 |

| $100,000 | $548 |

| $200,000 | $1,128 |

During the evaluation phase, the trader has to achieve the profit target of 10%, without violating their 4% maximum daily loss or their 6% maximum trailing loss rules. With regard to the time constraint, you have to note that there is no limitation on the number of trading days during the evaluation phase; however, you are to trade at least three trading days to get to a funded account.

Completing the evaluation phase will award you a funded account with a minimum withdrawal amount of $500. You only have to respect the 4% maximum daily loss and 6% maximum trailing loss rules. Your first payout on your funded account is after 30 calendar days, while all other withdrawals can be submitted on a bi-weekly basis. Your profit split will be 80% up to 85% (90% with add-on) based on the profit you make on your funded account.

Add-ons for Hexa Prop’s Simplex Challenge

- 90% Profit Split

Simplex Challenge Scaling Plan

The Simplex Challenge also comes with a scaling plan where disciplined and successful traders are provided the opportunity to grow trading capital up to a maximum allocation of $2.5 million USD. Scaling is not automated, though; it is requested by the trader and only applied when specific conditions are met, such as an account size increase equal to 30% of the initial account size every four months.

To qualify for a balance increase, traders have to meet certain conditions within a four-month cycle. The first condition is that the trader must generate a net profit of at least 15% of the initial account balance by the end of the fourth month. For instance, on a $100,000 account, the trader must have a minimum balance of $115,000 to qualify. The second condition is that while up to two months within the four-month cycle can be loss-making, the last month has to be profitable.

Apart from profitability, a trader needs to make at least three withdrawals within the four-month cycle. The withdrawals can be made at any time without affecting scaling eligibility. Furthermore, the account balance is not allowed to go below the initial account size during scaling requests. The increase in scaling is also not automatic. The evaluation request has to be done by the trader.

Example

- After 4 Months: A qualified $100,000 account becomes $130,000.

- After the Next 4 Months: A qualified $140,000 account becomes $160,000.

- After the Next 4 Months: A qualified $180,000 account becomes $190,000.

- And so on….

Simplex Challenge Trading Rules & Objectives

- Profit Target – To complete an evaluation phase, withdraw profits, or increase a trading account, traders must realize a specified profit percentage. The profit target for the evaluation phase is 10%. There are no profit targets on funded accounts.

- Maximum Daily Loss – The maximum loss a trader can incur in a single trading day before breaking the account. Every account size has a maximum daily loss of 4%.

- Maximum Trailing Loss – The difference between the highest achieved account balance and the lowest point of the drawdown determines the maximum trailing loss a trader is allowed to lose without breaching the account. All account sizes have a maximum trailing loss of 6%.

- Minimum Trading Days – The number of days within which you have to trade for you to successfully complete the evaluation period. The minimum trading day of the evaluation period is 3 days. You will also have a minimum trading day of 3 days when your account is funded.

- No News Trading – No trading is allowed during the high-impact news release.

- No Expert Advisors – This means that a trader is restricted from accessing the services of Expert Advisors while trading.

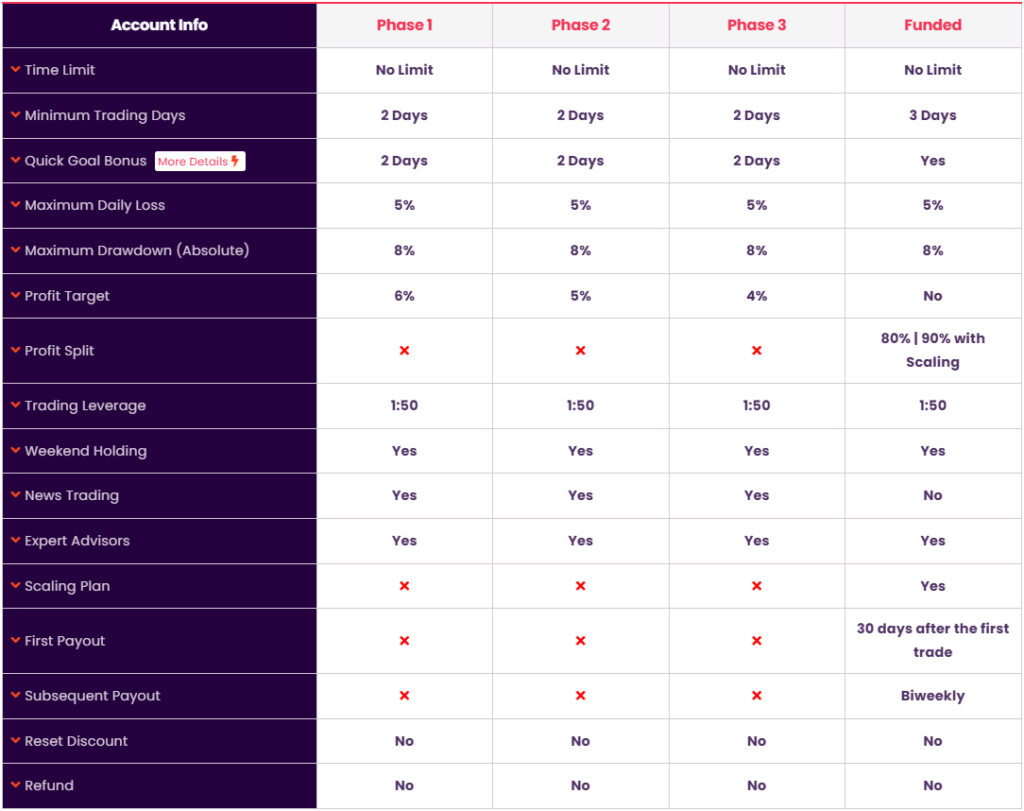

Triplex Challenge

Hexa Prop’s Triplex Challenge gives traders an opportunity to trade with a size of accounts from $10,000 up to $200,000. The goal is to determine the best performers who bring profit and can handle risk well during all three steps of the review process. The Triplex Challenge allows you to trade with a leverage of up to 1:50.

| Account Size | Price |

| $10,000 | $78 |

| $25,000 | $138 |

| $50,000 | $215 |

| $100,000 | $380 |

| $200,000 | $695 |

In evaluation phase one, a trader is expected to attain 6% profit without surpassing 5% in their daily maximum loss or an 8% maximum loss rule. About the time restrictions, it’s worth mentioning that there are no requirements for your trading days to have a limit. However, you have to make at least two trades, so that you can enter phase two.

Phase two of the evaluation requires a trader to hit 5% profit without breaking their 5% maximum loss rule for the day or their 8% maximum loss rule. As far as time constraints go, note that you have no maximum trading day requirements during phase two. However, you do have to trade at least two trading days to advance into phase three.

The profit target of phase three in the evaluation requires a trader to make at least 4% in profits without exceeding his/her maximum daily loss rules at 5% and his/her maximum loss rules at 8%. Regarding the time factor, note that you are not limited by maximum trading days in phase three. However, you have to trade at least two days before you can qualify to enter into a funded account.

Once you have successfully completed all three phases of evaluation, you will receive a funded account where your minimum withdrawal is $500. You must only abide by the rules of a maximum daily loss of 5% and a maximum loss of 8%. The first payout for your funded account comes after 30 calendar days, while any other withdrawal can be submitted bi-weekly. The split on your profit will be 80% up to 90% (90% with add-on) based on the profit you make on your funded account.

Add-ons for Hexa Prop’s Triplex Challenge

- 90% Profit Split

Triplex Challenge Scaling Plan

The Triplex Challenge also has a scaling plan, which allows disciplined and successful traders to grow their trading capital up to a maximum allocation of USD 2.5 million. The traders are allowed to request an account size increase equal to 30% of the initial account size every four months if they meet certain conditions. Scaling is not automated and must be requested by the trader.

If conditions are met within a cycle of four months, that is, the trader managed to generate a net profit of at least 15% of the initial amount transferred to the account by the end of the fourth month or has at least $115,000 on a $100,000 account, etc; and the last month does not make a loss-the balance can be increased in the following month. If within the cycle of four months, the trader has accumulated more loss than profit, then an increase in the balance does not take place.

Apart from profitability, at least three withdrawals have to be made in the cycle of four months. A trader can withdraw at any time and does not have any effect on the scaling process. Additionally, when applying for scaling, the balance of the account should not go below the size at which the account was created. Lastly, scaling increases are not automatic. Application for evaluation must be done by the traders.

Illustration:

- After 4 Months: A qualified $100,000 account grows to $130,000.

- After the Next 4 Months: A qualified $140,000 account grows to $160,000.

- After the Next 4 Months: A qualified $180,000 account grows to $190,000.

- And so on……

Triplex Challenge Trading Rules & Objectives

- Profit Target – To complete an evaluation phase, withdraw earnings, or scale the trading account, traders must reach a set profit percentage. For Phase 1, the profit target is 6%, Phase 2 is 5%, and Phase 3 requires reaching a profit target of 4%. Funded accounts do not have any set profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 8%.

- Minimum Trading Days – The minimum number of trading days you have to spend within the period before an evaluation stage is considered a success. All three evaluation stages require at least 2 days of a trading day, but when you finally get funded, the minimum is 3 trading days.

- No News Trading – Trading is not allowed during high-impact news releases. This means that opening new trades or closing existing trades on the listed instrument is not allowed within the 3-minute window both before and after the release of specific news. (Only on funded accounts)

Quick Goal Bonus Feature

Quick Goal Bonus is a special feature of Hexa Prop, active on Duplex and Triplex Challenges. In the course of your evaluation stages, you will be able to choose from two unique bonuses if you reach Funded status within 6 trading days.

- 10% Boose in Base Balance – The more your account balance is, the more your maximum allowable loss grows. For example, if you have a $100k account and a 10% drawdown limit, you can lose as much as $10k. If your balance rises to $110k with a 10% gain, your drawdown limit adjusts to $11k.

- 1% Increase in Max Daily Loss – More intraday loss limit means that you will have more opportunities to recoup on a bad day. For instance, if your limit increases from 5% to 6%, getting to a 5% loss still leaves space to take another well-timed trade.

Learn more about Quick Goal Bonus.

What Makes Hexa Prop Different From Other Prop Firms?

Hexa Prop differs from most industry-leading prop firms because of offering three different account types: two-step evaluation, one-step evaluation, and three-step evaluation. Besides that, they offer many favorable features like unlimited trading period, a beneficial 90% profit split add-on, unique quick goal bonus feature, multiple options of trading platforms, and bi-weekly future withdrawals.

Hexa Prop‘s Duplex Challenge is a two-stage evaluation where the trader needs to successfully complete two phases before becoming eligible for payouts. The profit target is 8% in phase one and 6% in phase two with a 5% maximum daily and 10% maximum loss rules. You also have no maximum trading day requirements during either evaluation phase. But in the evaluation phases, you have to trade at least for 3 calendar days. The Duplex Challenge has also a different plan for scaling. It means you will be able to deal with more considerable account sizes. Compared to all other funding programs in the industry, the Duplex Challenge stands out mainly by having an unlimited trading period, a lucrative 90% profit-split add-on, a unique feature of quick goal bonus, multiple trading platform options, and bi-weekly future withdrawal.

Example of comparison between Hexa Prop & FXIFY

| Trading Objectives | Hexa Prop | FXIFY |

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 6% | 5% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% (90% with add-on) | 80% up to 90% |

Example of comparison between Hexa Prop & FundedNext

| Trading Objectives | Hexa Prop | FundedNext (Evaluation) |

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 6% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: 4 WeeksPhase 2: 8 Weeks |

| Profit Split | 80% (90% with add-on) | 80% up to 95% |

Example of comparison between Hexa Prop & Blue Guardian

| Trading Objectives | Hexa Prop | Blue Guardian (Elite) |

| Phase 1 Profit Target | 8% | 10% |

| Phase 2 Profit Target | 6% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 3 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: Unlimited | Phase 1: UnlimitedPhase 2: Unlimited |

| Profit Split | 80% (90% with add-on) | 85% |

Hexa Prop’s Simplex Challenge is a one-phase evaluation where you must succeed at that one phase to become eligible for payouts. Profit target is 10%, maximum daily loss is 4%, and maximum trailing loss is 6%. Also, you have no limit of trading days during the evaluation phase. But you have to trade for at least 3 calendar days during the evaluation phase. Note that the Simplex Challenge also has a unique scaling plan, so traders can handle even bigger account sizes. Compared to other funding programs in the industry, the Simplex Challenge is mainly distinguished by having an unlimited trading period, a beneficial 90% profit split add-on, a unique quick goal bonus feature, numerous trading platform options, and bi-weekly future withdrawals.

Example of comparison between Hexa Prop & PipFarm

| Trading Objectives | Hexa Prop | PipFarm (Static) |

| Profit Target | 10% | 12% |

| Maximum Daily Loss | 4% | 3% |

| Maximum Loss | 6% (Trailing) | 6% |

| Minimum Trading Days | 3 Calendar Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 85% (90% with add-on) | 70% up to 95% |

Example of comparison between Hexa Prop & Alpha Capital Group

| Trading Objectives | Hexa Prop | Alpha Capital Group |

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 6% (Trailing) | 6% |

| Minimum Trading Days | 3 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 85% (90% with add-on) | 80% |

Example of comparison between Hexa Prop & FunderPro

| Trading Objectives | Hexa Prop | FunderPro |

| Profit Target | 10% | 14% |

| Maximum Daily Loss | 4% | 4% (5% Once Funded) |

| Maximum Loss | 6% (Trailing) | 7% (10% Once Funded) |

| Minimum Trading Days | 3 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 85% (90% with add-on) | 80% |

Hexa Prop’s Triplex Challenge is a three-step evaluation in which the trader needs to successfully complete three phases to be eligible for payouts. The profit target is 6% in phase one, 5% in phase two, and 4% in phase three, with a 5% maximum daily and 8% maximum loss rules. You also have no maximum trading day requirements during each evaluation phase. However, you are obligated to trade at least 2 calendar days of every evaluation phase. The Triplex Challenge also has a special scaling plan so that its traders can handle even greater account sizes. Compared to other funding programs within the industry, the Triplex Challenge stands out mainly on an unlimited trading period, beneficial 90% profit split add-on, a unique quick goal bonus feature, numerous trading platform options, and bi-weekly future withdrawals.

Example of comparison between Hexa Prop & The Funded Trader

| Trading Objectives | Hexa Prop | The Funded Trader |

| Phase 1 Profit Target | 6% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Phase 3 Profit Target | 4% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | 2 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% (90% with add-on) | 75% up to 95% |

Example of comparison between Hexa Prop & MyFundedFX

| Trading Objectives | Hexa Prop | MyFundedFX |

| Phase 1 Profit Target | 6% | 6% |

| Phase 2 Profit Target | 5% | 6% |

| Phase 3 Profit Target | 4% | 6% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 8% | 8% |

| Minimum Trading Days | 2 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% (90% with add-on) | 80% |

Example of comparison between Hexa Prop & E8 Markets

| Trading Objectives | Hexa Prop | E8 Markets |

| Phase 1 Profit Target | 6% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Phase 3 Profit Target | 4% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 8% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | 2 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited | Phase 1: UnlimitedPhase 2: UnlimitedPhase 3: Unlimited |

| Profit Split | 80% up to 90% (90% with add-on) | 80% |

In conclusion, Hexa Prop differs from other industry-leading prop firms Offering three unique account types: two-step evaluation, one-step evaluation, and three-step evaluation. They also offer a number of favorable features including unlimited trading period, 90% profit split add-on, unique quick goal bonus feature, various options for trading platforms, and future withdrawals every bi-week.

Is Getting Hexa Prop Capital Realistic?

It is very important to consider the achievability of trading requirements when looking for proprietary trading firms that match your forex trading style. While a company may look appealing with a high percentage profit split on a well-funded account, practicality goes down if they require high monthly gains with low maximum drawdown percentages, significantly lowering the chance of success. Moreover, review time constraints, as limitless trading period is more desirable since it eliminates the stresses associated with time constraints. Lastly, familiarize yourselves with all trading rules, especially during the evaluation procedure and subsequent funding stages in order to avoid accidentally being in breach of your terms of trading account.

- Receiving capital from the Duplex Challenge is realistic primarily because of its average profit targets (8% in phase one and 6% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). No maximum trading day requirements exist, but there is a minimum trading day requirement of 3 calendar days. Furthermore, on achieving a successful evaluation of both phases, the participants are eligible for payouts that carry a lucrative profit share of 80% (90% with add-on).

- Receiving capital from the Simplex Challenge is feasible primarily due to its average profit target of 10% coupled with average maximum loss rules (4% maximum daily and 6% maximum trailing loss). The minimum trading day requirement is 3 calendar days while there is no maximum trading day requirement. Furthermore, upon successfully completing the evaluation phase, participants qualify for payouts featuring an advantageous profit split of 80% up to 85% (90% with add-on).

- Receiving capital from the Triplex Challenge is realistic primarily because of its relatively modest profit targets, aside from the additional evaluation phase (6% in phase one, 5% in phase two, and 4% in phase three) coupled with slightly below-average maximum loss rules of 5% maximum daily and 8% maximum loss. Note that while having a minimum trading day requirement of 2 calendar days, there is no maximum trading day requirement. Also, once they successfully pass all three phases of evaluation, they become entitled to payouts that come with a highly favorable profit share ranging from 80% up to 90% (90% with add-on).

After considering all of these factors, Hexa Prop is highly recommended since you have three unique funding programs to choose from, two-step evaluation, one-step evaluation, and three-step evaluation, which all feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

Hexa Prop is a proprietary trading firm incorporated on March 1, 2024. They are working on creating a large community of traders.

While working with Hexa Prop and achieving a funded status with the Duplex Challenge, Simplex Challenge, or Triplex Challenge, you will qualify to earn your first payout after 30 calendar days. Subsequent to your first payout, you will also be eligible to earn payouts based on exceeding the account size on a daily basis once every 14 calendar days. The share of the profit will comprise a huge 80% (90% with add-on) for the profit generated on the funded Duplex Challenge account, 80% up to 85% (90% with add-on) for the funded Simplex Challenge account, and 80% up to 90% (90% with add-on) for the funded Triplex Challenge account.

The payment proof section will be updated as the first traders receive payouts from Hexa Prop.

Which Broker Does Hexa Prop Use?

Hexa Prop doesn’t trade with any of the common broker brands. Instead, they work with two liquidity providers to ensure superior simulated market trading conditions:

- Zenfinex: Currently powering the pricing for cTrader, Match-Trader, and DXtrade, Zenfinex uses an aggregated mix of tier-1 banks, brokers, and market makers to price its products. Their setup makes use of the YourBourse bridge to connect liquidity provider pricing to trading platforms.

- Netrios: Utilizing PipGrant as their bridge provider, Netrios serves as the liquidity provider for TradeLocker.

- As for trading platforms, while you are working with Hexa Prop, they allow you to trade on cTrader, TradeLocker, Match-Trader, or DXtrade.

Trading Instruments

As mentioned above, Hexa Prop is partnered with Zenfinex and Netrios It also allows you to get liquidity through your liquidity providers. Trading a vast number of trading instruments that include pairs, commodities, indices, and even cryptocurrencies with up to a leverage of 1:50 based on your funding program as well as the trading instrument that you trade.

Forex Pairs

| AUD/USD | EUR/USD | GBP/USD | NZD/USD | USD/CAD | USD/CHF |

| USD/JPY | AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | CAD/CHF |

| CAD/JPY | CHF/JPY | EUR/AUD | EUR/CAD | EUR/CHF | EUR/GBP |

| EUR/JPY | EUR/NZD | GBP/AUD | GBP/CAD | GBP/CHF | GBP/JPY |

| GBP/NZD | NZD/CAD | NZD/CHF | NZD/JPY | CAD/SGD | EUR/CZK |

| EUR/DKK | EUR/HKD | EUR/HUF | EUR/NOK | EUR/PLN | EUR/SEK |

| EUR/SGD | EUR/TRY | EUR/ZAR | GBP/DKK | GBP/NOK | GBP/SEK |

| NOK/SEK | USD/CNH | USD/CZK | USD/DKK | USD/HKD | USD/HUF |

| USD/ILS | USD/MXN | USD/NOK | USD/PLN | USD/RUB | USD/SGD |

| USD/TRY | USD/ZAR |

Commodities

| COPPER | XAG/USD | XAU/EUR | XAU/USD | XPT/USD |

| SOYBEANS | WHEAT | COFFEE | COCOA | BRENT |

| WTI |

Indices

| DAX | DOLLAR | ESP35 | EUSTX50 | FRA40 |

| JPN225 | NAS100 | SPX500 | UK100 | US30 |

Cryptocurrencies

| ADA/USD | AVA/USD | BAT/USD | BCH/USD |

| BNB/USD | BTC/USD | DASH/USD | DOGE/USD |

| DOT/USD | EOS/USD | ETC/USD | ETH/USD |

| IOTA/USD | LTC/USD | NEO/USD | OMG/USD |

| SHB/USD1000 | SOL/USD | TRX/USD | XLM/USD |

| XMR/USD | XRP/USD | ZEC/USD |

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

| FOREX | 7 USD / LOT |

| COMMODITIES | 7 USD / LOT (Only Metals) |

| INDICES | 0 USD / LOT |

| CRYPTO | 0 USD / LOT |

Spread Account

| Platform | Server | Login Number | Password | Download Platform |

| cTrader | ctid8781007 | [email protected] | d6C^eHmtr#8 | Click here |

| TradeLocker | Hexa | [email protected] | d6C^eHmtr#8 | Click here |

| Match-Trader | – | [email protected] | d6C^eHmtr#8 | Click here |

| DXtrade | – | hp_C0012065 | d6C^eHmtr#8 | Click here |

Education

Hexa Prop It offers its audience a comprehensive Trading Academy section filled with educational content. Furthermore, Hexa Prop has an exclusive “Be Funded!” educational section that will provide the following articles for traders to read:

Welcome to the World of Prop Trading!

- Choose Your Challenge

- How to Complete Your Chosen Challenge?

- How to Scale Up Your Account?

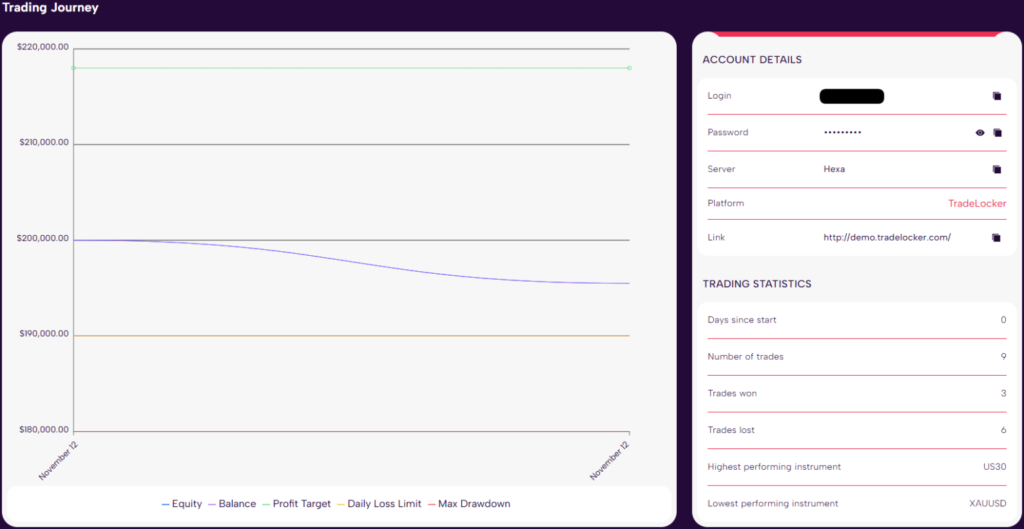

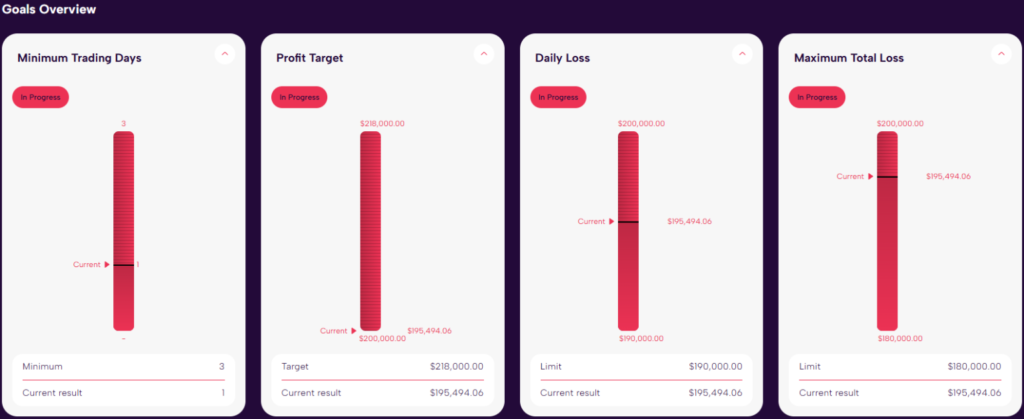

It is also worth noting that Hexa Prop offers all its clients access to a carefully designed trader dashboard that improves risk management by providing constant access to detailed statistics and goals. This ensures timely updates, which boosts user satisfaction.

Stay Funded!

Make Your Dreams Come True! | Trust Us, We’ve Been There

Trading Dashboard

Trustpilot Feedback

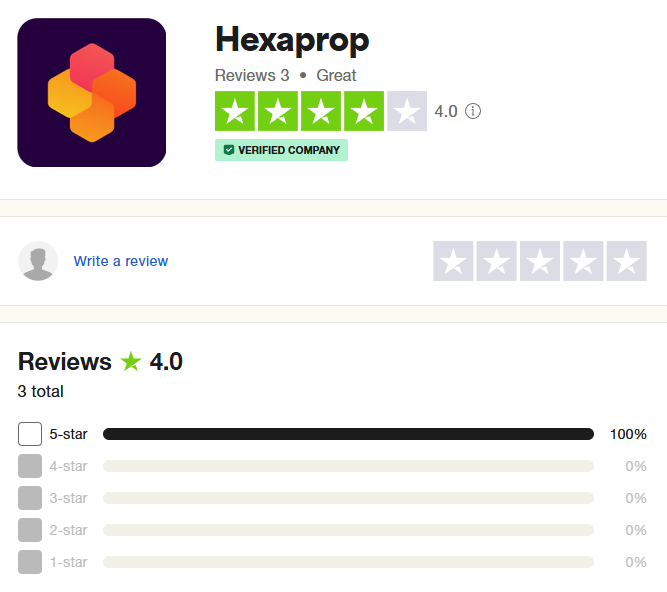

Hexa Prop has gathered a great score on Trustpilot based on their community’s feedback.

On Trustpilot, Hexa Prop Currently, still has a small community that comments and gives positive feedback on their company services because of its recent launch. The firm has a rating of 4.0 out of 5 from 3 reviews.

The client was highly satisfied with Hexa Prop, stating that it was an excellent funded trading platform. The user interface was described as great, and the tools and analytics that make trading easier are appreciated. The funding and evaluation process is fair according to the client, noting that it is based on skills and discipline. Also, the transparency of the payout and consistent support towards traders make them recommend Hexa Prop to anyone looking to advance their trading career.

The second client shared a positive experience with Hexa Prop, Praising the well-designed and user-friendly website. They rated support team a perfect 10/10 for their help. Currently, the client has just started the duplex challenge and expressed enthusiasm about recommending Hexa Prop to others. They also plan to buy a bigger challenge in the future.

Social Media Statistics

Hexa Prop can also be found on numerous social media platforms.

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Discord | Discord Link |

| FAQ | FAQ Link |

| Supported Languages | English |

Account Opening Process

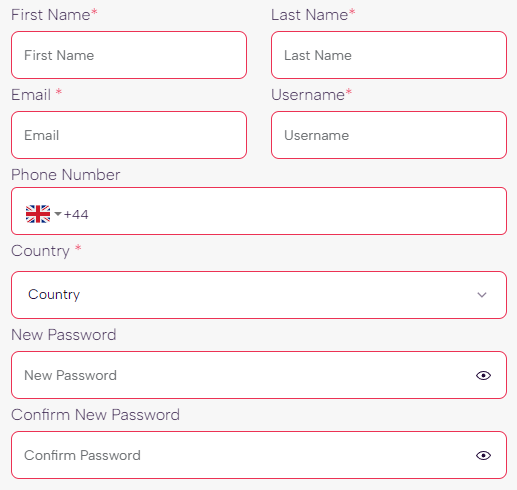

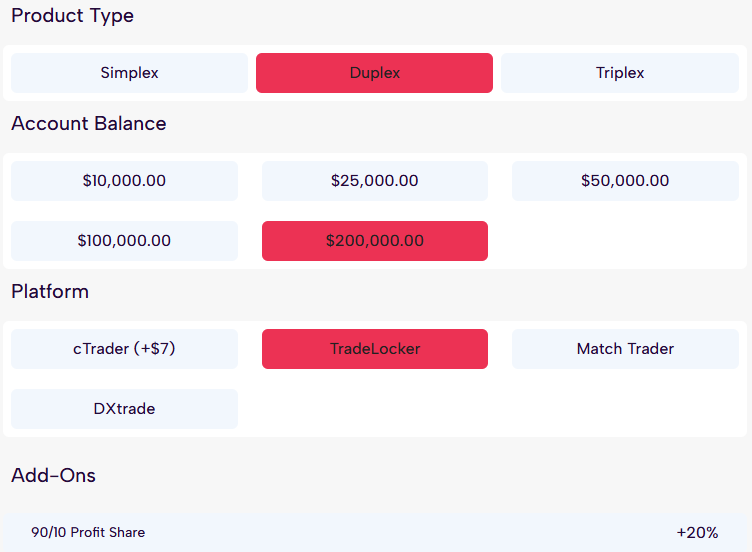

- Registration Form – Register with Hexa Prop by filling in the registration form with your personal details and logging into the trading dashboard.

- Choose Your Account – Select your account type, account size, trading platform, and add-ons.

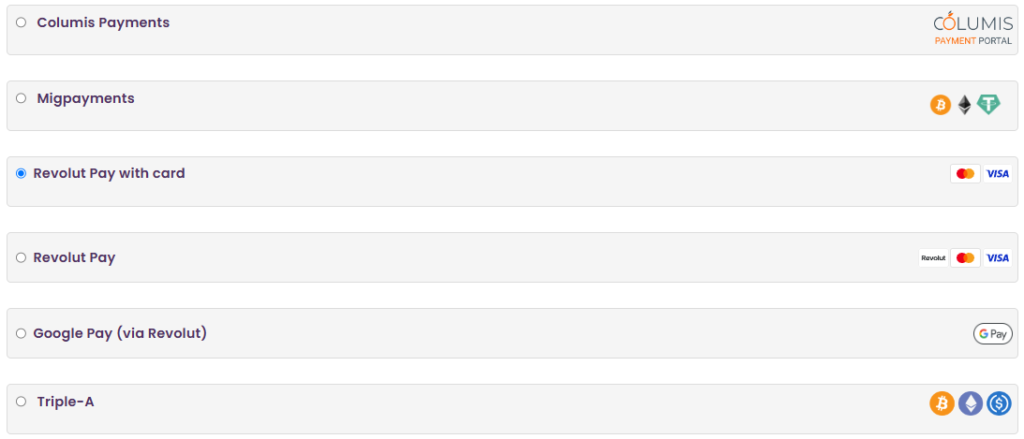

- Choose Your Payment Method – Use credit/debit card, Revolut, Google Pay, and cryptocurrency payment methods.

Conclusion

In conclusion, Hexa Prop is a reputable and trustworthy proprietary trading firm providing traders with an opportunity to choose between three funding programs: the Duplex Challenge, which is a two-step evaluation, the Simplex Challenge, which is a one-step evaluation, and the Triplex Challenge, which is a three-step evaluation.

- Hexa Prop‘s Duplex Challenge is an industry-standard two-step evaluation that entails two phases before being eligible to work with a funded account and receive 80% to 90% profit splits. The traders have to be able to hit profit targets of 8% in phase one and 6% in phase two before being considered to be successfully funded. These are very realistic trading objectives considering your 5% maximum loss rules during any one day and a 10% maximum daily loss rules. There aren’t maximum trading day requirements at either the evaluation phases; however you are expected to trade at least for 3 calendar days within each of these evaluation phases. Lastly, note that the Duplex Challenge has a plan of scaling, so there is always an opportunity to build your balance from the opening account.

- Hexa Prop Simplex Challenge, The Simplex Challenge of Hexa Prop is one step, where all that needs to be passed is a single phase of it. Then you would be qualified to manage the funded account and receive splits in 80% to 90% profit. So, a trader must generate 10% profit to qualify as a successfully funded account. These are realistic trading objectives, considering you have a 4% maximum daily and 6% maximum trailing loss rules to follow. In terms of time limits, you have no maximum trading day requirements during the evaluation phase. However, you are required to trade for a minimum of 3 calendar days during the evaluation phase. Finally, the Simplex Challenge offers a scaling plan; this will give you a chance to increase the starting balance of your account.

- The Hexa Prop‘s Triplex Challenge is a three-tiered evaluation that involves three stages before you become eligible to trade a funded account and 80% to 90% profit splits. To become successfully funded, you have to achieve the following profit targets: 6% in Phase One, 5% in Phase Two, and 4% in Phase Three. These are achievable trading goals because you have rules of 5% maximum daily and 8% maximum loss to adhere to. Time limitations, on the other hand, are not required since you have no maximum trading day for each phase of evaluation. However, you are obligated to trade for at least 2 calendar days in every evaluation phase. Lastly, there is a scaling plan provided in the Triplex Challenge, which means you can scale your initial account balance.

- I would advise Hexa Prop to those who are looking for a reliable proprietary trading company that offers great trading conditions for a wide variety of people with different styles. They offer traders a number of exclusive features, like an unlimited trading period, a 90% profit split add-on, a quick goal bonus feature, various options of trading platforms, and future withdrawals every other week. After considering everything Hexa Prop offers to traders all over the world, they are indeed desirable within the prop trading industry.

What are your individual opinions on Hexa Prop and the services they offer? Do they align with the trading conditions and services you’ve been seeking?

Let us know by commenting below if you enjoyed our detailed Hexa Prop review!

Leave a Reply